As an investor, what do you do with Shopify (Shopify Stock Quote, Chart, News TSX:SHOP)? The stock has already more than doubled this year, but as a representative of the so-called ‘new economy,’ it’s hard to judge whether SHOP is deserving of its lofty status.

So says Caldwell Investment Management’s Jennifer Radman, who thinks it’ll be difficult for the company to live up to the expectations baked into the current share price.

“All these [stocks] are trading on a price to revenue basis and in some accounts people are saying that revenue has to grow eight-fold just to justify the current valuation, and that to us just seems like a lot of growth,” Radman said.

“If you’re investing in Canada and you haven’t owned Shopify, there’s been a pretty big headwind that you’ve had to overcome and so I would put Shopify in this build-it-and- they-will-come kind of investment thesis,” said Radman, head of investments and senior portfolio manager at Caldwell, who spoke on BNN Bloomberg on Wednesday.

“All these [stocks] are trading on a price to revenue basis and in some accounts people are saying that revenue has to grow eight-fold just to justify the current valuation, and that to us just seems like a lot of growth,” Radman said.

Shopify’s share price took off like a rocket in March as investors cottoned on to the idea that pandemic-enforced lockdowns would entail a more accelerated shift of commerce online, a phenomenon that has boosted companies like Amazon and Shopify to all-time highs.

In SHOP’s case, after seeing returns of 183 per cent in 2019 the stock has gained another 170 per cent so far in 2020. That’s actually a lot better than Amazon, whose share price has increased by 70 per cent year to date.

Radman said the market has started to view some stocks through a different lens, one which puts a premium on future growth prospects.

“I get that the narrative is very positive,” Radman said. “Shopify is an alternative to Amazon and Amazon hasn’t been very friendly to a lot of its partners, and so Shopify is picking up a lot of their business.”

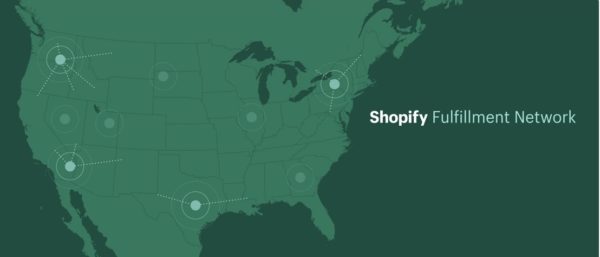

“But again, I think it’s just an illustration of the mindset of the market where the new sort of new age stocks, ‘new economy’-type stocks are being treated with a very different type of decision-making than some of the old economy stocks. And so, specifically, when Shopify talks about spending billions of dollars on its distribution centre network, for a lot of companies in old industries, if you just came out with that type of spending the stock maybe wouldn’t react so well,” Radman said.

“In Shopify’s case, it was very positive news because it meant building that infrastructure, that mousetrap, that everybody wants,” she said, “But, again, there are just a lot of expectations and a lot has to go right for that to continue.”

“But, in the short term, it’s certainly a great story, and so you could see continued positive upside momentum,” Radman said.

Some analysts appear to agree with that sentiment. This week, KeyBanc Capital Markets analyst Josh Beck reiterated his “Overweight (Buy)” rating and raised his price target on Shopify from $1,150 to $1,250 per share, which at press time represented a projected return of 17 per cent. (All figures in US dollars.)

Beck said Shopify’s investments into its fulfillment network will bring the company to the next level in terms of competing with Amazon. Beck called SHOP’s Fulfillment Network “a full-fledged, tightly integrated fulfillment solution for Shopify merchants and includes order/inventory management solutions, branding and data controls and access to scalable, flexible warehousing space to sell across multiple channels.”

At the same time, Morgan Stanley analyst Keith Weiss recently initiated coverage of Shopify with an “Equal Weight” rating and $970 target , saying that while Shopify has developed a “dominant competitive positioning” in the small to medium-sized business category, the stock is currently trading at 23x his ten-year free cash flow forecast compared to Amazon’s 23x for 2023 free cash flow as well as being currently at 35x SHOP’s estimated 2021 sales.

Which is too rich, according to Weiss, who advised, “We would look for a more attractive entry point, either on a pullback or early indications that estimates have to move meaningfully” higher.

Investors will get a further look into how Shopify is faring during the COVID-19 pandemic when it delivers its third quarter earnings on October 29. For its Q2, released on July 29, SHOP wowed the market with revenue almost doubling year-over-year to 714.3 million, with its Merchant Solutions growth jumping 148 per cent, showing the sped-up shift of commerce to online platforms.

Management had declined to give full-year or third quarter forecasts due to uncertainties surrounding COVID-19, but it expects the e-commerce boom to continue, saying in its Q2 press release, “The COVID-19 pandemic has accelerated the growth of ecommerce, shifting a larger share of retail spending to online commerce, a trend we believe will persist.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment