In a coverage launch on Tuesday, Beacon Securities analyst Russell Stanley called cannabis company Jushi Holdings (Jushi Holdings Stock Quote, Chart, News CSE:JUSH) a hidden gem in the US market, saying the multi-state operator offers investors high leverage to sought-after states Illinois and Pennsylvania.

In a coverage launch on Tuesday, Beacon Securities analyst Russell Stanley called cannabis company Jushi Holdings (Jushi Holdings Stock Quote, Chart, News CSE:JUSH) a hidden gem in the US market, saying the multi-state operator offers investors high leverage to sought-after states Illinois and Pennsylvania.

Stanley initiated coverage with a “Buy” rating and C$5.75 price target, which at press time represented a projected 12-month return of 65 per cent.

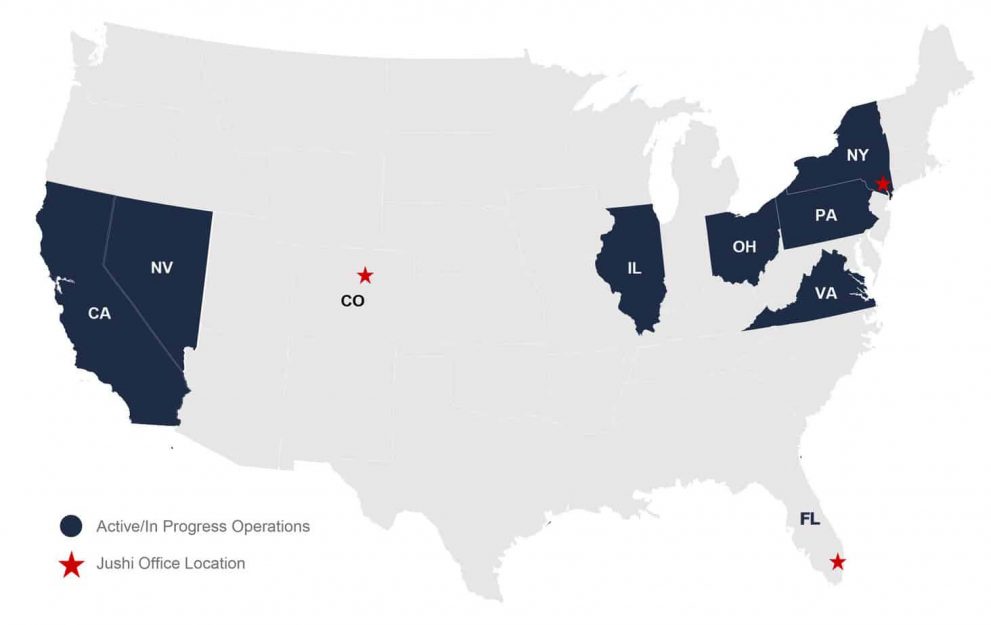

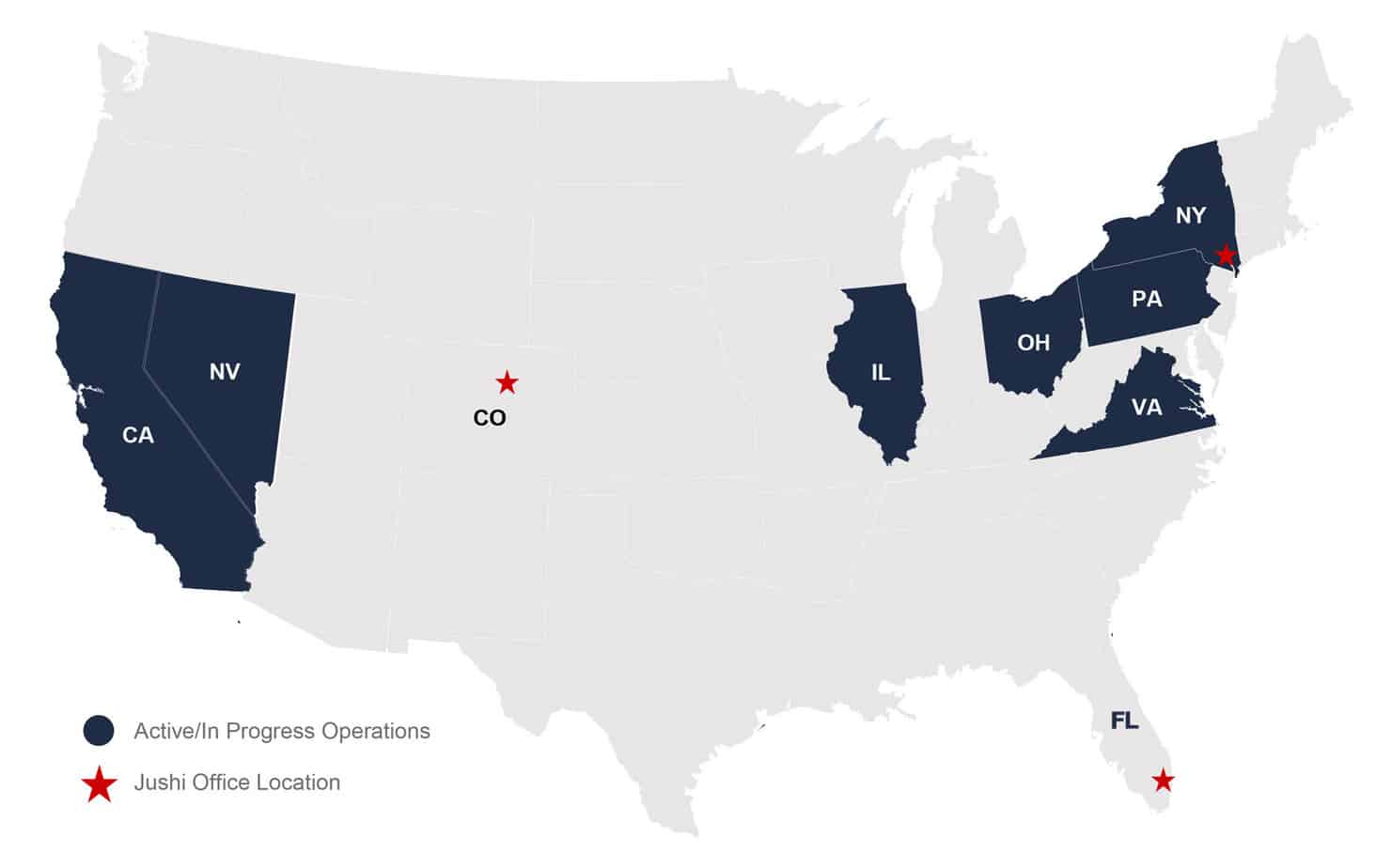

Jushi, which completed a reverse takeover in June 2019 and began trading on the CSE in December 2019, has a 75 per cent stake in two Illinois dispensaries and in July 2019 acquired a company with four Pennsylvania dispensary licenses, each of which allows the holder to open three dispensaries, with two of the 12 already opened at the time of purchase, along with the Beyond/Hello dispensary brand name.

Since then, the company has acquired a 62 per cent interest in Dalitso, one of five licensees in Virginia’s medical cannabis market, in September 2019, followed by the June 2020 acquisition of an 80 per cent stake in a company licensed for three dispensaries in Pennsylvania, bringing Jushi’s PA dispensary license portfolio to 15, the current state maximum. In August 2020, Jushi bought a 90,000 sq ft cultivation and manufacturing facility in Pennsylvania to self-supply its retail locations in the state along with setting it up for PA’s wholesale market.

Stanley said there’s a lot of untapped potential in the US cannabis market, as many large institutional investors continue to be wary of the space due to regulatory uncertainty, but the analyst pointed to, first, the projected legal cannabis trade’s numbers which are expected to hit between $30 and $37 billion in 2024 and, second, in the United States, the potential for a better chance for movement at the federal level via a government change in the upcoming election.

Stanley said Jushi’s exposure to the Illinois and Pennsylvania markets is key.

“While several of the space’s largest cannabis companies are major players in both markets, JUSH arguably offers investors the most revenue exposure to these ‘franchise player’ markets,” Stanley wrote.

“JUSH is also one of just two public companies licensed to operate in Virginia, a new medical market in a New Jersey-sized state that has been largely overlooked by investors. JUSH management aptly calls Virginia ‘the Sleeping Giant,’ making VA a #1 draft pick-type market, and a strong complement to IL and PA,” he said.

The analyst is calling for Jushi to generate fiscal 2020 (year end December 31) revenue and adjusted EBITDA of $77 million and negative $5 million, respectively, followed by fiscal 2021 revenue and adjusted EBITDA of $221 million and $44 million, respectively. (All figures in US dollars except where noted otherwise.)

As for company-specific catalysts, Stanley pointed to the opening of the company’s third Illinois retail site, the first harvest and/or dispensary opening in Virginia and the company’s third quarter results in November.

“Importantly, we believe JUSH is (for now) a surprisingly under-followed stock. As of writing, just one other broker follows this name. By comparison, the ‘heavyweights’ of this market are now covered by 13-17 analysts, making JUSH a relatively hidden gem,” Stanley wrote.

Pot stocks have perked up of late, after US vice-presidential candidate Kamala Harris confirmed in a debate that should would work to decriminalize marijuana at the federal level if elected. Harris, the running mate of Democratic nominee Joe Biden is the lead sponsor of the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act of 2019.

“We will decriminalize the use of marijuana and automatically expunge all marijuana use convictions and incarceration for drug use alone,” Harris said. “This is no time—from, I think, our collective perspective—this is no time for half-steppin’,” she argued. “This is no time for incrementalism. We need to deal with the system, and there needs to be significant change in the design of the system so that we can support working people, so that we can fight for the dignity of people, so that we can make sure that all people have equal access to opportunity and to justice.”

One industry expert said that while that would be a good start, much more is required than was Harris promised to do.

“While I applaud Kamala Harris’s focus on criminal justice reform, and in particular expungement and decriminalization of cannabis offenses at the federal level, true reform will require more,” Steve Hawkins, executive director of the Marijuana Policy Project, told the website Marijuana Moment.

“Removing criminal penalties for marijuana possession is an important first step. But as we have seen in states around the U.S., decriminalization alone will not stop the arrest and persecution of people of color —or so many others touched by the war on cannabis,” he added. “It is only when we take a comprehensive approach through the framework of legalization that can we move away from the cycle of abuse.”

Shares of Jushi Holdings closed Tuesday up $0.27 cents to close at $3.76.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment