Raymond James analyst Rahul Sarugaser has a few words of caution concerning cannabis play Auxly Cannabis Group (Auxly Cannabis Group Stock Quote, Chart, News TSXV:XLY) but says the stock is still a Buy.

Raymond James analyst Rahul Sarugaser has a few words of caution concerning cannabis play Auxly Cannabis Group (Auxly Cannabis Group Stock Quote, Chart, News TSXV:XLY) but says the stock is still a Buy.

Sarugaser reviewed Auxly’s latest quarterly results in an update to clients on Friday where he maintained his “Outperform 2” rating with the reduced target of $0.40 per share (previously $0.60 per share).

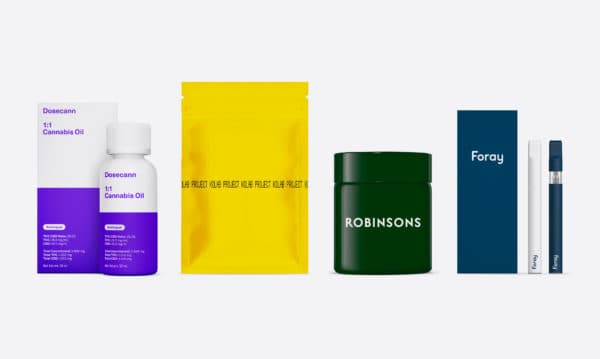

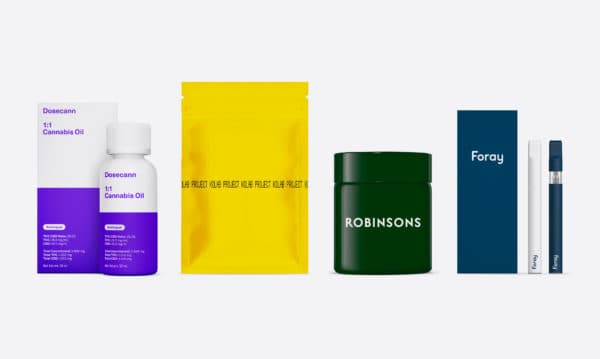

Toronto-based Auxly is a CPG-focused cannabis company with Cannabis 2.0 products and a strategic partnership with UK tobacco company Imperial Brands. The company delivered its Q2 2020 results on Friday for the three and six months ended June 30, 2020.

Auxly managed $8.6 million in net revenue for the Q2, which was a 200 per cent increase over a year ago, and a gross margin on cannabis products of 38.5 per cent.

Adjusted EBITDA came in at a loss of 47.8 million with SG&A at $13.6 million. Over the quarter, Auxly launched its Robinsons brand in Ontario and Nova Scotia, while its joint venture Partner Sunens received its cultivation license for the first phase of its greenhouse facility, which includes about 360,000 sq ft of cultivation, processing and storage. Auxly also secured a $25-million convertible debenture standby financing to meet its working capital requirements, with the company so far completing four tranches

for $9.25 million.

CEO Hugo Alves said Auxly is getting “tremendous” consumer response to its Robinsons and Kolab Project dried flower offerings and improved sales velocity for its key brands.

“Despite a decline in sales as compared to Q1 2020, due in part to temporary store closures as a result of COVID-19 and new competitor value brands entering the market, we have taken immediate and deliberate steps to align our Company to reflect current consumer demands and market conditions,” Alves said in a press release.

The company guided for positive cash flow in 2021, with its objectives for the rest of 2020 including: becoming a leader in the Canadian 2.0 market, completing construction and licensing at all its Canadian operations, working with Sunens to support its product offerings, collaborating with strategic partners on commercialization on the international front and taking measures to improve cash flow.

On the quarterly numbers, Sarugaser called them mostly in line with forecasts, with the $8.6 million in net revenue comparing to his estimate of $8.7 million, the gross margin of 38.5 per cent beating his 35 per cent estimate and the $7.8 million adjusted EBITDA loss beating his estimated loss of $9.8 million (as well as the consensus 35 per cent).

At the same time, Sarugaser had some words about two issues, namely, what he called the company’s bloated SG&A and the new convertible debt financing. On the former, the analyst said he’d like to see Auxly’s costs come more in line with its cannabis peers, while on the latter he said the terms of the financing are, in fact, “quite onerous.”

“While our estimate of the total potential dilution from this convertible debt facility is 136.9 million shares—an inordinate amount of dilution in our view—management has reflected that between growth of top-line revenue, increasing gross margins, and controlling costs, they should be able to mitigate further draws on the facility. We give them the benefit of the doubt, adding only the potential dilution from the currently drawn $9.5 million, and remain cautiously optimistic that management should succeed in sourcing less dilutive forms of financing to meet XLY's working capital needs,” Sarugaser wrote.

Due to the potential dilution from the convertible debt drawn to date, Sarugaser dropped his 12-month target to $0.40, saying, “we maintain our conviction that with its focus on C2.0 combined with support from its heavyweight partner, Imperial Brands, XLY is set up for long term success, so maintain our Outperform(2) rating.”

At press time, Sarugaser’s $0.40 target represented a projected return of 100 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment