National Bank Financial analyst Richard Tse likes the new move made by Sierra Wireless (Sierra Wireless Stock Quote, Chart, News TSX, NASDAQ:SW) to rid itself of its automotive business, but says the stock is still not a buy.

National Bank Financial analyst Richard Tse likes the new move made by Sierra Wireless (Sierra Wireless Stock Quote, Chart, News TSX, NASDAQ:SW) to rid itself of its automotive business, but says the stock is still not a buy.

In an update to clients on Friday, Tse kept his “Sector Perform” rating but raised his target from $11.00 to $12.50 per share, saying the longer-term prospects for Sierra look good.

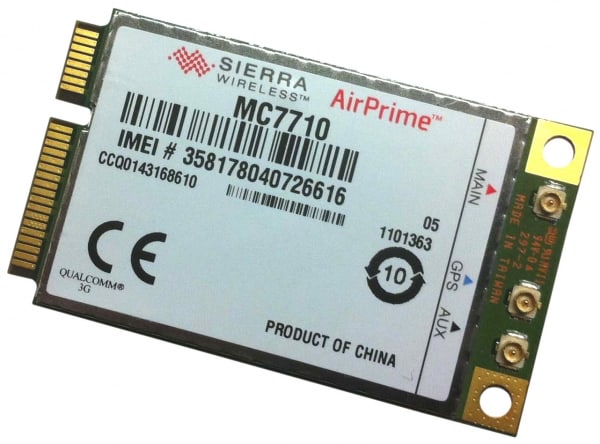

Vancouver-headquartered Sierra Wireless, which offers mobile computing and Internet-of-Things communication products to connect devices and applications over cellular networks, on Thursday announced on a definitive agreement to sell its Shenzhen, China-based automotive embedded module product line to Rolling Wireless (HK), a consortium led by Fibocom Wireless, for $165 million in cash. (All figures in US dollars.)

Sierra said the divestiture allows it to focus its energies on its IoT business. “This transaction will improve our balance sheet and allow us to expand our R&D centre in Richmond, British Columbia, to accelerate our innovation in integrated IoT solutions and 5G modules, gateways and routers,” said Kent Thexton, president and CEO of Sierra, in a press release.

In his update, Tse said that while Sierra’s automotive business was a meaningful vertical within its Embedded Broadband segment, the move is a positive one as it allows Sierra’s focus on higher value-add solutions.

“In our view, this divestiture comes as a welcome relief from a balance sheet perspective given an estimated negative CFO of ~$50 million (NTM) with just over $70 million of cash on the books,” said Tse.

“Further, we believe this segment had been challenging for the Company not only from a (lower relative) margin perspective but it was also subject to a lot of volatility. In our view, this divestiture will allow Sierra Wireless to re-focus its efforts on building out other verticals where it could provide IoT solutions that include a recurring revenue component. And while we don’t see a material lift in the overall growth trajectory in the short term, we think this move finally puts the Company in a much stronger position to make that shift,” Tse said.

Tse noted the announced transaction, expected to close in the fourth quarter of 2020, has the support of Sierra’s Board of Directors and is not subject to shareholder approval.

For his forecasts, Tse thinks Sierra will generate fiscal 2020 revenue and adjusted EBITDA of $602.6 million and negative $36.0 million, respectively, and fiscal 2020 revenue and EBITDA of $650.5 million and $4.2 million, respectively.

“Bottom line, while we like the potential pivot to IoT services when it comes to adding value, the three-to- four-year timeline laid out by Management is still a ways out. That said, we see a lift in the stock to reflect the premium embedded in this divestiture,” Tse wrote.

The analyst’s new $12.50 target represented at press time a projected 12-month return of 31.0 per cent. Sierra’s share price jumped almost 18 per cent on Friday and is currently up 18 per cent for the year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment