DocuSign (DocuSign Stock Quote, Chart, News NASDAQ:DOCU) has more than doubled since the start of the pandemic but even with all those gains investors should be considering the stock, says portfolio manager Paul Harris, who thinks the long-term growth prospects look good for the company.

DocuSign (DocuSign Stock Quote, Chart, News NASDAQ:DOCU) has more than doubled since the start of the pandemic but even with all those gains investors should be considering the stock, says portfolio manager Paul Harris, who thinks the long-term growth prospects look good for the company.

More than resistant to the economic slowdown due to COVID-19, DocuSign is one of a handful of companies — think Amazon and Shopify for e-commerce or Zoom and Microsoft for remote work — to see its business shoot upwards during the stay-at-home culture.

Last month, DocuSign delivered better-than-expected results for its fiscal first quarter 2021, coming in with earnings of $0.12 per share on revenue of $297.0 million. Analysts had been calling for earnings of $0.10 per share on revenue of $281.1 million.

“Our strong first quarter results reflect our ability to help organizations accelerate their digital transformation as they adapt to the changing business environment, magnified by COVID-19. Many are taking their first steps with us, while others are expanding their initiatives," said Dan Springer, DocuSign's CEO, in a press release.

DocuSign saw subscription revenue climb by 39 per cent over the quarter which ended April 30 and billings up by 59 per cent to $342 million. Free cash flow grew to $33 million versus $30 million a year earlier.

All that was enough to lift the stock by 23 per cent over the month of June. Since the beginning of the year, DOCU is up an incredible 173 per cent.

Harris, partner at Harris Douglas Asset Management, says DocuSign is in a pandemic sweet spot.

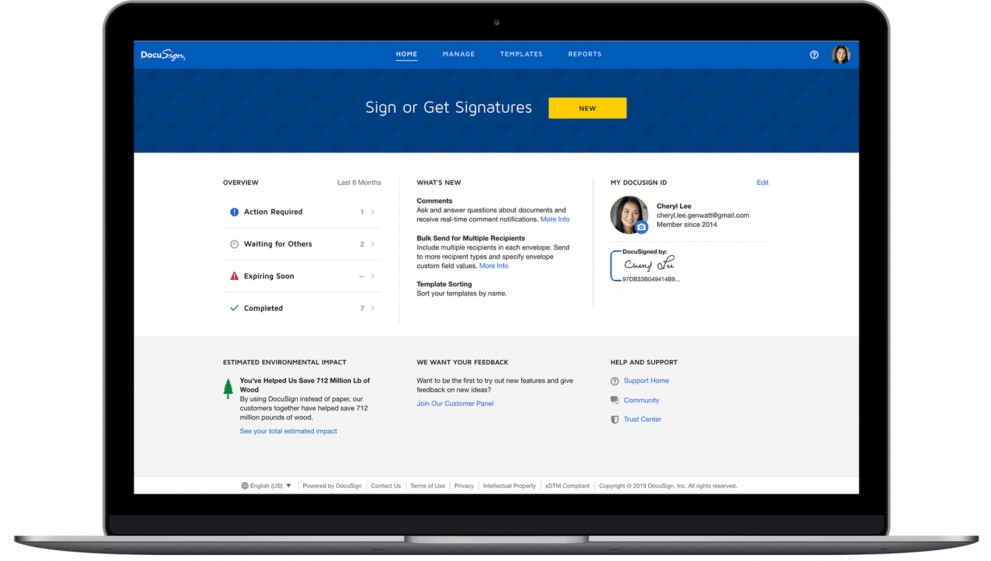

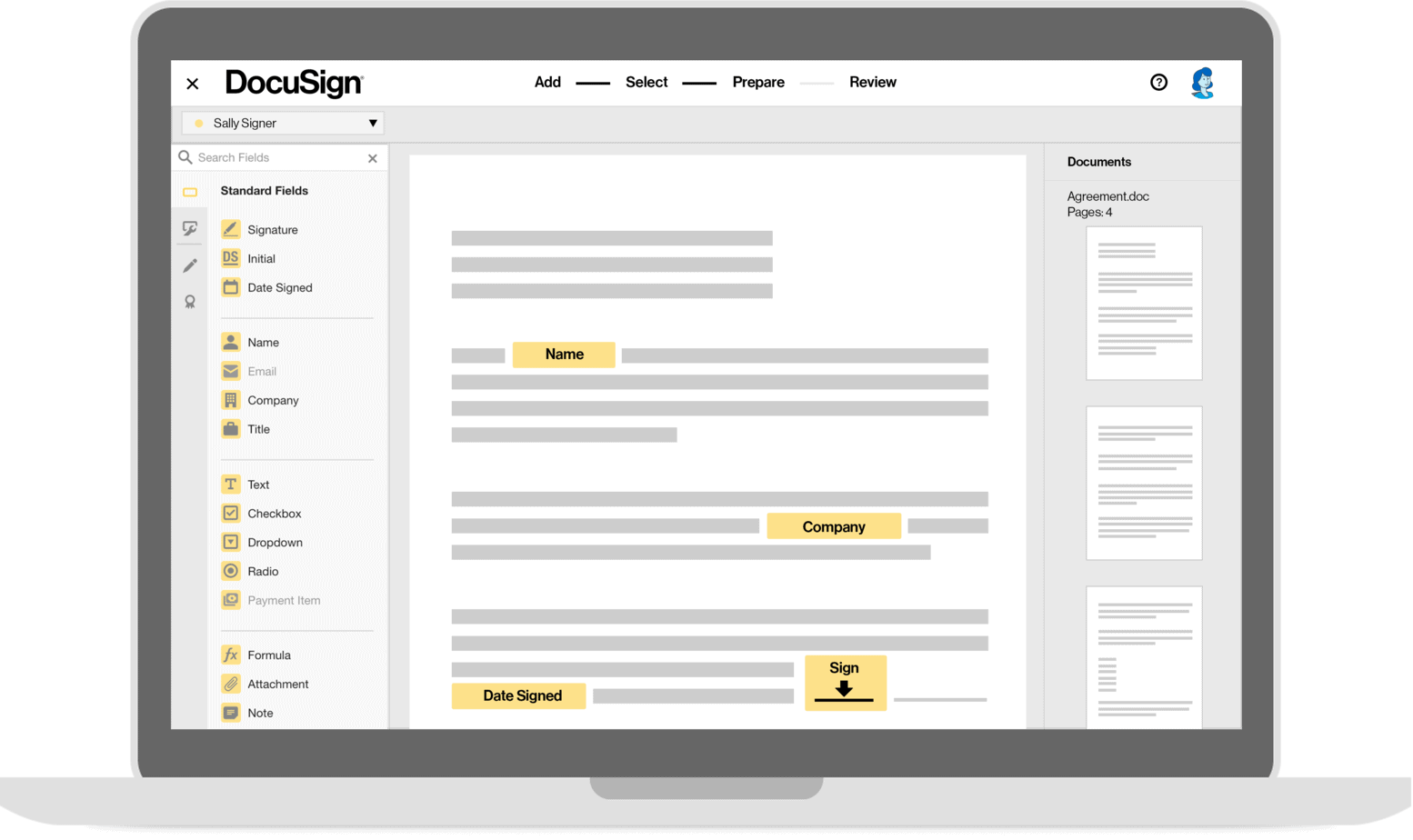

“DocuSign is a very interesting story. They do a signature and they do contract management so when you have a contract you're able to look at it online, make changes and sign it with that,” says Harris, speaking on BNN Bloomberg on Tuesday.

“The signature part of it is really benefitting from the fact that we went into a pandemic, and it's one of the stocks, the stay-at-home stocks, that’s done very, very well over the last little while,” Harris said.

Last week, DocuSign got a boost of confidence from both JP Morgan Chase and Wedbush who both raised their targets on DOCU, citing the company’s growth potential.

Recent M&A activity has been a positive sign, too, with the company picking up online notarization platform LiveOak and contract analytics business Seal Software.

Harris says a move to paperless transactions in the public sector could drive more upside to DocuSign.

“They bought a company just recently that allows them to do move away from the signature part to a more whole document area which I think is very good. If they can transition their subscriber base to this they can actually have quite decent growth and better pricing increases on their software,” said Harris.

“The last thing is there's a push in the US for the federal government to actually move to less paper, and DocuSign is one of the major parts of that,” Harris said. “So I think over the next two or three years you're going to see some very good revenue growth from the federal government side of their business, which should really help them over the next while.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment