Teladoc Health (Teladoc Health Stock Quote, Chart, News NYSE:TDOC) has been one of the best large caps on the market this year, but is there more lift to this rocket of a stock?

Teladoc Health (Teladoc Health Stock Quote, Chart, News NYSE:TDOC) has been one of the best large caps on the market this year, but is there more lift to this rocket of a stock?

Possibly, says investment advisor Gordon Reid, but there are better bets for investors looking for exposure in telemedicine.

“It’s obviously a company that’s been in the news and a concept that's in the news,” said Reid, president and CEO of Goodreid Investment Counsel, speaking to BNN Bloomberg Thursday. “I love new concepts because they often turn into very good companies, but my experience is that you're better served by investing in a new concept that has the cover of an existing business.”

Teladoc Health has been screaming up the charts this year, gaining more than 165 per cent since the start of the year. For months now, the market has been favouring companies expected to do well during the COVID-19 pandemic and telemedicine platform Teladoc fits the bill.

The company boasts service in 175 countries worldwide covering hospitals, health systems and patients, with US paid memberships approaching 50 million and over two million patient visits per quarter.

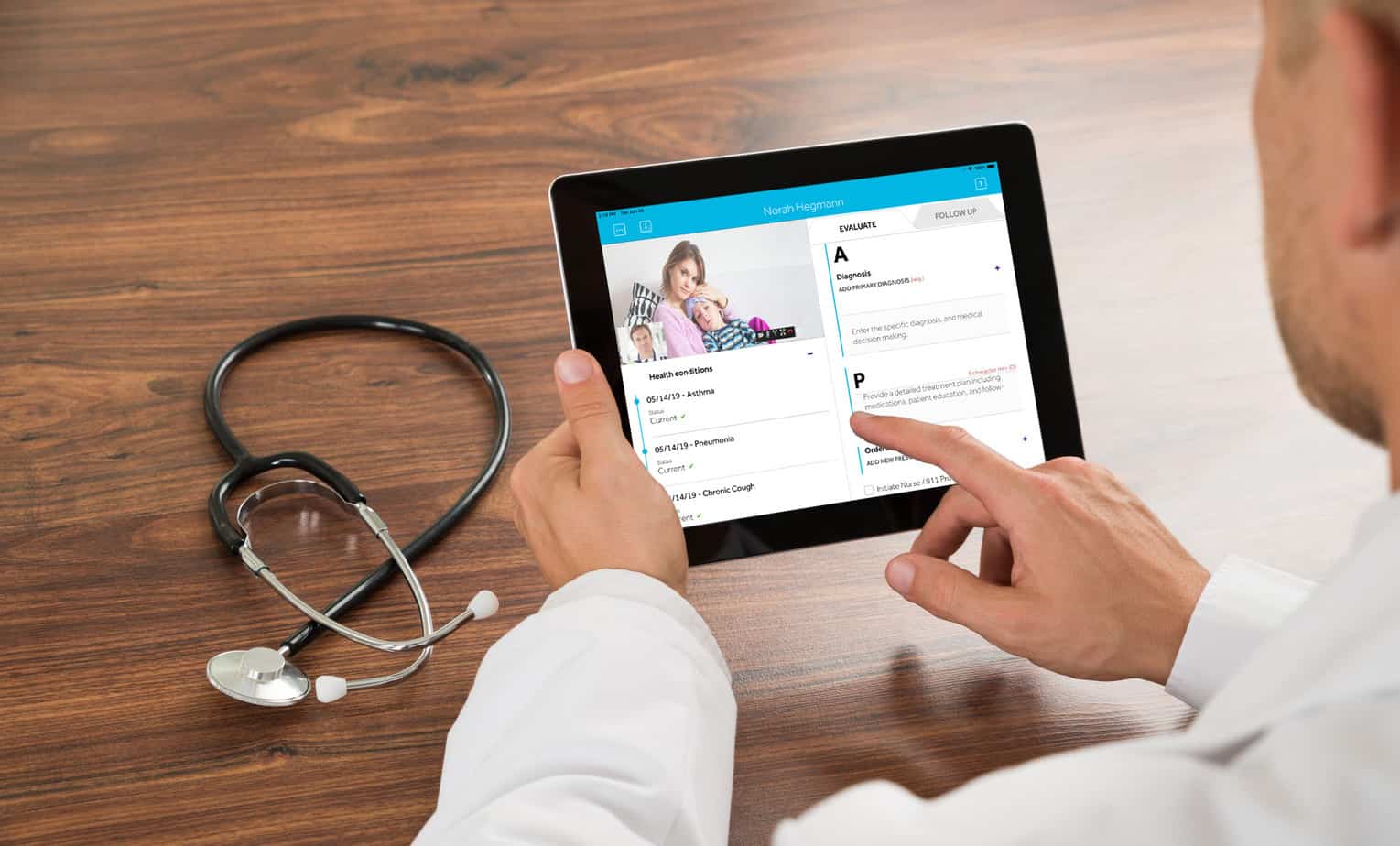

The company and stock got a boost earlier this month with the completed acquisition of enterprise telemedicine provider InTouch Health, a move seen as helping to round out Teladoc’s breadth of coverage, with the $600-million deal costing Teladoc about $150 million in cash and $450 million in stock.

On closing the acquisition, Teladoc said the COVID-19 pandemic has made consumers more open to the prospect of telemedicine.

“As virtual care quickly becomes a necessity for all healthcare providers, the acquisition of InTouch Health positions us to lead this transformation in healthcare and be that single, integrated partner,” said Jason Gorevic, CEO of Teladoc, in a press release.

“Doctors and hospitals need medical grade solutions and a unified virtual care strategy that can scale and grow with them. This acquisition makes Teladoc Health the first and only company to comprehensively deliver on that need.”

But even with all that momentum behind it, Reid is cautious about investing in Teladoc, due to all the hype currently surrounding the stock and the space.

“Rather than investing in a Teladoc I'd point you in the direction perhaps of CVS,” Reid said. “CVS is known as a pharmacy, of course, a drugstore, but they're also a healthcare solution with a tele-medical concept called the Health Hub at many of their pharmacies. And they offer up nurse practitioners and so on for people who want to have a lower cost opportunity to to get medical advice.”

“So I’d point you in that direction as opposed to a pure-play concept like Teladoc that might have a little bit too much buzz around it because of COVID-19,” he said. “You’d get in [to a company like Teladoc] and then although it becomes a very successful company, you find your stock price starts to wane simply because the multiple drips down because it's not as much front page news.”

Teladoc expects to report its second quarter financials next Wednesday. In its Q1, the company saw revenue grow by 41 per cent to $180.8 million and adjusted EBITDA of $10.7 million. For the Q2, management has guided for revenue to climb to between $215 and $225 million and adjusted EBITDA to come in the range of $20 to $24 million. (All figures in US dollars.)

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment