If you haven’t made your money yet on Zoom Video Communications (Zoom Video Communications Stock Quote, Chart, News NASDAQ:ZM), you may want to consider taking your profits soon.

If you haven’t made your money yet on Zoom Video Communications (Zoom Video Communications Stock Quote, Chart, News NASDAQ:ZM), you may want to consider taking your profits soon.

That’s according to Black Swan Dexteritas president Kim Bolton, who says the competition in the video conferencing space is hard to ignore.

Markets were down sharply on Thursday but one stock bucking the trend was Zoom, which vaulted even higher after literally doubling in value since the early days of COVID-19.

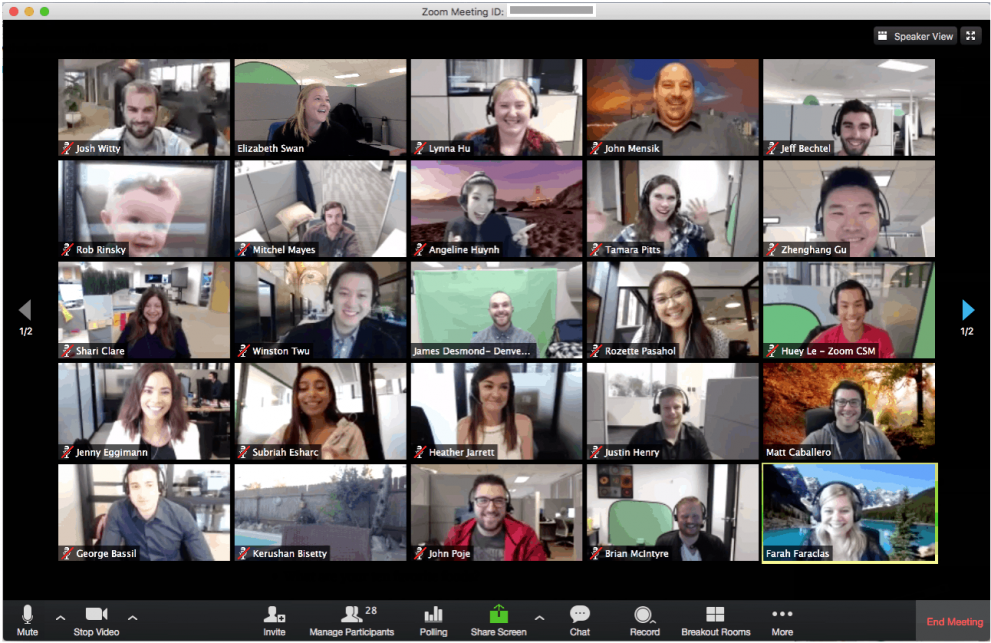

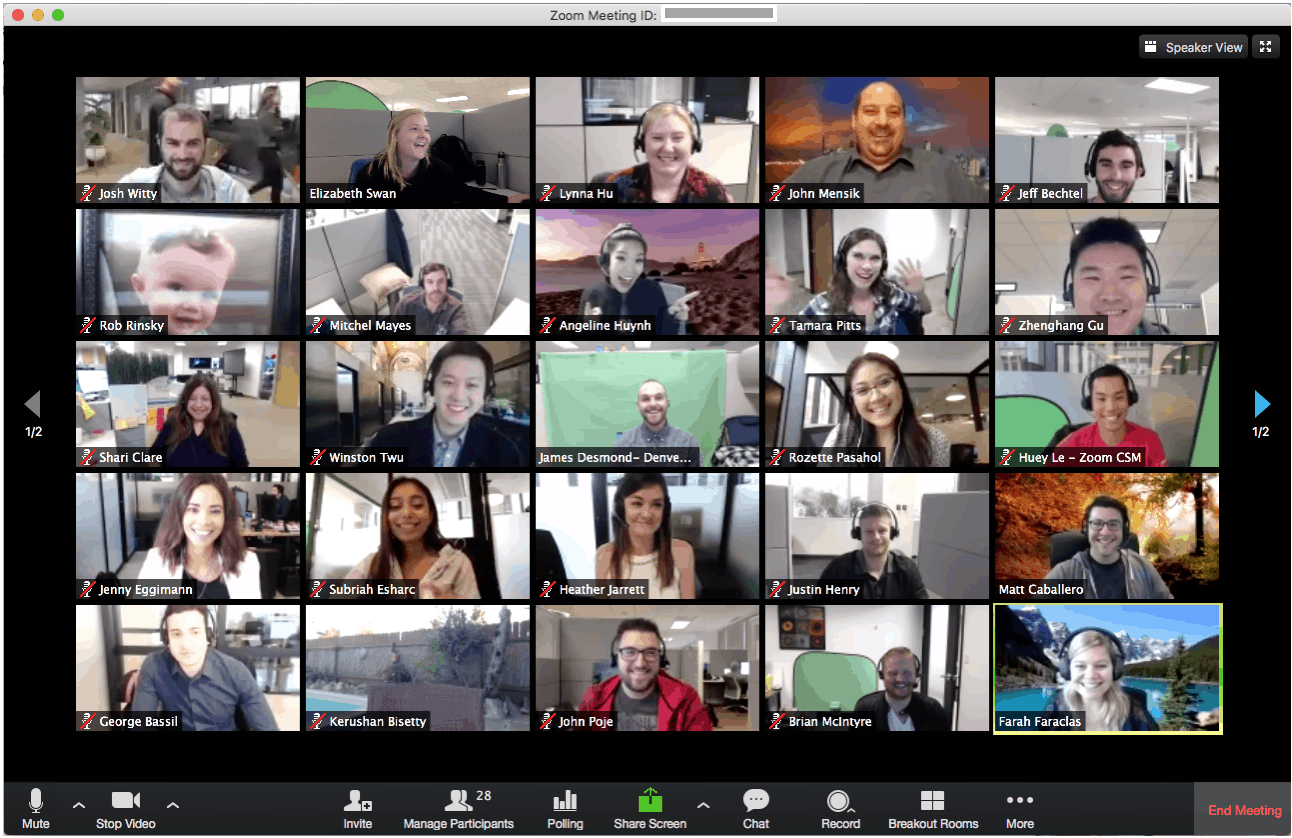

Zoom, which saw its daily users jump from about ten million in pre-pandemic times to reportedly hundreds of millions by April, has led the way in pandemic-proof group of stocks, despite hiccups in its platform and now the emergence of ethical and political bugaboos familiar to social media companies.

Privacy and security concerns were evident early on, as users dealt with “Zoom-bombing” by unwanted and often abusive meeting joiners, a problem that persists despite the company’s efforts to tighten security measures.

Now, Zoom is getting grilled for suspending the account of Humanitarian China, an activist group that was holding a Tiananmen Square commemoration event on the platform, allegedly to “comply with local law.”

“Like any global company, Zoom must comply with laws in the countries where we operate. We strive to limit actions taken to those necessary to comply with local law,” a Zoom spokesperson said in an emailed statement to CNBC .

But it’s a different issue that will likely be taking down Zoom’s share price, says Bolton, who spoke to BNN Bloomberg on Wednesday.

“This is quite the popular stock out there and for good reason,” Bolton said. “If you look back at December of 2019 Zoom had ten million daily active users and then at the end of April their daily active users grew all the way up to 300 million. It has basically benefited from the rapid rise of video conferencing and online online chatting, however, it’s pretty darn expensive here.”

“If you look at the P/E ratio it’s 6000 times. It starts to remind you of the old days of of Amazon,” Bolton said.

“We did own it. We cashed out took the profits, and I guess really the catalyst of why we cashed out was a lot of the player competition that came in with Google Meet, Microsoft Enterprise and then finally Facebook’s Workplace Rooms,” Bolton said. “So, we cashed out of it.”

Earlier this month, Zoom released its first quarter fiscal 2021 results which showed revenue climbing 169 per cent year-over-year to $328.2 million, way above analysts’ consensus estimate of $202.5 million.

Earnings per share were also a shocker at $0.20 per share compared to the expected $0.09 per share.

The number of video conferencing options has proliferated in recent times, going beyond offerings from the likes of Alphabet and Facebook to include Verizon Communications, which recently bought its own platform and cloud communications business RingCentral.

Zoom says its ease of use is a key factor separating it from the herd, while the company has a strong belief that the demand for video conferencing will continue in the post-pandemic world.

“We’ve heard from our customers that virtual events are even more efficient and more effective than [in-person conferences],” said Zoom CFO Kelly Steckelberg to CNBC Monday.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment