Shopify (Shopify Stock Quote, Chart, News TSX:SHOP) is firing on all cylinders during COVID-19 and while the stars are aligning well for the Canadian e-commerce sensation, the rollout of its fulfillment network could be a near-term headwind, says portfolio manager Paul Harris.

Shopify (Shopify Stock Quote, Chart, News TSX:SHOP) is firing on all cylinders during COVID-19 and while the stars are aligning well for the Canadian e-commerce sensation, the rollout of its fulfillment network could be a near-term headwind, says portfolio manager Paul Harris.

“We don't own the stock — like everybody, you probably wish you did — but the reality is that we've sort of changed the way we have to think about many things, and Shopify is in this really sweet spot where they're really helping companies who didn't have an online presence to have one,” said Harris, partner at Harris Douglas Asset Management, to BNN Bloomberg on Friday.

“I think that if you are a small or a medium sized company that has to be a part of the methodology that you will look to sell your products over the next little while. And I think that Shopify is helping companies do that and I don't think that's going to change,” he said.

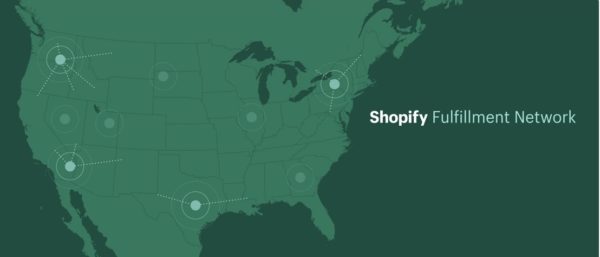

“The big issue for them is that they're moving into logistics so that a lot of their companies can package and sell their products through and for them. They’re going to become a much more robust company but that's going to be a big cost spend for them over the next little while, so I think that's the big issue that you're going to see over the next little while where a lot of the cashflow is being moved to that,” Harris said.

Shopify’s share price continues to climb higher as investors can’t get enough of the stock which is now up 20 per cent for the month of June and up an incredible 143 per cent for 2020.

Much of that growth seems to be COVID-19-related, as companies in the e-commerce space like Shopify, Amazon and Wayfair have benefited from the stay-at-home economy.

And with a stall in the easing of health restrictions across many US states and the pandemic seeing growing case numbers worldwide, online shopping could continue its run into the foreseeable future.

Even more interesting from a Shopify shareholder’s perspective, Harris says the e-commerce wave isn’t likely to turn around, even with the reopening of bricks and mortar shops.

“I don't think it changes the dynamic if you're a retailer and how you're going to think

about your business in the next several years,” Harris said. “You have to have a portion of your business online that allows you, if something like this happens again, to move very quickly to that methodology.”

“And I think that more and more people are comfortable with shopping online because of what's happened and so I think that's going to continue,” he said.

Shopify last reported earnings in early May where it saw first quarter revenue grow by 47 per cent to $470.0 million, coming in ahead of guidance and above analysts’ consensus estimate of $443 million. SHOP’s adjusted net income was $0.19 per share and met analysts’ forecast.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment