Disappointing quarterly results are cause for a downgrade for MediPharm Labs (MediPharm Labs Stock Quote, Chart, News TSX:LABS), says Mackie Research analyst Greg McLeish, who reviewed the company’s recent quarterly results in an update to clients on June 19.

Disappointing quarterly results are cause for a downgrade for MediPharm Labs (MediPharm Labs Stock Quote, Chart, News TSX:LABS), says Mackie Research analyst Greg McLeish, who reviewed the company’s recent quarterly results in an update to clients on June 19.

McLeish changed his rating from “Buy” to “Hold” and offered his new target price of $1.75 per share,

which at press time translated to a projected 12-month return of 20 per cent.

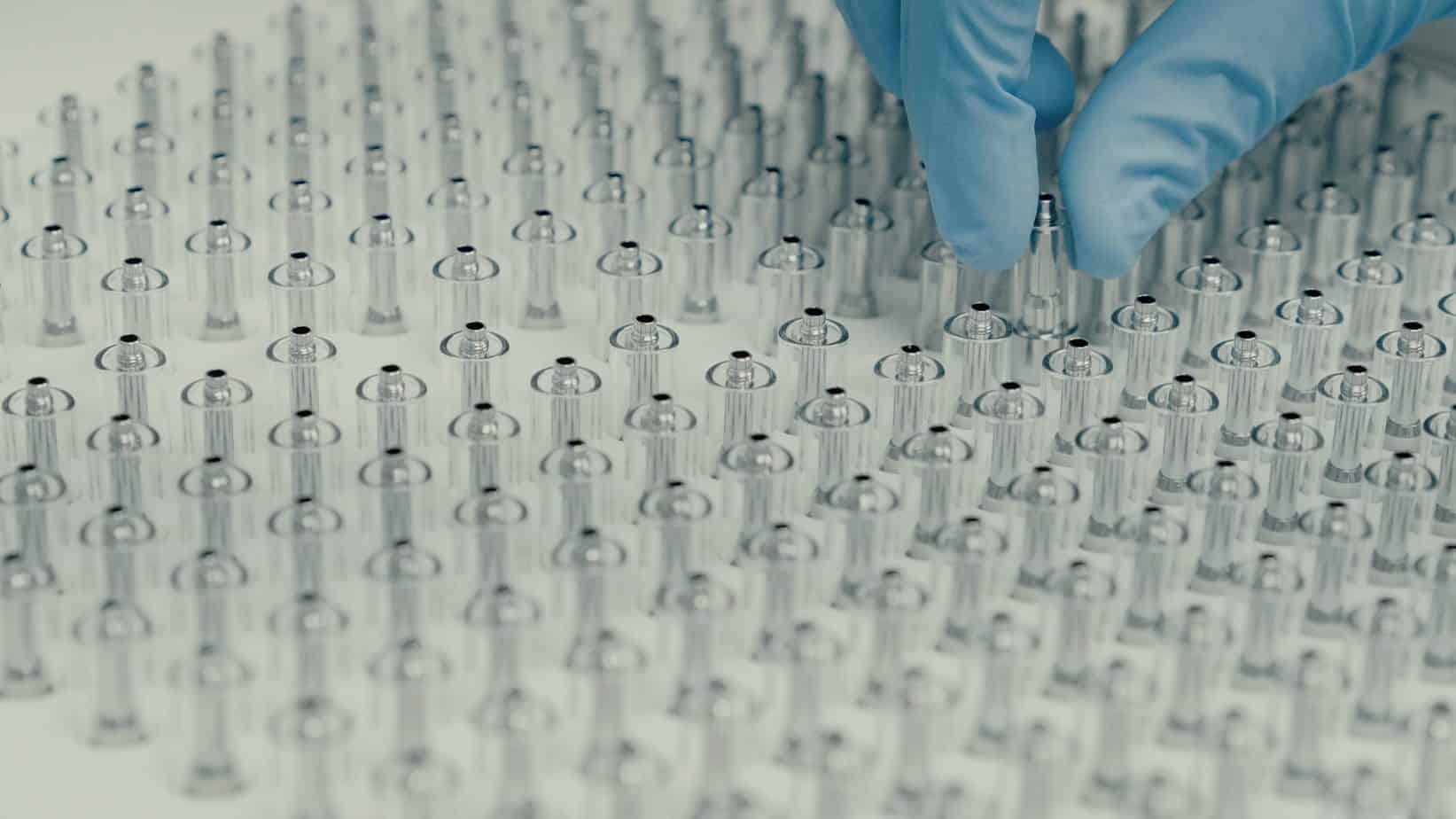

Extraction business MediPharm Labs produces pharmaceutical-quality cannabis oils and concentrates as well as derivative products. The company has a wholesale business as well as a white label platform, with sales in the domestic market as well as exports to Australia and the near-commercialization of an Australian extraction facility.

The company released its fiscal quarter 2020 results on June 18, showing revenue down 49.5 per cent sequentially to $11.1 million and down from $22.0 million a year earlier.

LABS also reported a net loss before tax of $22 million, which included a $12.8-million inventory write-down.

Management referred to a decrease in selling prices for extracts as cause for the revenue decline, along with reduced volumes sold as the demand in the Canadian market was softer.

“We successfully scaled our B2B bulk business in the lead up to Cannabis 2.0 legalization where demand for bulk cannabis concentrates soared, but the limitations of a single regulated market, with limited distribution and slow finished product roll-out, resulted in a decrease in demand for those bulk concentrates beginning in Q4 2019 and continuing to today,” said Pat McCutcheon, CEO, in a press release.

“This is why our vision of operating a global platform for multi-customer, multi-product and multi-jurisdictional relationships covering medicinal, wellness and adult-use segments makes sense from strategic, risk management and value creation perspective as the Canadian market for concentrate-based products continues to mature,” he said.

On the bright side, McLeish pointed in his update to LABS’ balance sheet which he said remained strong at a cash position of $21.4 million by the end of the Q1 (and subsequent to that, the company completed a private placement, raising aggregate gross proceeds of $37.8 million.

Additionally, the analyst noted that LABS’ finished product sales were gaining momentum over the quarter, with the company having launched three new SKUs of finished formulated products across five provinces by the end of the Q1, boosting sales of finished formula products to 13 per cent of quarterly revenue from practically nil during the previous quarter.

Still, McLeish said the overall results were disappointing, where the Q1 bulk crude resin and distillate sales were down 56 per cent year-over-year.

“The company attributes this decline to (i) a slow expansion of retail channels in Canada, (ii) slow commercialization of specialized Cannabis 2.0 businesses and (iii) operational constraints of vertically integrated licensed producers limiting their conversion of bulk concentrates inventory into finished formulated products,” said McLeish.

“The significant challenges experienced in the Canadian market for bulk concentrates were further exacerbated by the impact of the COVID-19 pandemic, including additional delays in the anticipated expansion of retail channels in Canada and increased market uncertainty leading to decreased expenditures from its bulk concentrates’ client-base,” he wrote.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment