In-line fourth quarter results from Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Chart, News TSXV:QUIS) give the name a positive outlook for 2020’s first quarter, says Focus Merchant Group analyst Ralph Garcea, who on Monday provided clients with an update on the company.

In-line fourth quarter results from Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Chart, News TSXV:QUIS) give the name a positive outlook for 2020’s first quarter, says Focus Merchant Group analyst Ralph Garcea, who on Monday provided clients with an update on the company.

Toronto-based Microsoft solutions provider Quisitive released its Q4 and full-year ended December 31, 2019, financials on April 28, sporting 47 per cent year-over-year growth with revenue climbing to $18.5 million for the year. The company’s net loss for 2019 was $7.4 million and its adjusted EBITDA was $1.3 million compared to a loss of $1.0 million a year earlier.

For the fourth quarter, Quisitive’s revenue grew 39 per cent year-over-year to $5.4 million, while adjusted EBITDA was $780,000.

CEO Mike Reinhart said that despite the impact of COVID-19, Quisitive is still poised for strong growth in 2020.

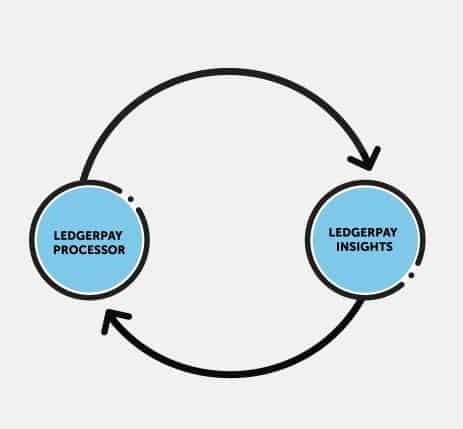

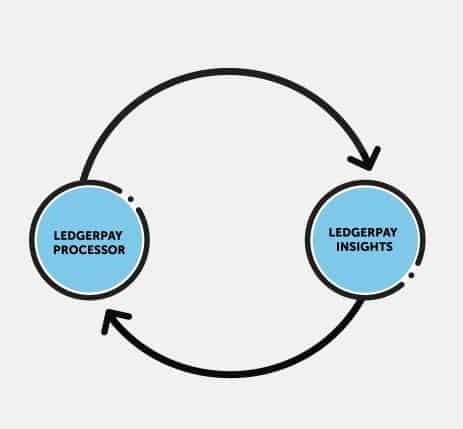

“We are beginning 2020 from a position of financial strength and anticipate another year of substantial growth by leveraging our acquisition of Menlo Technologies, capitalizing on our investment to activate LedgerPay, and continuing to build our recurring revenues for the remainder of 2020. Our acquisition pipeline remains strong and we look forward to continuing to assess new acquisition opportunities,” Reinhart said.

Quisitive’s share price has been a rocket over the past five months, climbing over 400 per cent since mid-November. Quisitive was named Microsoft’s US Partner of the Year in 2019 for innovation and implementation of customer solutions based on Microsoft technology.

In his update, Garcea said Quisitive’s fourth quarter revenue of $5.4 million came in-line with the consensus $5.5 million while adjusted EBITDA of $780,000 was above the consensus $600,000.

Looking ahead, Quisitive’s management has guided for first quarter revenue between $10.9 million and $11.1 million, where the consensus was estimating $10.0 million, and adjusted EBITDA of between $1.0 million and $1.2 million, where the consensus called for $1.4 million.

Calling the guidance positive, Garcea also pointed out that recent acquisition Menlo would be in the Q1 but that contributions from payment processing acquisition LedgerPay wouldn’t fully appear until Q2.

In his update, Garcea also pointed to the recent surge in use of Microsoft platforms, where Microsoft Teams now has over 75 million daily active users and Microsoft Office and Dynamics continued to see momentum in its latest quarter, while the company’s cloud computing is also growing by leaps and bounds as businesses turn to remote work environments.

“We believe QUIS will continue to build the Microsoft Partner of the Future – both organically and through acquisitions. The combined company heading into 2020, will have 300+ employees, with a rev/EBITDA run rate of US$44M/US$4.4M (without any revenue synergies or LedgerPay). The QUIS management team is uniquely comprised of former and current Microsoft leaders and technologists who share a deep

understanding of market needs and the appropriate application of Microsoft cloud technology.”

“QUIS is executing a targeted Microsoft partner consolidation strategy to fuel the build of the premier Microsoft partner in North America for business solutions and cloud innovation,” Garcea wrote.

With the update, Garcea has raised his valuation on QUIS, now putting the range between $0.73 and $1.46 per share, whereas previously it was between $0.69 and $1.41 per share. Quisitive closed trading on Monday at $0.72 per share.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment