In a research note to clients on Tuesday, M Partners analyst Andrew Hood said he likes the new deal made by Quarterhill (Quarterhill Stock Quote, Chart, News TSX:QTRH) and thinks the stock has a lot of upside in the year ahead.

In a research note to clients on Tuesday, M Partners analyst Andrew Hood said he likes the new deal made by Quarterhill (Quarterhill Stock Quote, Chart, News TSX:QTRH) and thinks the stock has a lot of upside in the year ahead.

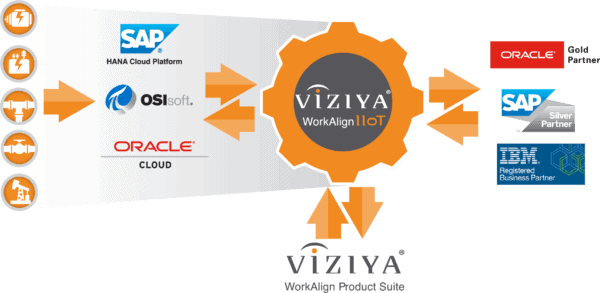

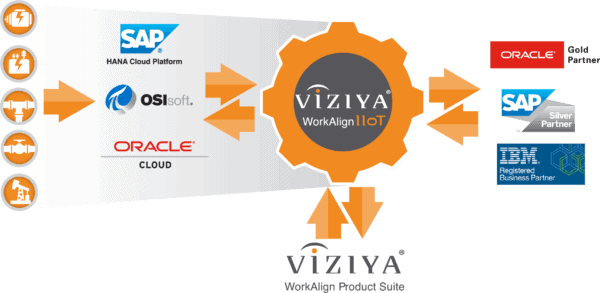

Quarterhill shares spiked on Tuesday with the announcement that the tech-focused investment holding company was selling Viziya, its Hamilton, Ontario-headquartered software company for $49.4 million to North Carolina firm Prometheus Group.

Quarterhill bought Viziya in June 2017 for $24.3 million in cash plus $16.2 million in earn-outs which were not achieved by July 31, 2019.

Quarterhill chair John Gillberry said the company wasn’t looking to sell Viziya but that the sale gives the company more flexibility going forward.

“One, [the sale] generates significant cash proceeds and further strengthens our balance sheet. Second, it enables us to both drive our future growth and return some capital to shareholders, which will be the subject of an announcement on May 21, 2020, and, third, it delivers a strong internal rate of return (IRR) on our initial investment in VIZIYA,” said Gillberry in a Tuesday press release. Along with its vertical market and IoT software businesses, Kitchener, Ontario-based Quarterhill has a patent monetizing subsidiary, WiLAN. The company lost its CEO and president last fall when Doug Parker resigned but earlier this month appointed Paul Hill to the two roles, with Quarterhill’s focus now on “improving the operations of Quarterhill’s existing portfolio companies, engaging with employees and shareholders and updating Quarterhill’s strategy,” said Gillberry, who wrote in a May 5 press release.

In his update, Hood said the loss of Viziya will mean less predictability in the short to medium term in QTRH’s revenue but that considering the currently volatile economic climate, having more cash on hand is never a bad thing.

“While the sale of this core business was a surprise to us, we view the economics of the transaction very positively. In this tougher economic environment, we believe that the potential to more than double its money in three years was too good for Quarterhill to pass up though it was not looking at divesting VIZIYA. Further, in our view VIZIYA’s business was likely to be most impacted by the COVID-19 pandemic,” Hood wrote.

Hood estimates Quarterhill to now have about US$120 million in cash on the balance sheet which the company will likely be deploying as capital returns to shareholders (likely to be announced with its first quarter earnings on May 21) as well as M&A activity going forward.

“We also remind investors that judgement as a matter of law (JOML) proceedings are ongoing with Apple in March, with a likely deadline to appeal within a month. While the ultimate payout could be up to 2 years away, it is possible that QTRH will receive $85.2 million (minus contingent legal fees) in additional cash from Apple this year. We are not currently modelling this, and it would provide another ~$0.70/share in cash,” Hood wrote.

With the update, Hood has reiterated his “Buy” rating and $3.00 target price, which at press time represented a projected 12-month return of 62 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment