New data from Profound Medical (Profound Medical Stock Quote, Chart, News TSX:PRN) has Raymond James analyst Rahul Sarugaser more excited about prospects for the company’s TULSA-PRO medical device.

New data from Profound Medical (Profound Medical Stock Quote, Chart, News TSX:PRN) has Raymond James analyst Rahul Sarugaser more excited about prospects for the company’s TULSA-PRO medical device.

In an update to clients on Tuesday, Sarugaser detailed the findings and reasserted his “Strong Buy 1” rating for PRN, saying more widespread adoption of the TULSA-PRO across the US could be in the cards.

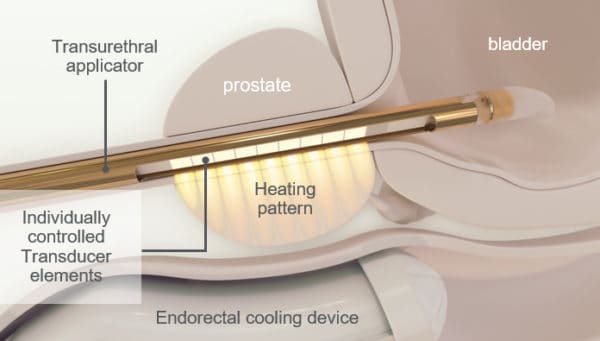

Profound Medical is commercializing in the United States its non-invasive technology, the TULSA-PRO, for the ablation of prostate tissue. Profound received 510(k) marketing authorization from the FDA last August, while this year so far, Profound announced its first multi-site imaging centre agreement with diagnostic imagining company RadNet.

Also over the first quarter of 2020 Profound closed on a financing round for proceeds of US$39.5 million.

Last year at this time, Profound gave one-year follow-up data on the TULSA PRO at the annual meeting of the American Urological Association, while this year it had two-year data to present, which, in Sarugaser’s words, “was even stronger than its one-year data, further affirming TULSA’s strong efficacy and industry-leading safety profile, important accelerators of physician and patient adoption alike.”

On the findings, Sarugaser pointed to three aspects: prostate specific antigen (PSA) levels remained stable, implying that the cancers has not returned in two years in patients having received treatment; urinary incontinence, which is up to 11 per cent in standard care, decreased to 2.6 per cent at the one-year mark and down to one per cent at the two-year mark; on sexual dysfunction, which has a rate of almost 80 per cent in the standard of care, PRN saw 25 per cent of patients presenting after one year and only 17 per cent at the two-year mark.

“While the one-year data presented at AUA last year was already impressive, this two-year data, in our view, is even more impressive,” wrote Sarugaser.

“From this new data, we see that PSA levels remained stable, indicating that little to no cancer has returned two years post-treatment; a strong signal of durable efficacy. Just as important, PRN’s safety profile with respect to incontinence and erectile dysfunction continues to improve. As such, we believe that both physicians and patients will be encouraged by the durability of TULSA’s strong efficacy and safety, which—in turn—should drive strong adoption as PRN continues to commercialize TULSA,” he wrote.

“Further, we expect that PRN having presented this compelling data at a seminal meeting such as AUA will have caught the eye of urologists hailing from large, influential academic centres; we wouldn’t be surprised to see installations of TULSA at these thought-leading institutions in the near-term, which—in our view—would drive broader adoption among the urology community at large,” Sarugaser wrote.

By the analyst’s estimates, PRN should generate fiscal 2020 revenue of $8 million and an EBITDA loss of $25 million, while in fiscal 2021, Sarugaser is calling for revenue of $22 million and an EBITDA loss of $23 million. (All figures in Cdn dollars except where noted otherwise.)

So far in 2020, PRN’s share price is up 14.7 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment