National Bank Financial analyst Richard Tse resumed coverage of Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP) on Tuesday with an “Outperform” rating and reiterated $850.00 per share target, saying there’s still more runway for the e-commerce sensation.

National Bank Financial analyst Richard Tse resumed coverage of Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP) on Tuesday with an “Outperform” rating and reiterated $850.00 per share target, saying there’s still more runway for the e-commerce sensation.

Following on SHOP’s completion of its public share offering announced last week and then closed on Tuesday, Tse moved his rating from “Restricted” back to “Outperform” and calling Shopify a growth driver for the new economy.

“We continue to believe Shopify is in the early stages of a market that’s structurally changing towards more e-commerce. We believe Shopify remains a leading e-commerce disruptor and we believe upside in the stock will come from a number of different incremental growth drivers noted above,” said Tse.

Shopify’s share price has been on a mission lately, climbing a full 52 per cent over the month of April and now jumping another 16 per cent over the first stretch of May.

SHOP is riding a wave of interest in e-commerce as a result of COVID-19-based restrictions which have forced more retailers to beef up their online presence in lieu of bricks and mortar. The company reported first quarter earnings last week which showed a glimpse of what Shopify looks like under work-from-home and social distancing measures.

The Q1 (ended March 31) featured revenue up 47 per cent year-over-year to $470.0 million and adjusted net income of $22.3 million or $0.19 per share. Breaking down the top line, Subscription Solutions revenue came in at $188 million while Merchant Solutions was $282 million. (All figures in US dollars.)

With the first quarter commentary, management reported new stores on its platform grew an impressive 62 per cent between March 13 and April 24 compared to the prior six-week period, which the company attributed to both COVID-19 driving commerce online and Shopify’s own measures to help out businesses, notably, by extending the free trial period from 14 to 90 days for new businesses, although the company did underline that the longevity of new stores is intimately tied to their ability to generate sales, a particular unknown at this point in time.

As for Shopify’s new financing round, the company took advantage of its high share price to issue 2.1 million Class A subordinate voting shares for proceeds of $1.489 billion, money the company says will go towards strengthening its balance sheet and helping fund its growth strategies.

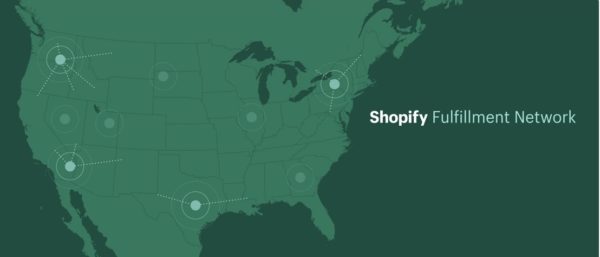

For his part, Tse listed a number of reasons to like SHOP, including Shopify’s fulfillment network, whose value has only been amplified by the pandemic, Tse said; Shopify Plus, the company’s enterprise platform, another potential multi-billion opportunity, Tse said; the company’s international push, which now accounts for about 70 per cent of new merchants on the platform; new services like Shop and Shopify POS which will encourage more adoption and up take-rates; and, finally, Shopify’s sparkling balance sheet with now $3.8 billion in cash: “That gives Shopify flexibility to executing on its numerous growth initiatives,” Tse said.

At press time, Tse’s $850.00 target represented a projected one-year return of 11 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment