Barometer Capital’s David Burrows likes the look of biotech name iRhythm Technologies (iRhythm Technologies Stock Quote, Chart, News NASDAQ:IRTC) which has made tremendous gains during the COVID-19 era but is poised to benefit from pandemic-inspired changes to healthcare.

Barometer Capital’s David Burrows likes the look of biotech name iRhythm Technologies (iRhythm Technologies Stock Quote, Chart, News NASDAQ:IRTC) which has made tremendous gains during the COVID-19 era but is poised to benefit from pandemic-inspired changes to healthcare.

“It’s a great, great theme, medical devices, with lots of stuff to look at there,” said Burrows, president and chief investment strategist at Barometer Capital, in conversation with BNN Bloomberg on Thursday.

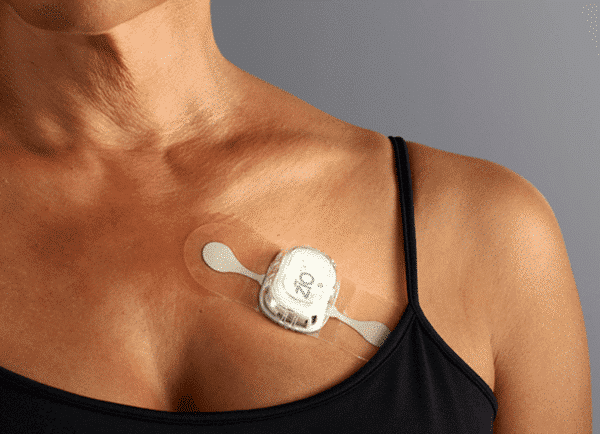

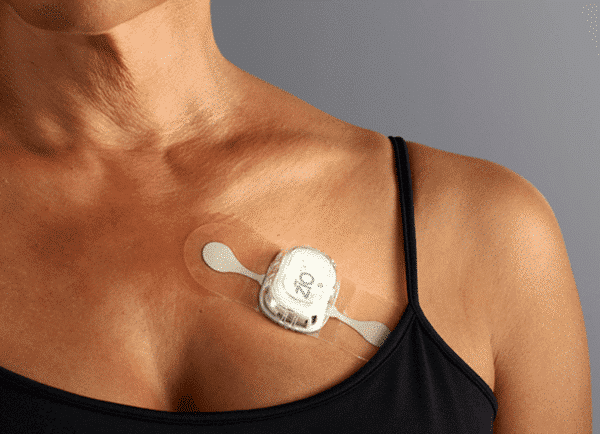

“iRhythm Technology is a company that makes biosensors that connect wirelessly up to the cloud to report a patient’s condition. So the primary use for iRhythms technology is they make heart rate monitors that effectively monitor the heart rate and send it to the cloud and they use artificial intelligence to recognize when you may be getting into difficulty,” Burrows said.

iRhythm’s share price took off at the start of April and hasn’t looked back, climbing from $90 per share to where it’s been trading for the past week around $130.

And while the rise in interest in IRTC has definitely coincided with the market’s search for pandemic-friendly stocks in fields like healthcare and tech that fit our now stay-at-home work and lifestyles, iRhythm is no flash in the pan success story.

The company has been a strong performer over the past year, where it has beaten revenue estimates over the past five quarters, including the most recent first quarter results delivered on May 7. There, IRTC hit $63.5 million in revenue, a 31-per-cent year-over-year increase and an eight-per-cent sequential increase, where analysts had been calling for $61.4 million. (All figures in US dollars.)

Management estimated the Q1 impact of COVID-19 at 2.0 million, while maintaining its position of withdrawing guidance for the remainder of the year due to uncertainties related to the pandemic.

“Prior to the onset of the COVID-19 virus and its widespread impact on the healthcare sector, we had an exceptionally strong start to the year,” said Kevin King, CEO, in the first quarter press release. “The components of our near and mid-term strategy remain sound and we expect these to continue to drive expansion of our business as the recovery takes hold and in a longer-term post-recovery environment.”

Burrows says the stock should still have some upside.

“Clearly, we are in a world right now where we may well want to have biosensors to monitor people’s conditions for change. And so iRhythm is right in the centre of that theme,” Burrows said.

“The stock had a great run recently and doubled off the bottom, and I don’t want to say that that means it’s done,” he said. “The markets that they’re playing into are giant.”

“The stock consolidated between $100 at the high end and $60 at the low end between September of 2018 and when it recently broke out, so it could certainly pull back, but I would be a buyer of the stock,” he said. “I think that these technologies are being accelerated not decelerated and iRhythm is right in the centre of a space that could be involved in testing and monitoring for COVID, ultimately.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment