A newer stock you might want to keep on your radar is enterprise virtual training company Docebo (Docebo Stock Quote, Chart, News TSX:DCBO), says portfolio manager Bruce Campbell, who says he missed out on the stock’s recent run.

A newer stock you might want to keep on your radar is enterprise virtual training company Docebo (Docebo Stock Quote, Chart, News TSX:DCBO), says portfolio manager Bruce Campbell, who says he missed out on the stock’s recent run.

Docebo has been a bullet of a stock over the past couple of weeks, thanks to its services fitting in nicely with remote work and stay-at-home regulations.

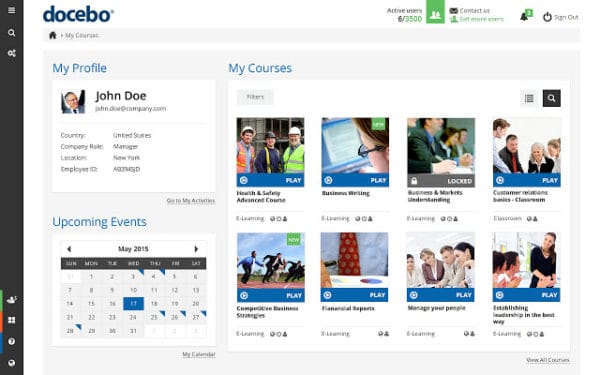

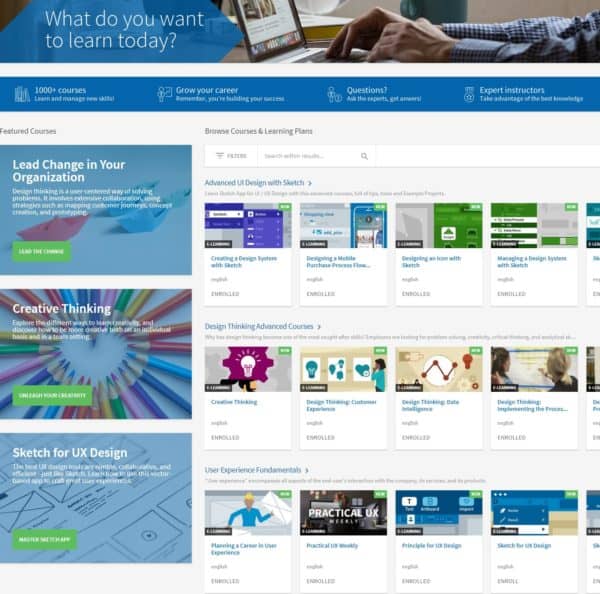

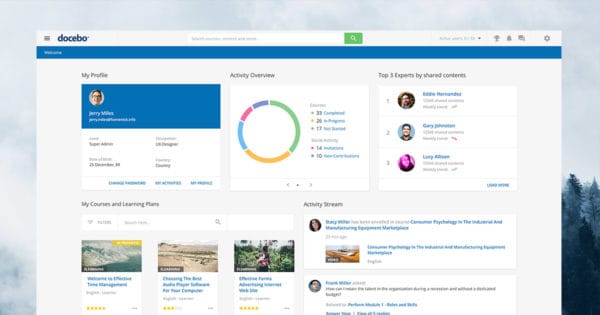

Docebo has a cloud-based and AI-powered e-learning platform that’s customizable for businesses to offer their own courses and training — earlier this month, the Toronto-based company donated nine months of free use of their service to the Heart & Stroke Foundation which will put Docebo’s platform to work in delivering critical training during COVID-19 such as resuscitation training.

Founded back in 2005, Docebo went public last fall at the $16.00 mark, and while the stock dipped at the start of the pandemic-inspired market pullback, DCBO has since rocketed higher, this week hanging around $26.00 per share.

Campbell, portfolio manager for StoneCastle Investment Management, says there’s lots of potential here.

“It’s one that we looked at when they originally went public,” says Campbell, speaking on BNN Bloomberg on Wednesday. “To start with, it takes a lot to get your head wrapped around what they do — they basically have a online learning platform so if you’re a company and you want to train your employees, then you would do so with their technology.”

“Of course, the stock’s done phenomenally well in the pandemic because now everyone needs to do this remotely. The days of getting together in a meeting or convention are kind of done or are at least on hold for a while, and so, somebody like Docebo has done phenomenal, the stock price has really moved up here.”

Earlier this month, Docebo released its first quarter 2020 results which saw revenue grow 57 per cent year-over-year to $13.5 million, with subscription revenue up 60.6 per cent to $12.2 million. Adjusted EBITDA was a loss of $2.4 million compared to a loss of $1.6 million a year earlier.

The company reported having its platform now in use by 1,938 customers, up from 1,596 a year ago and including major additions over the Q1 Walmart and Barilla. In his quarterly commentary, CEO and founder Claudio Erba said the company has seen higher use and interest in its platform through the pandemic.

“Although we must be pragmatic and appropriately cautious in the current environment, as economies recover from this pandemic we believe there will be lasting changes in remote working behaviour that further underscores importance of LMS for every enterprise,” Erba said.

On the company’s profitability prospects, Campbell said, “It’s still pre-earnings so obviously it trades at a little bit higher multiple. It’s one that we don’t own. We kind of missed out because we were trying to get our heads around the business and didn’t really see the opportunity there.”

“But it’s an interesting one and in this environment they probably do quite well,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment