Cipher Pharmaceuticals gets bullish new target at Mackie Research

Specialty Pharma name Cipher Pharmaceuticals (Cipher Pharmaceuticals Stock Quote, Chart, News TSX:CPH) has received a target raise from analyst André Uddin of Mackie Research Capital after the company latest quarterly earnings.

Specialty Pharma name Cipher Pharmaceuticals (Cipher Pharmaceuticals Stock Quote, Chart, News TSX:CPH) has received a target raise from analyst André Uddin of Mackie Research Capital after the company latest quarterly earnings.

Uddin updated clients on Cipher in a Friday research report where he spoke of a major upcoming catalyst for the company and stock.

Oakville, Ontario’s Cipher Pharma has a portfolio of commercial and early to late-stage products and does clinical development all the way to marketing, either directly in Canada or indirectly through partners in Canada, the US and South America.

Shares of Cipher shot up on Friday after the company released its first quarter 2020 figures on Thursday, featuring total revenue up 15 per cent year-over-year to $5.9 million, while product revenue grew by 41 per cent to $2.6 million and SG&A dropped 51 per cent to $1.4 million. Adjusted EBITDA for the term grew by 132 per cent year-over-year to $4.1 million.

Management commented on the combined top line growth and expense management prowess for the quarter, creating strong operating leverage. In the press release, interim CEO Craig Mull mentioned solid growth from acne drug Epuris, which finished the quarter with a 40 per cent market share in Canada and $2.4 million in revenue.

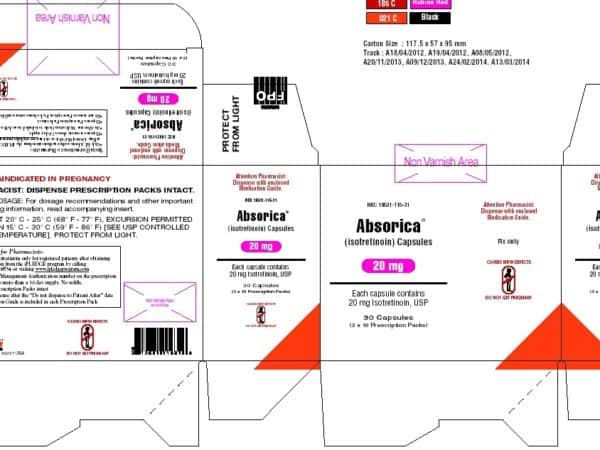

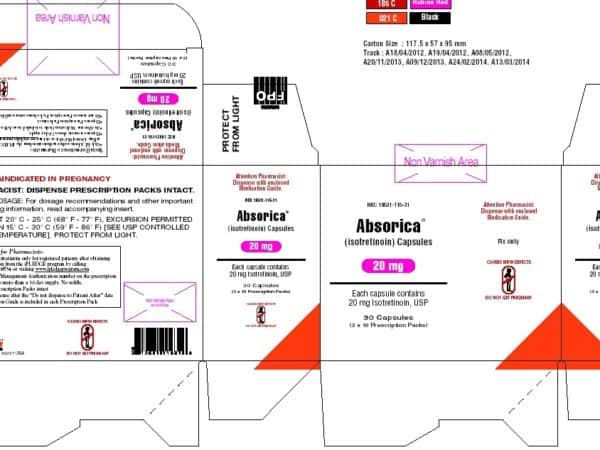

Also over the quarter was the launch of Absorica LD capsules in the US by partner Sun Pharmaceuticals and subsequent to the quarter’s end was the conclusion of a lawsuit (ending in binding arbitration) by Cipher on Upsher-Smith for alleged patent infringement.

“We believe the launch of ABSORICA LD and the conclusion of the arbitration with Upsher-Smith improves and extends the competitive position of our products, placing the Company in a strong position to benefit from the future revenue stream associated with Absorica and ABSORICA LD,” said Mull in the press release.

The quarter’s top and bottom lines were beats of Uddin’s estimates, where Uddin was calling for $4.5 million in revenue compared to Cipher’s $5.9 million and for $3.1 million in adjusted EBITDA compared to CPH’s $4.1 million.

Uddin commented that Cipher’s Canadian segment generated product sales of $2.6 million, which was stronger than he had expected at $1.5 million and better than last year’s $1.8 million. The analyst said that concluding a distribution agreement on its Canadian products will be a catalyst for the company, as it’s part of Cipher’s plan to transition to a leaner structure based solely on revenue from product sales royalties.

“Cipher is looking to forge a distribution agreement with a potential partner for all of its Canadian products – in this way the company would still retain the rights to those assets.

We have assumed the timing of this transaction in Q4 2020,” Uddin said. On the company’s US licensing segment and its Absorica sales, Uddin said it’s showing signs of revenue stabilization.

“The franchise ended Q1 with 6.2 per cent market share. Cipher’s licensing revenues decreased in the last two years due to declining Absorica royalties as a result of no promotional efforts by Sun Pharma. We believe the revenues of this segment could potentially stabilize in 2020 – which remain an important, high-margin cash flow stream to Cipher,” Uddin wrote.

With the update, Uddin has maintained his “Buy” rating but raised his target from $1.00 to $1.50, reflecting at the time of publication a projected return of 67 per cent.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.