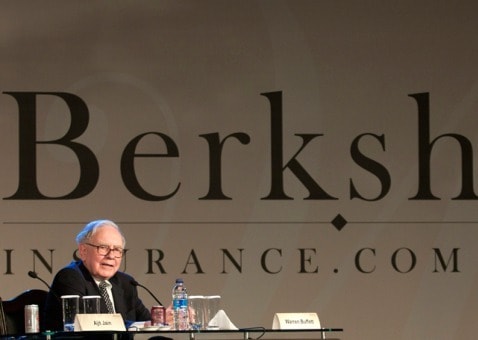

The doubters have been coming out of the woodwork on Berkshire Hathaway (Berkshire Hathaway Stock Quote, Chart, News NYSE:BRK.B) with the stock down considerably in 2020, but John O’Connell of Davis Rea Investment Counsel says the company’s take on the COVID-19 crisis and ensuing economic fallout may prove to be the wisest in the long run.

Holding company Berkshire Hathaway released its first quarter earnings earlier this month, posting a Q1 loss of nearly $50 billion as its businesses were hit hard by the worldwide economic slowdown. Even as Berkshire’s operating profit climbed by six per cent, the company admitted that more than 90 of its businesses are dealing with severe negative effects from COVID-19.

At the company’s annual meeting, chairman Warren Buffett admitted he’d made a mistake in buying stakes in airlines, with the company selling in April over $6 billion in airline stocks, a sector that has been virtually shut down and now comes with a load of uncertainty surrounding the next few years. Berkshire began acquiring holdings in US airlines such as United Airlines, Delta, Southwest and American back in 2016.

Berkshire has been uncharacteristically reticent towards acquisitions recently, even during the economic downturn, with the company sitting on over $137 billion in cash.

In his annual comments, taken as gospel by his legions of followers, Buffett also made the case for investing in the S&P 500 index rather than trying to pick winners during these turbulent times, which in essence was a vote of confidence in companies such as the FAANG tech giants who make up over one fifth of the index.

But O’Connell says it’s far from clear how the economy will fare over the next while, making it a tough investment climate and perhaps Buffett and Berkshire the more wiser for staying on the sidelines.

“We’re obviously big fans of Warren Buffett’s investment philosophy,” said O’Connell, CEO of Davis Rea, who spoke on BNN Bloomberg on Tuesday. “We follow many of the same tenants and thought processes.”

“I think one of the most interesting takeaways I took from Warren Buffett’s recent speeches was that during this pandemic he hasn’t done any buying. If you listen to a lot of the major, well established, very successful long term investors, they’ve been sitting on their hands during this whole process because really quantifying and thinking what the long term impacts of this is going to be is is very, very difficult.”

Famous for beating the S&P 500 Index over many decades, Berkshire’s streak has been put to the test in recent years. Last year, while the S&P returned over 30 per cent, BRK was up a more modest 11 per cent. So far in 2020, Berkshire is down 18 per cent.

“You have a company that’s sitting on billion in cash, so they’re in a pretty good position, and well run, well diversified. And so I think certainly the company is lagging behind the markets in a significant way. I think it’s attractive at these prices and I wouldn’t hesitate to be an owner of it,” O’Connell said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment