Is Canopy Growth (Canopy Growth Stock Quote, Chart, News TSX:WEED) a buy? According to at least one cheerleader, there is a set of circumstances that could very well propel it higher.

Is Canopy Growth (Canopy Growth Stock Quote, Chart, News TSX:WEED) a buy? According to at least one cheerleader, there is a set of circumstances that could very well propel it higher.

It says something about the enormous impact of the coronavirus that the November 3 election has been pushed to at least the second page. But sometime, possibly as soon as this summer, things will return to a new normal. And when they do the election will be front and center and investors will be wondering how they can profit from the change.

If you are betting on blue sweep, you should be buying Canopy Growth Corp, says Jim Cramer.

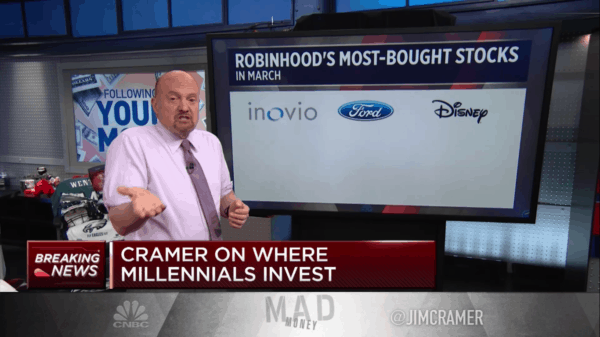

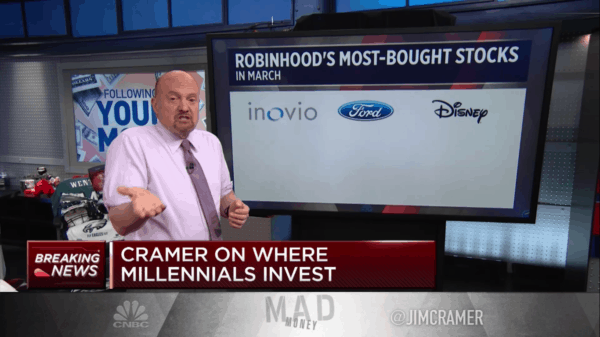

The bald and boisterous host of “Mad Money” today tackled what he described as “millennial stocks”, those issuers favoured by those Whiteclaw-swigging, Fortnight-binging toddlers who are somehow now between 23 and 39 years-old. Cramer, who says avoid the penny stock noise in the space, says Canopy is the clear leader.

“I don’t like penny stocks, they’re penny stocks for a reason,” he said. “The blue chip cannabis play is Canopy Growth, which is backed by the incredibly well run Constellation Brands.If you want to bet on a Democratic sweep in November followed by marijuana legalization: Canopy.

But all is not well in Canopy land, as the company on April 16 announced some tough measures designed to help the coming months, including exiting its operations in South Africa and Lesotho, a shutdown of its 90,000 square-foot indoor facility in Yorkton, Saskatchewan, a cease of operations at its cultivation facility in Colombia and its farming operations in Springfield, New York.

“When I arrived at Canopy Growth in January, I committed to conducting a strategic review in order to lower our cost structure and reduce our cash burn,” CEO David Klein said. “I believe the changes outlined today are an important step in our continuing efforts to focus the company’s priorities, and will result in a healthier, stronger organization that will continue to be an innovator and leader in this industry. I want to sincerely thank the members of the teams affected by these decisions for their contributions in helping build Canopy Growth.”

At least one analyst is buying what Klein is selling.

Cowen analyst Vivien Azer said the moves underscored her “Outperform” rating on Canopy Growth, for which she has a price target of (C) $35.00.

“Our thesis continues to be driven by the quality of its management team, namely CEO and former [Constellation Brands] CFO David Klein, as well as its balance sheet,” she wrote in a research update to clients.

Another analyst, Andrew Carter of Stifel, said this was a sign of the times for a once high-flying space.

“We are not surprised Canopy is transferring ownership of its local operations in South Africa/Lesotho while abandoning cultivation in Colombia,” Carter said. “While a number of countries have legalized marijuana for medical use, the pace of implementing commercial systems has been well below the industry’s aggressive projections.”

A growing number of Americans, support the legalization of marijuana. A recent poll conducted by Pew Research Center found that 67 per cent of U.S. residents do. But the support does split along party lines: 55 per cent of Republicans back legalizing pot, while a whopping 78 percent of Democrats do.

Shares of Canopy Growth Corp on the TSX closed Tuesday down 0.9 per cent to $21.27.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment