Looking for bright spots within the ongoing market deluge? Raymond James analyst Rahul Sarugaser says Profound Medical (Profound Medical Stock Quote, Chart, News TSX:PRN) should be top of mind, as the company appears to be well-insulated with respect to the COVID-19 pandemic.

Looking for bright spots within the ongoing market deluge? Raymond James analyst Rahul Sarugaser says Profound Medical (Profound Medical Stock Quote, Chart, News TSX:PRN) should be top of mind, as the company appears to be well-insulated with respect to the COVID-19 pandemic.

In an update to clients on Thursday, Sarugaser reaffirmed his “Strong Buy 1” rating for PRN, saying that the stock remains his “Analyst Current Favourite” and Raymond James’ Top Pick for 2020.

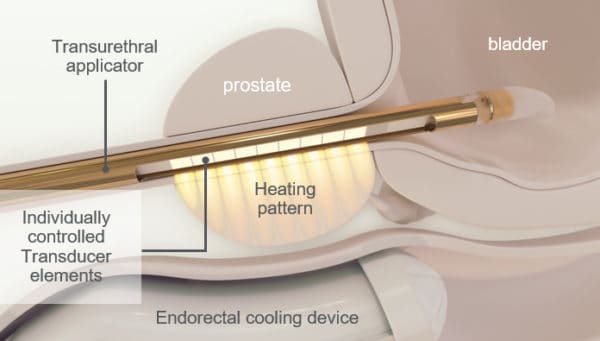

Toronto-based Profound Medical is commercializing a novel non-invasive, image-guided therapeutic technology, the TULSA-PRO, for the ablation of pathologic prostate tissue while protecting critical surrounding anatomy.

The company recently received 510(k) marketing authorization from the US Food and Drug Administration and is in the process of rolling out its marketing efforts across the United States.

After years of treading water, the stock took off late last year, ending 2019 up 168 per cent. PRN did even better over the first stretch of 2020, rocketing up 77 per cent between January 1 and mid-February. After that it’s been all downhill, however, with the stock having effectively lost all of the gains made this year.

But the stock should really fare well during the current market downturn, according to Sarugaser.

“With the recent market volatility around COVID-19, we have been combing through our coverage universe to identify companies that we see as insulated from the economic challenges being driven by this pandemic,” the analyst said. “With this, we’re reiterating our Analyst Current Favourite as Profound Medical, which we see as particularly insulated from the current economic fallout of COVID-19.”

Why PRN?

Sarugaser pointed to three reasons: one, after its recent capital raise and debt retirement the company has lots of cash — about $53 million — which is enough to fund two full years of operations; two, in recent years the company has brought all of its manufacturing in-house to its facility in Mississauga, Ontario, leaving it free from potential supply chain woes related to overseas manufacturing; three, the company has reported no narrowing of its sales pipeline in response to the coronavirus outbreak, with

ongoing installations proceeding in California and no indications of delay.

In sum, Sarugaser said that the company should be on pace to meet his fiscal first quarter 2020 revenue estimate of $2.0 million.

“All of this said, given PRN's limited liquidity, we do expect the company's stock to be susceptible to the overall market volatility—the stock is down ~30 per cent during the last month (versus the TSX down ~20 per cent), closing ~C$15.00 [on Wednesday] —however we do see this as an opportunity for clients to step in progressively, or average down. PRN is our Analyst Current Favourite and our 2020 Best Pick,” Sarugaser said.

Looking ahead, the analyst thinks PRN will generate fiscal 2020 revenue and EBITDA of $11 million and negative $23 million, respectively, and fiscal 2021 revenue and EBITDA of $27 million and negative $20 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment