We hope that you, your family, and colleagues are doing well. Crises always create fear and stress, but somehow, someway, we manage to come out the other side mostly intact.

We hope that you, your family, and colleagues are doing well. Crises always create fear and stress, but somehow, someway, we manage to come out the other side mostly intact.

Consider that over the past 100 years, we have:

• survived pandemics that killed millions, like the Spanish Flu, HIV/AIDS, Asian Flu, Hong Kong Flu;

• recovered from over 30 wars, including WW1, WW2, Korea, Vietnam, Persian Gulf, Afghanistan War, Iraq, and;

• withstood global warming, global cooling, ozone deterioration, acid rain, gas crisis, Y2K

and 9-11.

Although the current financial market crisis is not as important as your family and friends, we survive them too. Over the past 100 years, we’ve endured 25 bear markets where the S&P 500 declined 20% or more. And in our experience, microcaps with solid balance sheets often outperform when the bear ends.

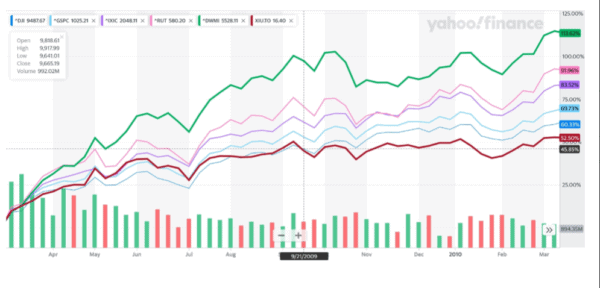

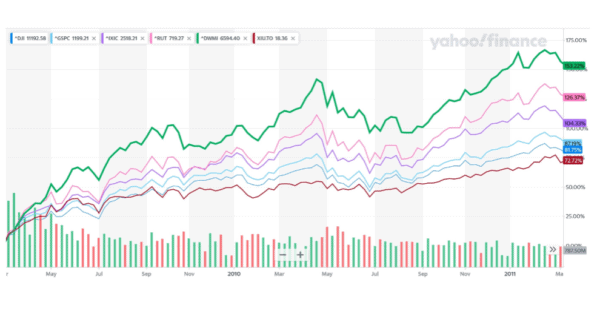

Look at the 1-year, 2-year, and 5-year performance of the Dow Jones U.S. Micro-Cap Total Stock Market Index (green lines) below. It outperformed the Dow Jones Industrial Average, S&P500, NASDAQ, Russell 2000, and S&P/TSX 60 one, two, and five years after the March 9, 2009 credit crisis low. Even if you invested January 1, 2009 before the markets hit bottom, microcaps still outperformed one year after the low.

“The Brave Soul Can Mend Disaster” – Catherine the Great

So, if you’re bold and looking to step into microcaps while the market whips around, here are names (Disclaimer: All companies listed are Sophic Capital clients) to consider:

Kraken Robotics (Kraken Robotics Stock Quote, Chart, News TSXV:PNG) is a marine technology company engaged in the design, development and marketing of advanced sensors for Unmanned Underwater Vehicles used in military and commercial applications. Kraken is currently working on $300 million of contract pursuits and has won several contracts worth tens of millions of dollars each. At the end of September 30, 2019, the Company had:

• working capital of $7.7 million (including $2.7 million of cash) compared to $4.9 million at

December 31, 2018;

• $560K total debt, with $200K current;

• Adjusted EBITDA was $1 million;

• Nine-month cash flow from operations before non-cash working capital changes was $1.9

million;

OneSoft Solutions (OneSoft Solutions Stock Quote, Chart, News TSXV:OSS) has designed a machine learning cloud solution that predicts when oil and gas pipeline failures can occur. Current clients include Phillips 66 and one of the seven oil and gas supermajors. OneSoft has no competitors. At the end of September 30, 2019, the Company had:

• working capital of $9.1 million (including $11.5 million of cash) compared to $2.4 million at

December 31, 2018;

• zero debt;

• Nine-month cash burn from operations before non-cash working capital changes was $1.6

million.

Legend Power Systems (Legend Power Systems Stock Quote, Chart, News TSXV:LPS) produces a power management platform that analyzes and auto-corrects common building power challenges, reducing risk to systems and eliminating wasted expenditures. The Company has a solid client base in Ontario and has been targeting the U.S. Northeast for the last year, where one of the world’s largest technology companies bought a unit and subsequently ordered two more. At the end of December 31, 2019, the Company had:

• working capital of $6.4 million (including $4.2 million of cash) compared to $7.9 million at

September 30, 2019;

• zero debt;

• Three-month cash burn from operations before non-cash working capital changes was $1.3

million.

Nanotech Security (Nanotech Security Stock Quote, Chart, News TSXV:NTS) provides customizable nano-optic visual authentication technology with a unique combination of multiple colours, 3D depth and omni-directional movement. The Company continues to work on a $30 million development contract from one of the world’s top 10 currency issuers and has opportunities with brands. At the end of December 31, 2019, the Company had:

• working capital of $9.1 million (including $9.5 million of cash) compared to $9.7 million at

September 30, 2019;

• zero debt;

• Three-month cash burn from operations before non-cash working capital changes was

$405,000;

Remember, this current global crisis will end, and we kind of know how – we’ll get the virus under control (maybe a vaccine accelerates the timeline), infections will decline, and hopefully deaths will cease. Until then, stay safe, help your elderly neighbors, and remember that we’re in this together.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment