Fresh enthusiasm for Organigram (Organigram Stock Quote, Chart, News TSX:OGI) is well deserved, says Paradigm Capital analyst Corey Hammill.

Fresh enthusiasm for Organigram (Organigram Stock Quote, Chart, News TSX:OGI) is well deserved, says Paradigm Capital analyst Corey Hammill.

On Tuesday, Organigram reported its Q1, 2020 results. The company report a net loss from continuing operations of $863,000 on net revenue of $25.2-million, a topline that was up 103 per cent over the same period last year. In the quarter, the company returned to positive EBITDA.

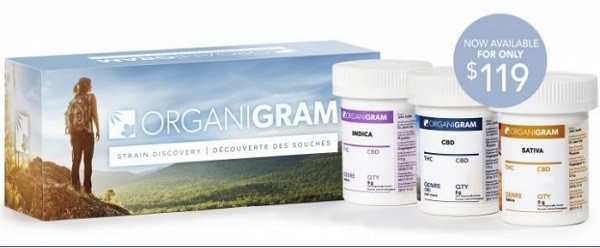

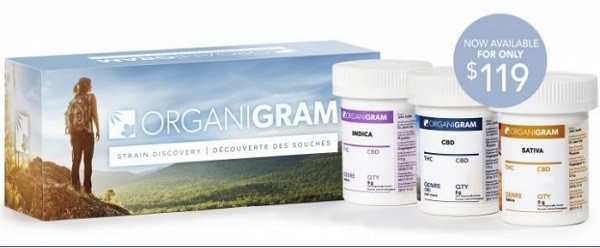

“Despite ongoing industry challenges, we are pleased with solid Q1 2020 results and our return to positive adjusted EBITDA during the quarter, said CEO Greg Engel. Our team was also successful in shipping the first of our Rec 2.0 products as planned and on schedule in December of 2019. We also look forward to the launch of the remainder of our vape pen portfolio followed soon after by our premium cannabis-infused chocolate products. In addition to an exciting line-up of 2.0 products, we are rolling out a couple of new core strains, such as our high THC Edison Limelight, across the country following their success as limited-time-offers in smaller markets.”

Hammill notes that the results have brought renewed enthusiasm to Organigram in a time when that emotion is in short supply for LPs.

“Despite dealing with a tough Canadian industry tape – caught in a lull leading up to the first impact of cannabis 2.0, still with an undeveloped brick and mortar retail model (especially in meaningful markets), and faced with a scenario of extreme industry oversupply—Organigram posted a very solid Q1 2020,” he said. “As other L.P’s scratch and claw for capital and experience financial distress, OGI is well positioned due to its high margin, low cost cultivation methodology (yielding high-quality flower for less than $1 per gram all-in) and its strong balance sheet (+C$100M in liquidity with prudent spending tactics).”

In a research update to clients today, Hammill maintained his “Buy” rating and one-year price target of $5.25 on OGI, a figure that implied a return of 87 per cent at the time of publication.

Hammill thinks Organigram will post Adjusted EBITDA of $32.0-million on revenue of $122.7-million in fiscal 2020. He expects those numbers will improve to EBITDA of $60.0-million on a topline of $216.1-million the following year.

The analyst said OGI has clearly distinguished itself in a crowded field.

“After an off quarter in Q4/19, Organigram followed up by surprising the Street in Q1/20 which sent the stock up +20% in afterhours trading on Tuesday evening. The quarter will likely serve to shift the focus back to the fact that OGI is a clearly differentiated Canadian LP (licensed producer). We continue to favour OGI for its low-cost production methodologies, its established nationwide distribution network, and its strategy for approaching Cannabis 2.0. Despite having what we believe are superior fundamentals, OGI shares continue to underperform the Canadian Tier 1 LP tracking basket, down 15% versus 5% in the last month. Using consensus estimates, OGI trades at ~2.4x 2021e sales, a steep discount compared to the peer average at ~5x.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment