A Cannabinoid-based treatment for heart disease? Cardiol Therapeutics is one to watch, says Raymond James

Cannabinoid company Cardiol Therapeutics (Cardiol Therapeutics Stock Quote, Chart, News TSX:CRDL) received a coverage launch from Raymond James last Friday with analyst Rahul Sarugaser giving the stock an “Outperform 2” rating and a C$5.00 price target.

Cannabinoid company Cardiol Therapeutics (Cardiol Therapeutics Stock Quote, Chart, News TSX:CRDL) received a coverage launch from Raymond James last Friday with analyst Rahul Sarugaser giving the stock an “Outperform 2” rating and a C$5.00 price target.

Sarugaser said that while there is upside potential from Cardiol’s penetration into Canada’s CBD products market, the real prize is the company’s development program for a cannabinoid-based treatment for heart disease.

Off the bat in his report, Sarugaser stressed that Cardiol is not a cannabis company in that it neither grows cannabis nor sells cannabis.

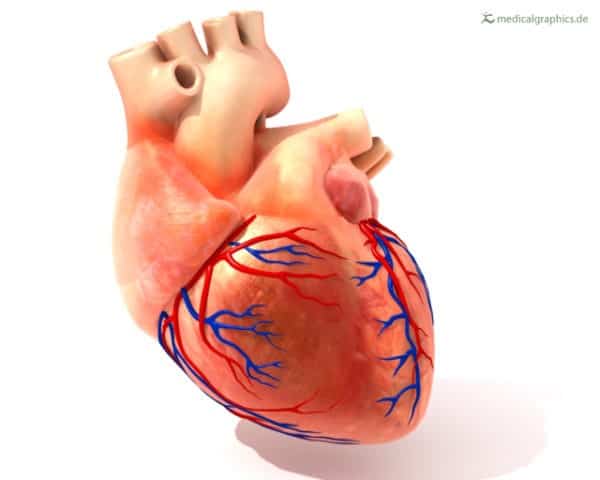

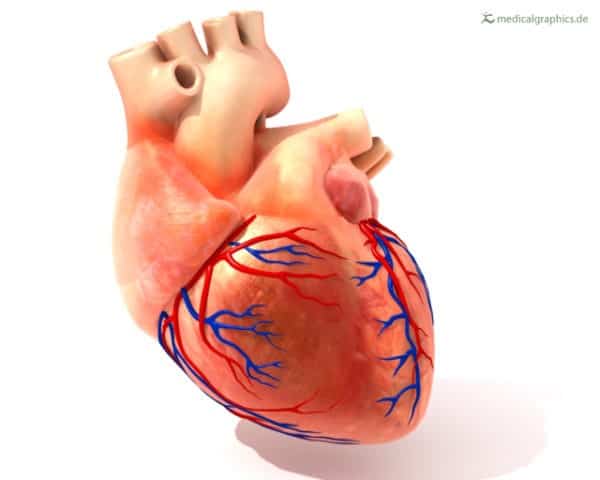

What it is is a biopharmaceutical company that derives CBD by chemical synthesis and has two segments: as a producer of pharma-grade CBD products directed towards underserved patient populations that most need their source of CBD to be THC-free and as a clinical developer of innovative therapies for acute myocarditis and other causes of heart failure.

And while the two business lines are linked, it’s the latter that could be the more lucrative endeavour in the long run, says Sarugaser.

“CRDL has the unique opportunity to pursue gold-standard, randomized, controlled clinical trials in tandem with commercializing pharmaceutical quality formulations of CBD for patients. In this way, the safety and efficacy evidence accumulated through clinical trials in its indications of focus, we expect, will drive sales of its commercial products: physicians and pharmacists are trained to evaluate this sort of data before supporting the prescription of any therapy, including cannabinoid-based therapy. This confidence is further supported by the pharmaceutical protocols CRDL employs to manufacture its products, ensuring their stability, consistency, and purity across all of its batches,” Sarugaser wrote in his coverage initiation.

The analyst likes Cardiol’s heritage, where management is rooted in the biopharmaceutical industry and many have come from clinical-stage inflammation-focused biotech company Vasogen (whose market cap is over US$1 billion).

Sarugaser also likes the synthetic approach to cannabinoid production over its traditional alternative, especially for the medical market. On the one hand, deriving a THC-free CBD formulation from hemp and cannabis plants is extremely difficult and expensive, says Sarugaser, while on the other hand, the plant-derived approach can’t achieve the pure, consistent, stable and readily characterizable ingredient but the synthetic approach can — and Cardiol is sourcing its CBD from one of the world’s largest producers of pharma-quality controlled substances, Noramco, through its subsidiary Purisys.

“While we do not foresee chemical synthesis being the long-run cost leader in the cannabinoid manufacturing arena—we predict cannabinoid biosynthesis to lead in cost-efficiency, in the fullness of time (see our biosynthesis-focused note)—we do see both chemical synthesis and biosynthesis providing reliable quantities of pure, scalable cannabinoids suited to cGMP production and the molecules’ incorporation in pharmaceutical drugs,” wrote Sarugaser.

The analyst says CRDL’s path forward is catalyst-studded, primarily with the company securing a licensed channel through which it can activate sales revenues of CardiolRx under Canada’s medical cannabis legislation, and through CRDL’s following in the footsteps of Britain’s GW Pharmaceuticals, which has developed a CBD drug for treatment of Lennox-Gastaut syndrome and Dravet syndrome in the UK and the US but not in Canada. Sarugaser says that proceeding through Health Canada and US FDA Phase 1, 2 and 3 clinical milestones will each offer “massive value inflection points” for CRDL.

Sarugaser thinks CRDL will generate fiscal 2020 revenue and EBITDA of $2-million and negative $14-million, respectively. As of press time, his C$5.00 target represented a projected 12-month return of 25 per cent.