Beacon Securities analyst Gabriel Leung is bullish on SaaS-based healthcare applications company VitalHub (VitalHub Stock Quote, Chart, News TSXV:VHI), which got a “Buy” rating and $0.35 per share target from the analyst in a coverage launch on Tuesday.

Beacon Securities analyst Gabriel Leung is bullish on SaaS-based healthcare applications company VitalHub (VitalHub Stock Quote, Chart, News TSXV:VHI), which got a “Buy” rating and $0.35 per share target from the analyst in a coverage launch on Tuesday.

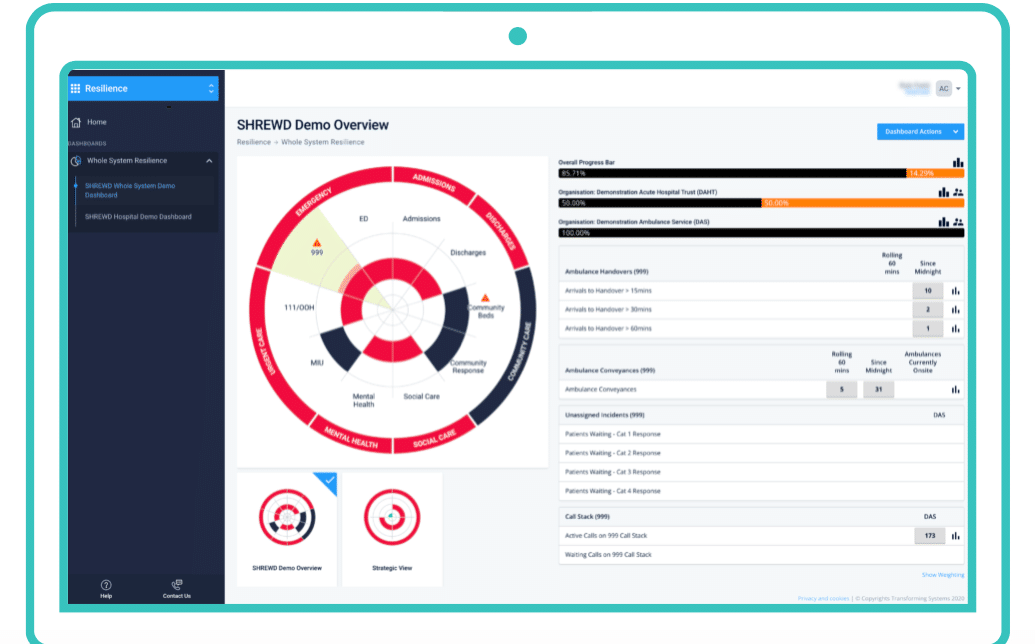

Toronto-based VitalHub develops and supports web, mobile and electronic healthcare record solutions for providers in the acute care, mental health, community health services and long-term care sectors. VitalHub currently supports more than 200 corporate customers across North America and has an offshore development hub in Sri Lanka.

The company says its strategy couples aggressive M&A with strong organic growth. Since going public through a reverse takeover in December, 2016, VitalHub has completed six acquisitions.

Last month, the company closed on the acquisition of healthcare startup Oculys for $4.2 million, while earlier this year VitalHub acquired software and service company The Oak Group for $1.64 million. Its largest acquisition to date was HI Next, bought in January of 2018 for $6.6 million.

Leung says there are a number of pluses that contribute to his positive take on VitalHub, starting with the fragmented healthcare market where a number of small, single-product and geographically-focused companies exist which would represent good M&A candidates for VHI to quickly gain revenue scale.

Leung likes the path taken so far by VitalHub, which has seen five of its six acquisitions become accretive to earnings, generating organic growth even while early in the company’s lifecycle.

“VHI’s integration model looks to reduce costs approximately 20 per cent post acquisition through synergistic reductions and utilization of cost effective offshore R&D resources. When combined with cross-selling, the company looks to increase EBITDA by 20–30 per cent,” Leung wrote.

The analyst pointed to VitalHub’s management team as another check mark, where CEO Dan Matlow and CFO Brian Goffenberg have extensive enterprise software experience, according to Leung, including being part of Medworxx, a patient flow software provider acquired by Aptean.

As well, Leung likes the company’s business model and valuation metrics.

“Shares of Vitalhub are currently trading at ~2.1x EV/Sales and ~8.3x EV/EBITDA, which we view as an attractive entry point given the large growth opportunity before the company (via organic and M&A initiatives), potential operating leverage (EBITDA margins expected to hit 25 per cent in our forecast period), and strong recurring revenue base (approximately 60 per cent of total revenues),” Leung wrote.

VitalHub last reported earnings on November 22, where its third quarter delivered revenues of $2.4 million, up from $2.1 million a year earlier, against EBITDA of $342,000, up from $156,000 a year earlier. Quarterly revenue included $1.4 million in recurring term/maintenance and support, $18,000 in perpetual license and $1.0 million in service revenues. The company’s gross margins were at 71.5 per cent and its EBITDA margins were at 14.3 per cent. Vitalhub ended the Q3 with $4.2 million in cash and $1.7 million in debt.

“We are happy with the results as we continue to have positive EBITDA numbers while continuing to grow our recurring license values,” said Matlow in a press release.

Looking ahead, Leung thinks VitalHub will generate full fiscal 2019 revenue and EBITDA of $10.2 million and $1.8 million, respectively, and fiscal 2020 revenue and EBITDA of $15.1 million and $3.8 million, respectively.

At the time of publication, Leung’s $0.35 target represented a projected 12-month return of 94 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment