That all depends on how you read the tea leaves around the 5G revolution, particularly, how much all that new infrastructure will cost companies like BCE, Rogers and Shaw Communications (Shaw Communications Stock Quote, Chart, News TSX:SJR.B), says investor David Cockfield, who argues there may be downside ahead for the telcos as the 5G build-out continues.

Canada and the rest of the world are preparing for the fifth generation in mobile broadband which comes with promises of vastly superior connectivity including download and upload speeds between ten and 20 times faster than what’s available on current 4G networks.

But setting up the network and transmission points will include major capital expenditures for Canadian telcos. Accounts vary, but a 2018 report by Accenture estimated that while 5G could add 250,000 permanent new jobs and $40 billion annually to Canada’s economy, deploying the infrastructure could cost as much as $26 billion for Canadian carriers.

And Cockfield says until the projected costs are clearly stated, investors should be wary of telecom companies, especially ones like Shaw who stand outside of the Big Three —BCE, Rogers and Telus— and could feel the impact of the 5G deployment more strongly.

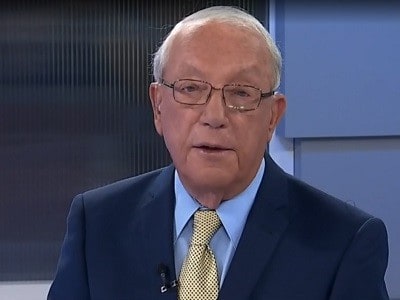

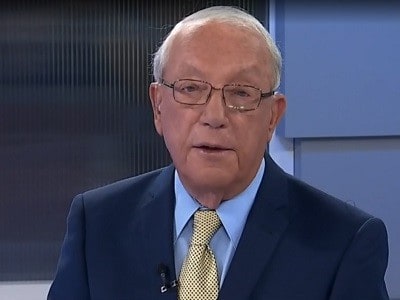

“I really think that this is a question that should be asked a little more because 5G is going to be very expensive and I look at BCE and Shaw and think that BCE is probably better to absorb the cost,” said Cockburn, managing director and portfolio manager at Northland Wealth, who spoke to BNN Bloomberg on Friday.

“This is a big, big step that the companies are having to take and an expensive one. It’s a confusing situation,” he said.

“My view is that you probably stand back and wait and see,” said Cockburn. Canada’s telcos have trod different paths in 2019, an anomaly for names which often travel as a sector as investors take greater or lesser defensive positions. Where BCE and Telus showed good gains, the past 12 months have been less kind to Rogers, which will likely finish the year in the negative, and Shaw, which made modest gains but is still tracking within the same range that it has been for the past half-decade.

Ahead of Shaw’s quarterly numbers due in early January, the company’s fiscal fourth quarter in October delivered higher subscriber growth from Freedom Mobile which exceeded expectations with 90,7000 new customers. Revenue for the quarter was up marginally to $1.35 billion while Shaw’s profit sank from $0.38 per share last year to $0.32 per share.

“I read the various researcher reports and none of the ones on the big telecommunications companies have come forward with estimates on how much this is going to cost. So I’d be a little cautious about stepping into any of the communications stocks right at this time until I see a little more background on what the actual 5G cost is going to be,” Cockfield said.

“We’re going to 5G whether we want it or not because if we don’t, we’ll be behind the rest of the world. And it is a big step forward. The increase in efficiency has to happen. But the cost has to happen, as well, unfortunately,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment