Mackie Research analyst André Uddin maintains that oncology-focused immunotherapy company Medicenna (Medicenna Stock Quote, Chart, News TSX:MDNA) remains a highly undervalued stock.

Mackie Research analyst André Uddin maintains that oncology-focused immunotherapy company Medicenna (Medicenna Stock Quote, Chart, News TSX:MDNA) remains a highly undervalued stock.

In an update to clients on Tuesday, the analyst reviewed Medicenna’s latest quarterly results, saying that a number of important catalysts are upcoming.

Toronto-based Medicenna is a clinical stage biotech company specializing in developing novel interleukin (IL)-based treatments. The company’s lead orphan drug candidate is MDNA55, which is in development for glioblastoma in Phase II studies.

Medicenna reported its second quarter fiscal 2020 financials on Tuesday, with president and CEO Dr Fahar Merchant calling the quarter an exceptionally productive period for the company and noted Medicenna’s recently closed public offering of $6.9 million as a positive sign.

“We significantly advance MDNA55 as an innovative treatment paradigm for patients with end-stage recurrent glioblastoma (rGBM). This has been validated by a recent oversubscribed financing providing strong testament by investors that we have widespread market support to build further value with each of our programs,” said Dr. Merchant, in a press release.

“We have the requisite financial resources leading into several key near-term milestones, including additional data from the MDNA55 Phase 2b clinical trial followed by an End of Phase 2 meeting with the US FDA in early 2020 and advancing MDNA19 towards the clinic,” writes Merchant.

Medicenna reported $0.0 million in revenue and a net loss of $1.9 million or $0.07 per share for its second quarter.

Uddin had called for $0.0 million in revenue and a net loss of $4.0 million or $0.12 per share, although the analyst said that financials are less important at this time, as MDNA is still a clinical-stage company.

Uddin mentions a number of upcoming catalysts for Medicenna, including remaining data from the company’s Phase 2b trial testing a low dose and a high dose of MDNA55 to treat recurring glioblastoma, which will be presented at the 2019 Society of Neuro-Oncology (SNO) meeting in Phoenix, Arizona, between November 20 and 24, with the final data expected in Q2 2020 (Uddin calls this an important catalyst). Finally, the analyst mentions

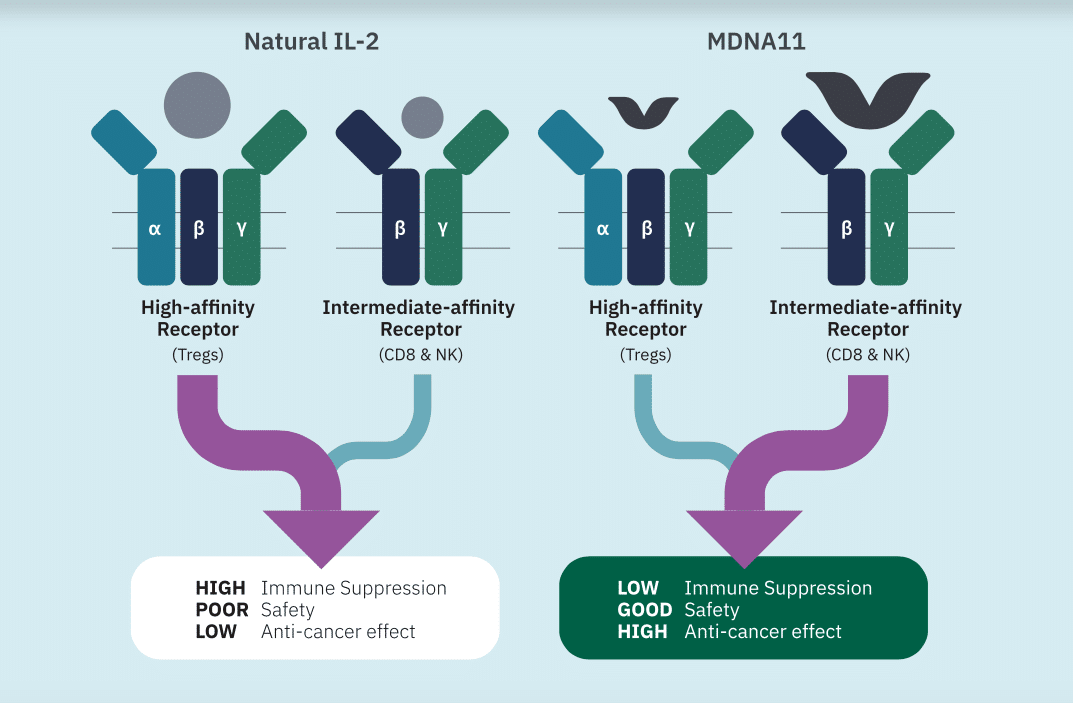

Secondly, Uddin points to an end-of-Phase II meeting with the US FDA in Q1 2020 at which the company should find out if full results of the Phase IIb trial are sufficient to support a BLA filing for MDNA55. And thirdly, Medicenna expects to file an IND for its engineered IL-2 product MDNA19 in late 2020.

“In a best case scenario, the FDA would allow MDNA to file a BLA for MDNA55 based on positive Phase 2b results. We have conservatively assumed the filing in 2022 after MDNA successfully conducts a Phase 3 trial. In either of the two scenarios, we believe MDNA is highly undervalued – as it is a late-stage biotech company targeting an orphan cancer indication,” writes Uddin.

The analyst thinks MDNA will generate negligible revenue until fiscal 2023 where he estimates $3.0 million in revenue and fully diluted EPS of negative $0.18 per share, followed in fiscal 2024 with revenue of $24.3 million and fully diluted EPS of $0.44 per share.

Uddin is maintaining his “Speculative Buy” rating and one-year target of $3.30, which represented a projected return of 156 per cent at time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment