Acreage Holdings has price target slashed at Beacon Securities

The buildout continues for US multi-state operator Acreage Holdings (Acreage Holdings Stock Quote, Chart, News CSE:ACRG.U) but the stock got a price target cut on reduced revenue and EBITDA expectations from Beacon Securities analyst Russell Stanley.

The buildout continues for US multi-state operator Acreage Holdings (Acreage Holdings Stock Quote, Chart, News CSE:ACRG.U) but the stock got a price target cut on reduced revenue and EBITDA expectations from Beacon Securities analyst Russell Stanley.

The analyst reviewed Acreage’s latest quarterly results in an earnings update to clients on Thursday.

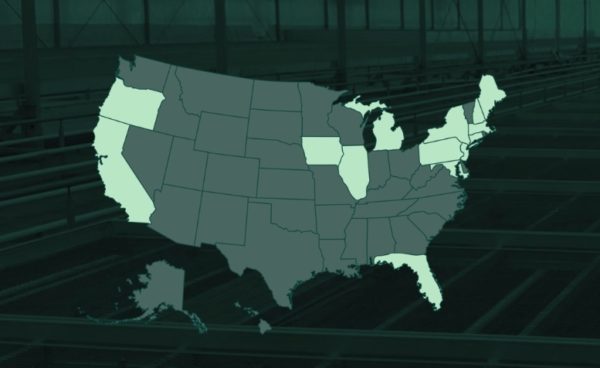

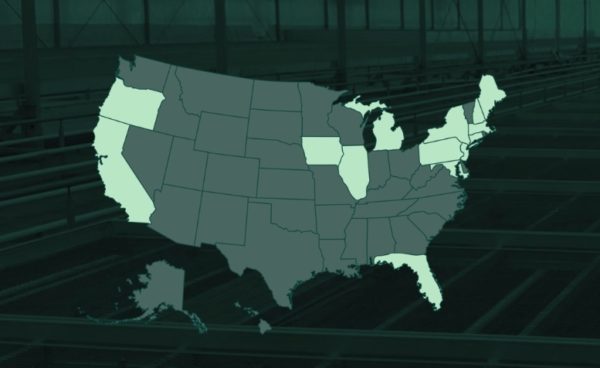

New York-based Acreage, which operates cannabis cultivation, production and retail businesses with interests in 20 states, released its third quarter 2019 results on Tuesday. The Q3 featured revenue of $22.4 million, a 307-per-cent increase year-over-year, whereas pro forma revenue for the quarter was $42.2 million while pro forma EBITDA was a loss of $9 million. (All figures in US dollars unless where noted otherwise.)

Acreage chairman and CEO Kevin Murphy said that while the last six months has been challenging for the entire cannabis industry, he is optimistic about Acreage’s future.

“The third quarter was highlighted by tremendous progress of our long-term plan. We launched great cannabis brands that are receiving strong influencer praise, continued building out our wholesale businesses across our national footprint, and achieved 100 per cent retail distribution in the fast growing market of Pennsylvania. Importantly, we also have a path to secure the capital resources necessary to fund our future expansion and acquisition activities,” said Murphy, in a press release.

Acreage Holdings price target cut from $27.00 to $17.00 at Beacon Securities

Stanley says the quarterly numbers came in below his estimates, which called for pro forma revenue and EBITDA of $47 million and negative $4 million, respectively (the consensus forecast was for $44 million and negative $12 million, respectively). The analyst says that going forward, regulatory changes in California, Maine and New Jersey will allow Acreage to consolidate the results of its operations starting in Q1 of 2020, which should close some of the gap between IFRS and pro forma revenue numbers, thus giving a clear picture of the company’s operating performance.

The analyst says despite the top and bottom line misses, he is viewing the quarterly update as a positive, noting that management has reiterated its retail buildout plans, which have called for it to exit 2019 with 35 to 45 dispensaries operating. Stanley notes that as of the close of the third quarter, ACRG had 26 stores open, with its partner in Ohio having since opened three more and with another four awaiting regulatory approval to begin operations, running to a total of 33 stores.

“We believe management’s target is very reasonable from a construction perspective, though time required for the regulatory approvals required to begin operations may push some dispensary openings into Q1/20,” writes Stanley.

At the same time, the slower pace of the ramp up has led to reduction in expectations, with Stanley now calling for fiscal 2019 revenue and adjusted EBITDA of $103 million and negative $22 million, respectively, and for fiscal 2020 revenue and adjusted EBITDA of $431 million and $75 million, respectively.

With the update, Stanley is reasserting his “Buy” recommendation for Acreage while cutting his price target from C$27.00 to C$17.00, which represented a projected 12-month return of 274 per cent at the time of publication.

Staff

Writer