Cleveland Rocks for Acreage Holdings, says one analyst.

Cleveland Rocks for Acreage Holdings, says one analyst.

News on an Ohio expansion for Acreage Holdings (Acreage Holdings Stock Quote, Chart, News CSE:ACRG.U) has Beacon Securities analyst Russell Stanley maintaining his “Buy” rating on the stock.

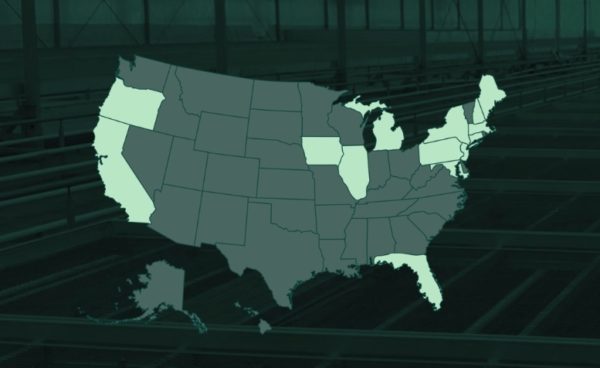

This morning, Acreage announced it had opened two new cannabis dispensaries in Ohio, one in Cleveland and the other in Columbus, through partner Greenleaf Apothecaries LLC. The firm now has 28 dispensaries in 11 states.

Stanley says these new openings max out Acreage Holdings’ retail footprint in Ohio.

“Earlier today, Acreage announced recent grand openings of two dispensaries by the company’s local partner, Greenleaf Apothecaries. As discussed in Our October 15th note, the company recently entered a settlement with the Ohio Board of Pharmacy that called for the regulator to complete final inspections for these locations by the end of October. This morning’s press release confirms that those inspections were completed, allowing these locations to open earlier this week. According to the Board of Pharmacy’s data, Greenleaf has received certificates of operation (COA) for the state maximum of five dispensaries, including four locations operating under The Botanist brand. This includes locations in Cleveland, Columbus, Akron, Canton and Wickliffe.”

The analyst says despite a slow start, this market has all the right ingredients.

The state has thus far issued 56 provisional dispensary licenses, of which 44 have been issued COAs allowing them to open. As of October 17th, the program had almost 64,000 registered patients, and almost 41,000 had made purchases. While this market has opened more slowly than many predicted, we continue to expect it will develop into one of the strongest medical markets in the US. Its population of 11.7M ranks it 7th largest in the US, and its list of allowable medical conditions could allow approximately 3.5M residents (30% of the state) to qualify for medical cannabis use.

In a research update to clients today, Stanley maintained his “Buy” rating and one-year price target of (US) $27.00 for Acreage Holdings, implying a return of 344 per cent at the time of publication.

Stanley thinks ACRG will post Adjusted EBITDA of negative $4.0-million on revenue of $145.0-million in fiscal 2019. He expects those numbers will improve to EBITDA of positive $118.0-million on a topline of $473.0-million the following year.

“ACRG is now trading at a 48% discount to the implied value of the Canopy acquisition price, as of last night’s close,” the analyst added.

In October, Greenleaf resolved its dispute with the state of Ohio which in July alleged that it had violated state ownership rules.

““We are thrilled to share the news that Greenleaf Apothecaries has resolved its dispute with the Ohio Board of Pharmacy in a way that allows Greenleaf to open its remaining three dispensaries in Cleveland, Columbus, and Akron, while maintaining its relationship with Acreage Holdings,” Acreage Chairman and CEO Kevin Murphy said. “As part of our consulting relationship with Greenleaf, which includes a licensing agreement, all five of their dispensaries will be called The Botanist.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment