Based on the latest announcement from HEXO Corp (HEXO Corp Stock Quote, Chart, News TSX:HEXO), Beacon Securities analyst Russell Stanley has downgraded his rating on the stock from “Buy” to “Hold,” saying he has reduced his revenue and EBITDA estimates to match the more modest forecast for the company.

Based on the latest announcement from HEXO Corp (HEXO Corp Stock Quote, Chart, News TSX:HEXO), Beacon Securities analyst Russell Stanley has downgraded his rating on the stock from “Buy” to “Hold,” saying he has reduced his revenue and EBITDA estimates to match the more modest forecast for the company.

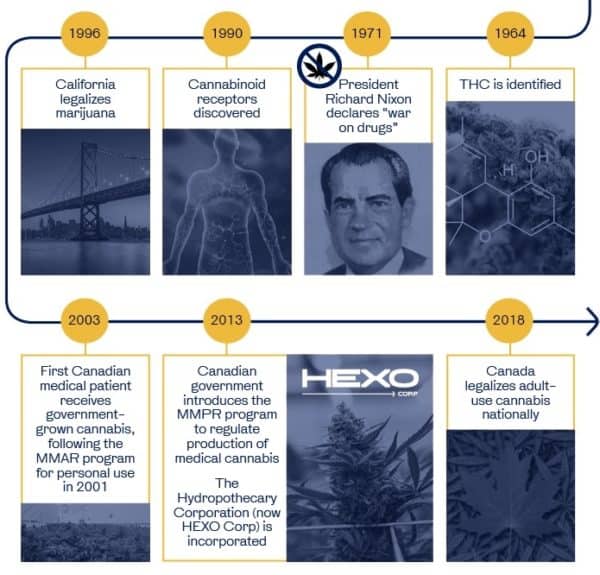

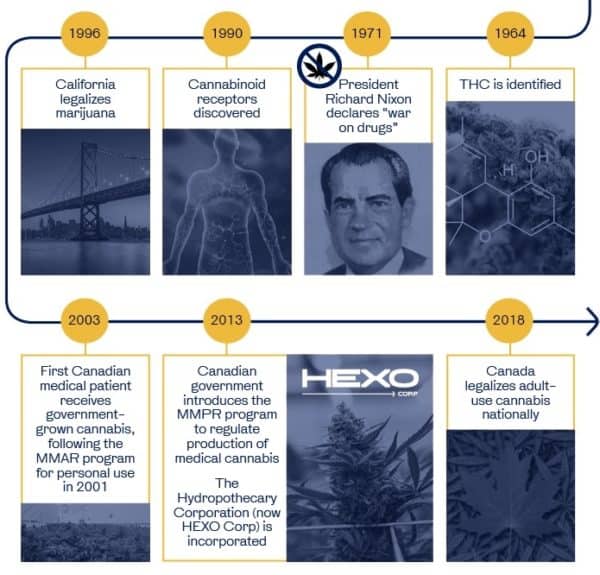

In a press release from Gatineau, Quebec’s HEXO Corp on Thursday, the company lowered its sales estimates for the quarter ending July 31 and withdrew its 2020 revenue forecast. Citing factors such as slower store rollouts across Canada, a purported delay in the federal rollout of cannabis derivatives and early signs of pricing pressure, HEXO management said that their fourth quarter results, which are set to be delivered on October 24, will likely feature revenue between $14.5 million and $16.5 million versus the previous call made in June for Q4 revenue of $26 million. HEXO’s previous call for fiscal 2020 net revenue had been for $400 million.

HEXO downgrade: Beacon moves from “Buy” to “Hold”

“Fourth quarter revenue is below our expectation and guidance, primarily due to lower than expected product sell through,” said CEO and co-founder Sebastien St-Louis in a press release. “While we are disappointed with these results, we are making significant changes to our sales and operations strategy to drive future results. Over the past quarter, we began re-configuring our operations to focus on high-selling strains and initiated a new sales strategy that we believe will meaningfully improve performance. We plan to discuss these in more detail on our upcoming earnings call.”

The market responded to the announcement by dropping HEXO’s share price by almost 23 per cent in Thursday trading, while seemingly also triggering a sector-wide selloff — the Horizons Marijuana Life Sciences ETF fell eight per cent on Thursday.

Stanley, in an update to clients Thursday, said the reduced visibility caused by the decision to pull their 2020 outlook is a problem for the stock. The analyst has reduced his revenue and EBITDA forecast, now calling for fiscal 2020 revenue and EBITDA of $236.6 million and $27.7 million (was $374 million and $157 million) and for fiscal 2021 revenue and EBITDA of $373.5 million and $83.4 million (was $482 million and $209 million).

At the same time, Stanley said HEXO’s balance sheet remains strong, with cash and cash equivalents at the end of the third quarter 2019 (ending April 30) of $173 million and total debt of $34 million.

“The company’s only debt reflects the amount drawn on a $65 million credit facility from a syndicate led by CIBC and BMO. The facility includes a $50 million term loan and a $15 million revolver, neither of which matures before 2022. The loans are expected to pay mid/high 5 per cent per annum over their respective terms. Subsequent to quarter end, the company realized gross proceeds of almost $44 million on the exercise of warrants and options. Even based on our revised estimates, which contemplate considerable investments in working capital as sales improve, our forecast shows that HEXO has ample balance sheet capacity to support its growth,” Stanley writes.

The analyst’s “Hold” rating comes with a reduced target price of $4.00 (was $14.00), which represented a potential return of five per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment