(Editor’s note: This multi-part series on the eSports industry is provided by Echelon Wealth Partners. You can find more information on Echelon Wealth Partners here.)

(Editor’s note: This multi-part series on the eSports industry is provided by Echelon Wealth Partners. You can find more information on Echelon Wealth Partners here.)

We are exceptionally bullish on the broadly defined esports ecosystem as an emerging new media and entertainment market set to eclipse the billion-dollar threshold. Technology, demographic, regulatory, and capital tailwinds support compelling value realization across the ecosystem. The shift of legacy advertising and sponsorship dollars to esports’ audience demographics where the IP enabled targeting capabilities and measured advertising ROIs are in the early innings is on track to surpass the billion-dollar mark.

Billion-dollar legacy sports franchises need to play the long game given audiences that are increasingly long-inthe-tooth with average ages of 50+. Esports leagues and franchises represent both a hedge on audiences moving away from traditional sports but also a means to cultivate younger audiences.

Technology titans have placed billion-dollar bets on platforms and publishing titles. Their competitive dynamics support further capital flows and a selfregulation of league and tournament economics to stimulate user growth ahead of near-term monetization. We refer investors to the hockey stick analogy of going to where the puck is headed – we see sustained momentum in audience growth and consequently esports revenues.

We do not see this as a build it and they will come situation. Rather, the audience is there, set to grow fuelled by aggressive infrastructure investments and regulatory support, and monetization is key. Gambling is viewed as both an audience catalyst and source of revenues. Continued audience growth is expected to push advertising/marketing through the billion-dollar level.

DEEP DIVE INTO THE ESPORTS INDUSTRY

Solid Viewership | Lucrative Brand Partnerships | Underappreciated Esports Betting Summary

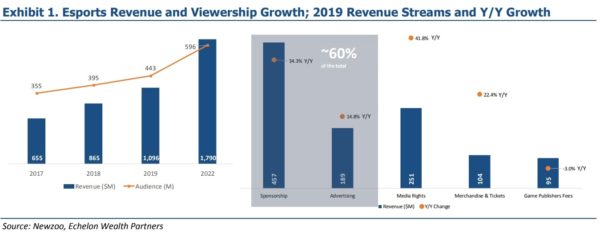

The competitive gaming esports phenomenon is poised to eclipse the billion-dollar threshold as it represents a game-changing new media and entertainment category. Audience engagement and growth have driven esports industry revenues on a steep trajectory tracking towards $1.1B (estimates by Newzoo, Exhibit 1) in 2019 from merely $195.0M five years back, representing a cannot-be-ignored CAGR of 41.3%.

Structurally, esports is similar to traditional sports as both have professional and amateur players that compete in leagues and tournaments for prize money, either individually or as part of a team. Much like legacy sports, the growth in pro-level gaming has been an important driver in audience growth and amateur adoption as professional players have broadened awareness, provided playing strategies, and inspired young players to pursue professional careers.

Technological innovation, the use of data analytics and investment in gaming arenas, initially for pro-level gaming, are supporting increased amateur engagement and user growth. In fact, the amateur gaming industry has created its own niche in the last few years with open source tournaments and social play that bring additional industry revenue potential.

Advertising growth along with in-game purchases have the titans of game publishing and online platforms leveraged to accelerate esports adoption ahead of near-term monetization strategies that could potentially moderate growth.

We highlight the continued appreciation in legacy sports franchises where NBA franchise prices have jumped from $5.0M to ~$2.2B over the past 40 years. We now draw on the much-used hockey quote where Wayne Gretzky’s greatness was attributed in large part to his ability to go where the puck was going.

We are optimistic that esports franchise valuations, and more broadly the ecosystem, represent a new media and entertainment category where audience trends suggest the analogy to traditional sports franchises applies for investors and industry participants. We find that the reference also applies to owners of legacy sports franchises where we see esports team ownership and audience outreach as a strategic imperative to reach and engage millennials.

We have seen forecasts that have US esports viewer levels exceeding those of all legacy sports leagues with the exception of the NFL by 2021. The NFL’s just-announced partnership with TikTok reflects its strategic imperative to engage younger viewers and broaden its audience.

Both Wimbledon and the NBA have begun working with TikTok to similarly engage younger viewers. It is noteworthy that the NFL similarly moved to expand its audience through live-streaming video on Twitter, it was the first sports league on Snapchat Discover, and launched an Alexa voice app. With legacy sporting franchises sporting billion-dollar valuations, owners are playing the long game where audience rejuvenation and broadening must be a central consideration.

Esports player demographics continue to expand at both ends of the age spectrum…

The average viewer of an NFL game is over 50 years old with a downward trend in personal consumption (average age of MLB/PGA viewers is put at ~57/64+ years). Esports player demographics continue to expand at both ends of the age spectrum, while the industry moves to attract younger amateur and prospective professional players.

Significant investments and strong partners have invested in both college and high school level platforms broadening the development of younger participants and audiences. For example, Cineplex (CGX-TSX, C$25.34, Buy, C$34.00 PT) invested C$15.0M to acquire WorldGaming where it saw the value in its US college network and the potential to leverage its Canadian real estate platform for tournament and league play.

Moving below the college level, PlayVS (Private), a gaming platform targeting high school esports tournaments, received $30.5M from investors including Adidas (ADS-ETR, NR), Samsung (005930-KSE, NR), Sean “Diddy” Combs, and the VC arm of the Los Angeles Dodgers to make esports more accessible for teenagers and to support recruiting new talent. We highlight that Discord (Private), a messaging app with a focus on video gamers and particularly strong with youth, raised $50.0M at an implied valuation of $1.7B in Q218 with an estimated 150M+ users at the time versus its 250M unique users in March 2019 (including 180K+ members on Fortnite’s server).

We see the roll-out of esports gambling as a significant catalyst for greater audience engagement and growth…

It is also worth noting that, the US High School Esports League (HSEL) has advanced from 200 to 1,200+ during 2018 with its current reach at 2,000+ schools representing 50K+ students. The HSEL reflects both the expanding North American market and prospectively a pipeline for further growth.

However, at its core, the solid viewership of wealthy millennials, mostly male (we expect that to normalize in the coming years), provides esports its oxygen. If Newzoo’s numbers are to be trusted, there were around 380.2M esports viewers globally in 2018 and it is set to grow by 15.0% y/y to 453.8M in 2019, ~44.0% of which are esports enthusiasts (individuals that watch more than once a month). This number is expected to reach 557M by 2021, out of which 44-45% would be enthusiasts and the remaining would be occasional viewers. Still, similar growth in both categories suggests a possible natural evolution of occasional viewers to enthusiasts.

We see the roll-out of esports gambling as a significant catalyst for greater audience engagement and growth. Esports gambling, due to its solid viewership, is a sub-segment that should not be overlooked by early stage investors. Globally, the total amount of money/items wagered around major esports titles was at $5.5B in 2016. Eilers & Krejcik predicts this number to reach $13.0B by 2020, at their base level assumptions suggesting royalties of $700-800M.

Broad-based brand interest: Both endemic (within the ecosystem, such as hardware manufacturers) and non-endemic brands are rushing to partner with the elite leagues/tournament organizers, players, influencers, and team organizations to reach millennials..

Broad-based brand interest: Both endemic (within the ecosystem, such as hardware manufacturers) and non-endemic brands are rushing to partner with the elite leagues/tournament organizers, players, influencers, and team organizations to reach millennials in a meaningful way, as traditional digital advertising formats are losing their sheen and advertisers are continuously looking for innovative ways to interact with their customers.

If we put advertising and brand sponsorships into a single basket of money flowing into esports from marketers, they currently account for ~60% or $645.9M of the total estimated $1.1B esports industry in 2019 (Exhibit 1). North American revenues are forecast at roughly 37% or $407.0M for 2019 with China put at 19%.

Endemic brands to esports such as Intel (INTC-Nasdaq, NR), MSI (Private), and Logitech (LOGI-Nasdaq, NR) are promoted when players either use or recommend their products based on their own experience. Yet, with their growing maturity, non-endemic brands now account for the majority of the total sponsorship and advertising esports spend.

In a recent partnership, the Overwatch League (OWL) signed a multi-year deal with Kellogg (K-NYSE, NR) to promote Pringles and Cheez-it, which is one example.

Drawing on the traditional sports model, brands are looking for spots where they can interact with consumers either by placing an ad in the competition arenas or placing a branded logo on players clothing or sponsoring the event. Interestingly, individual players and influencers who stream on platforms such as Twitch (owned by Amazon (AMZN-Nasdaq, NR)), YouTube Gaming or Mixer (owned by Microsoft (MSFT-Nasdaq, NR)) also partner with brands, where non-endemic brand logos appear on their clothing or their game screen.

For instance, Richard Tyler Blevins, better known as his online alias “Ninja”, has partnered with brands such as Adidas and Red Bull (Private). Ninja also recently signed a lucrative contract with Mixer (speculation includes as much as $100.0M although the debate then moves on to whether it was per year or for the duration of the three-year contract) leaving Twitch, which many argue was a key to his fame.

Nonetheless, Ninja amassed more than 2M subscribers in his first month of joining Mixer. This talks to the strength of these celebrity players/influencers in the esports ecosystem and their ability to influence viewers to migrate from one streaming platform to another. Ninja had 14M followers on Twitch prior to his departure.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment