Following its most recent acquisition, National Bank Financial analyst Richard Tse remains bullish on Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP).

Following its most recent acquisition, National Bank Financial analyst Richard Tse remains bullish on Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP).

On Monday, Shopify announced it would acquire Massachusetts-based warehouse fulfillment company 6 River Systems for approximately $450-million. The founders of 6 River were previously execs at Kiva Systems, which is now known as Amazon Robotics.

“Shopify is taking on fulfilment the same way we’ve approached other commerce challenges, by bringing together the best technology to help everyone compete,” said Shopify CEO Tobi Lutke. “With 6 River Systems, we will bring technology and operational efficiencies to companies of all sizes around the world.”

Shopify fulfillment plans expanding….

Tse says this development underscores that Shopify is very serious about fulfillment.

“What’s clear is that Shopify is very serious about fulfillment given the price being paid in this strategic acquisition and that the Company is serious about its aspirations here,” he said.

“As a recap, the Shopify Fulfillment Network (SFN) is designed to democratize fulfillment technology to merchants of all sizes. Today, it already supports merchants shipping 10 – 10,000 packages per day. By year end, that range will go to 3 – 30,000 packages per day covering shipping in 99% of the continental U.S. in two days or less. What’s impressive is that this initiative essentially came out of left field and yet Shopify is already executing.”

The analyst says 6 River owns some cutting edge solutions.

“No doubt, we think 6 Rivers adds to Shopify’s aspirations of driving more efficiencies across the fulfillment process from a cost and time perspective,” he writes.

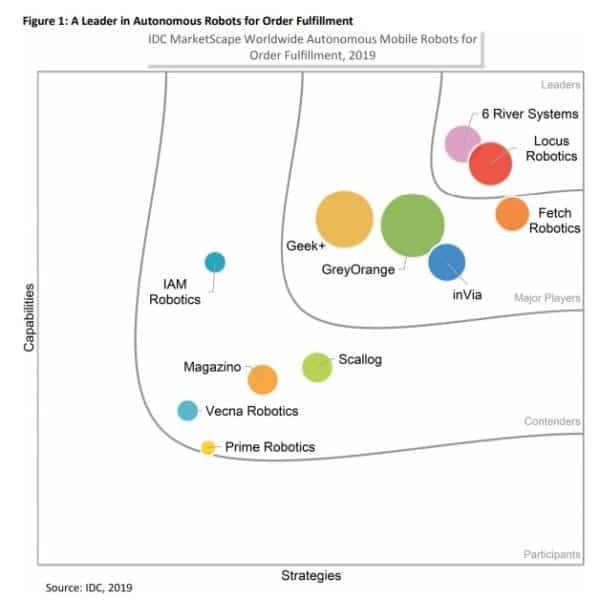

“According to IDC, 6 River Systems is ranked a “leader” in its autonomous mobile. The Company is powered by a robot called “Chuck”, which coordinates tasks on a warehouse floor, working collaboratively with employees to eliminate long walks, reduce in-aisle walking and speed up warehouse tasks (think picking, sorting, replenishment, etc).”

In a research “Flash” update to clients today, Tse maintained his “Outperform” rating and one-year price target of (US) $400.00, implying a return of 11.5 per cent at the time of publication.

The analyst characterizes the risk rating on SHOP as “Above Average”.

“Bottom line, we see it helping in Shopify’s course to add another incremental revenue opportunity from storage and shipping / fulfillment fees that could generate upwards $500 million based on our initial estimates,” the analyst adds. “Only time can only confirm whether this was a fair price – but until then, it’s helping firm up another revenue stream and increasing the TAM. We maintain our target price of US$400 (unchanged) based on our DCF. Our target implies EV/sales of 16.1x on F21E (unchanged).”

6 River is Shopify’s tenth acquisition and second this year…

6 River is the tenth acquisition for Ottawa-based Shopify and the second this year. In May, the company acquired New York-based ecommerce firm Handshake for what was reported to be less than $100-million.

The opportunity that Handshake had identified, and now Shopify is targeting, is the area of the e-commerce market where brands and other merchants sell items wholesale, potentially alongside retail efforts also focused on consumers,” said TechCrunch reporter Ingrid Lunden of the deal.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment