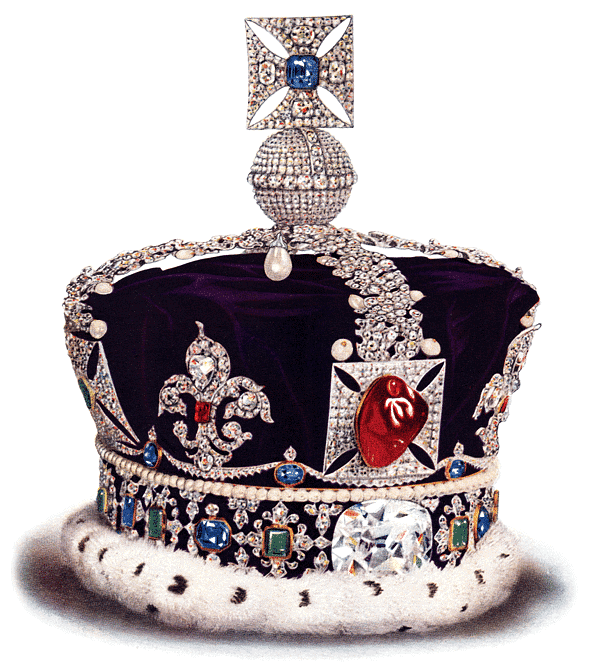

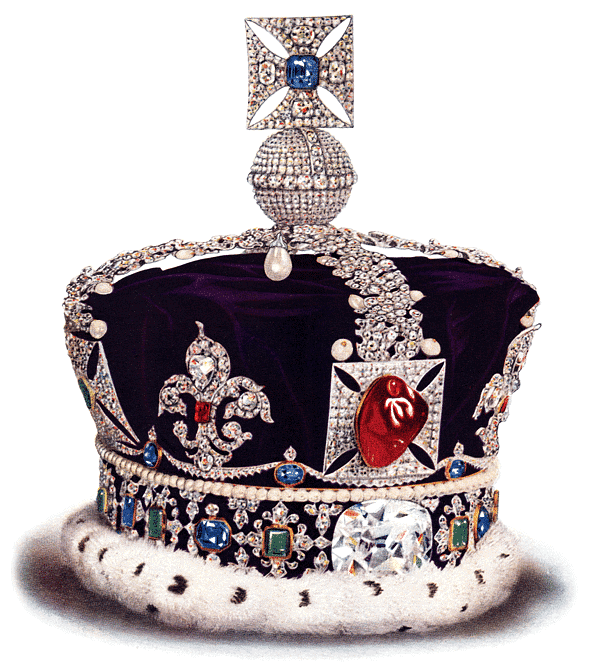

Beacon Securities analyst Doug Cooper says Village Farms International (Village Farms International Stock Quote, Chart, News TSX:VFF) is headed towards grabbing more than 25 per cent of the Canadian market, making it King of Canadian Cannabis.

Beacon Securities analyst Doug Cooper says Village Farms International (Village Farms International Stock Quote, Chart, News TSX:VFF) is headed towards grabbing more than 25 per cent of the Canadian market, making it King of Canadian Cannabis.

In an update to clients on Tuesday, Cooper reviewed VFF’s second quarter results and stuck with his “Buy” rating and C$60.00 target price, which represented a projected return of 229 per cent at the time of publication.

Vancouver-based Village Farms released its Q2 for the period ended June 30, 2019, on Monday, boasting strong numbers from Pure Sun Farms, its 50-per-cent owned joint venture in the cannabis space. PSF generated C$32.4 million in sales and EBITDA of $25.2 million, representing an EBITDA margin of 78 per cent.

Over the quarter, PSF got to full run-rate production capacity at its 1.1-million sq ft facility in Delta, BC, while VFF expanded its US hemp cultivation and CBD extraction programs.

On the Q2 results, CEO Michael DeGiglio wrote that he expects PSF to deliver consistent quarter-on-quarter growth throughout this year and next, with the company now proceeding with the conversion of a second greenhouse in Delta.

“Pure Sunfarms’ second quarter financial results firmly rank it among the largest, most efficient and most profitable licensed cannabis producers in Canada, and clearly demonstrates that we have built a best in class cannabis operation setting a new bar for industry performance,” said DeGiglio in the Q2 press release.

Village Farms results “the best ever from a Canadian cannabis company…”

Flat out, Cooper calls the quarterly results “the best ever from a Canadian cannabis company.” He points to the ramp up in EBITDA margins, which went from 47 per cent in last year’s Q4 to 60 per cent in Q1 and now 78 per cent. Cooper notes that only one other Canadian licensed producer has so far reported EBITDA profitability, that being Organigram with a 31-per-cent margin, far below PSF’s.

In terms of kilos sold, Cooper says that PSF is now the number three Canadian producer and the analyst says that it could very well be the number one supplier to the adult-use recreational market by the year’s end.

“PSF’s insurmountable cost advantage and its footprint will continue to put PSF in the position to be a major price disruptor, which will result in eventual market share of more than 25 per cent, in our opinion,” writes Cooper.

The analyst notes that as of June 30, PSF’s biological asset was $34 million, representing plus-86 per cent sequentially, an indicator that the company’s upcoming Q3 will turn out to be another very strong quarter.

Cooper says that VFF remains by far the cheapest cannabis company in Canada, with the stock trading at an 8x fiscal 2019 exit rate, whereas the peer group average is 38x for fiscal 2020. By comparison, matching the peer group would put VFF at $84.00 per share.

“Experience matters and VFF’s 30-year industrial agriculture experience is showing when the rubber is hitting the road. As the company starts to get broader recognition, it will undergo a significant re- valuation and multiple expansion. We are maintaining our current forecast but have an upward bias if the company maintains its current margin profile in Q3,” writes Cooper.

The analyst is calling for fiscal 2019 revenue and adjusted EBITDA of $395.0 million and $38.4 million, fiscal 2020 revenue and adjusted EBITDA of $316.0 million and $80.8 million, and fiscal 2021 revenue and adjusted EBITDA of $430.0 and $149.1 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment