Following the company’s third quarter results, Paradigm Capital analyst Corey Hammill is maintaining his “Buy” rating on OrganiGram (OrganiGram News, Stock Quote, Chart TSX:OGI).

Following the company’s third quarter results, Paradigm Capital analyst Corey Hammill is maintaining his “Buy” rating on OrganiGram (OrganiGram News, Stock Quote, Chart TSX:OGI).

On Monday, OGI reported its Q3, 2019 results. The company lost $10.18-million on net revenue of $24.75-million, up 626 per cent from the $3.44-million the company posted in last year’s Q3.

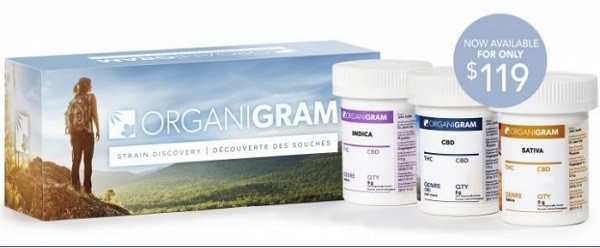

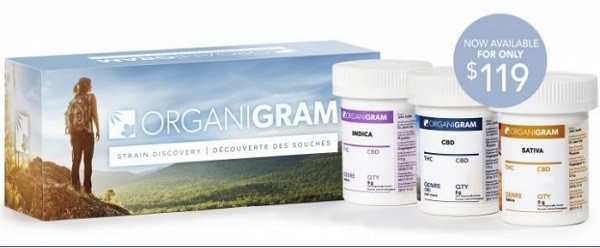

“We are very excited for fiscal 2020 which should build upon an already successful 2019,” CEO Greg Engel said. “By the first half of fiscal 2020, we expect to benefit from record harvests of high-quality indoor-grown dried flower, the sale of a variety of vape pen products as well as our initial edible product forms. The Canadian market will be much more mature from a distribution and retail perspective with Ontario anticipated to have three times the current number of stores by October, 2019, and Quebec planning to more than double its retail presence by March, 2020, and with Alberta continuing to grow its already leading number of retail distribution points.”

Hammill notes that OGI’s results came in below both his expectations and the street’s, but says his focus is now on the company’s fourth consecutive EBITDA positive quarter, and on management’s bullish outlook for the first half of 2020.

“OrganiGram is quickly separating itself from other Canadian LPs,” the analyst says. “It is a low-cost producer, has an established nationwide distribution network and has invested in preparing for Canada’s next wave of legalization. OGI shares are down ~5% in the last month, largely in line with the cannabis sector which has been selling off with investors focused on both results and valuation. Organigram offers a positive combination of both. We have amended our target price range to $10.00–$14.00 ($12.00 mid-point). The basis for our range is an LP industry average EV/Sales multiple of 5x at the low end and a US craft beverage alcohol EV/EBITDA multiple of 18x at the high end. We maintain our Buy recommendation.

Hammill thinks OrganiGram will post Adjusted EBITDA of $39.5-million on revenue of $94.8-million in fiscal 2019. He expects those numbers will improve to EBITDA of $76.5-million on a topline of $186.3-million in fiscal 2020.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment