Following the company’s third quarter results, M Partners analyst Andrew Hood is maintaining his “Buy” rating on Opsens (Opsens News, Stock Quote, Chart TSX:OPS).

Following the company’s third quarter results, M Partners analyst Andrew Hood is maintaining his “Buy” rating on Opsens (Opsens News, Stock Quote, Chart TSX:OPS).

On Thursday, OPS reported its Q3, 2019 results. The company lost $1.1-million on revenue of $7.9-million, a topline that was up 23 per cent over the same period last year.

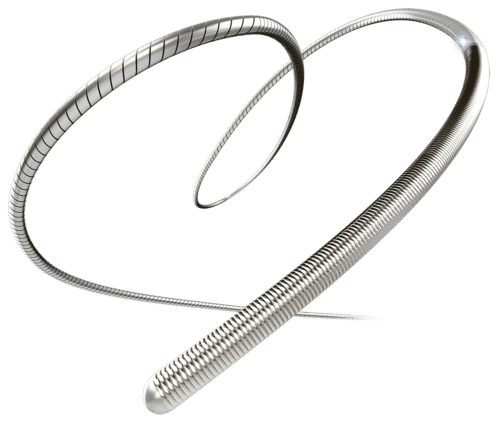

“These results reflect cardiologists’ acceptance of the OptoWire’s distinctive features and the positive evolution of our sales approach deployed in the past year,” CEO Louis Laflamme said. “We are also pleased with Opsens’s extended collaboration with Abiomed through the signing of a five-year contract to supply a critical portion of their Impella CP heart pump technology widely used in the United States. The agreement follows a co-development project to integrate Opsens’s miniature optical pressure sensor into the Impella CP. This partnership highlights the benefits of our optical technology for cardiac applications, as well as the accuracy of our measurement technology and the quality of our manufacturing capabilities.”

Hood says these were strong results from Opsens.

“Revenue in the quarter was $7.9M vs. our expectations of $7.7M, including a quarterly record $5.2M in FFR ($5.0M expected) as traction continued to build in the U.S. market. FFR revenues in the U.S. expanded 25% QoQ to over $900K. We believe with the Columbia/St. Francis study touting the superior accuracy of the OptoWire, Opsens has an even stronger sales pitch in the U.S. market. Opsens can now point to studies in Europe, Japan and the U.S. that have all concluded superior performance/lower drift in FFR measurements. The Other Medical segment was also strong, with $2.0M in revenues. Of this amount, $1.8M came from Abiomed, on top of the remaining $0.4M milestone payment from the 2014 co-development and license agreement. We mentioned in a previous note that Opsens had entered into a five-year supply agreement with Abiomed (ABMDNASDAQ|N/R), to supply a critical component for Abiomed’s Impella CP heart pump. This relationship provides Opsens more critical mass, increases market visibility and improves stability of revenue streams vs. the historical milestone-based relationship.”

In a research update to clients Thursday, Hood maintained his “Buy” rating and one-year price target of $1.60 on OPS, implying a return of 74 per cent at the time of publication.

Hood thinks OPS will post EBITDA of zero on revenue of $33.0-million in fiscal 2019.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment