Beacon Securities analyst Ahmad Shaath says Greenlane Renewables (Greenlane Renewables News, Stock Quote, Chart TSXV:GRN) is a cleantech junior that should be on everyone’s radar.

Beacon Securities analyst Ahmad Shaath says Greenlane Renewables (Greenlane Renewables News, Stock Quote, Chart TSXV:GRN) is a cleantech junior that should be on everyone’s radar.

In a research report to clients today, Shaath initiated coverage of GRN with a “Buy” rating and one-year price target of $0.55, implying a return of 129 per cent at the time of publication.

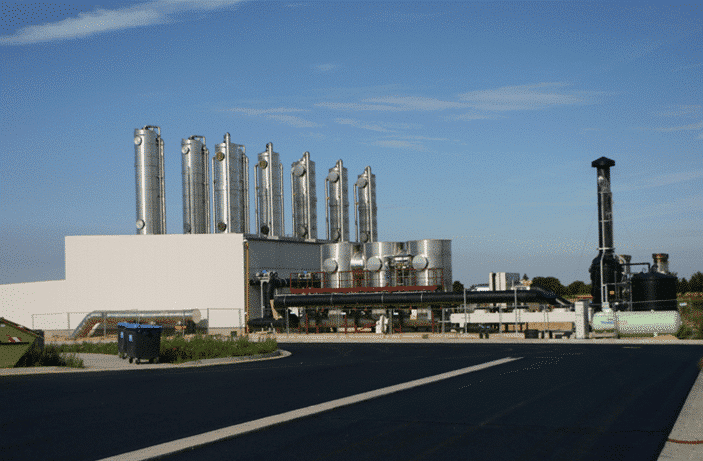

Vancouver-based Greenlane Renewables is an industrial tech company that designs, develops, sells, supplies, and services equipment for upgrading biogas to renewable natural gas. Although the company’s market cap is small Shaath says it actually offers investors the opportunity to own the world’s largest biogas upgrading company.

“Greenlane ranks as the world’s number 1 on installed capacity of biogas upgrading equipment, with over 100 installations in 18 countries including the world’s two largest plants in Canada and Germany,” the analyst notes. “The company has ~25 years of experience in biogas upgrading equipment and is currently the only provider of the three main upgrading technologies (water wash, PSA and membrane), allowing it to bid on the largest number of opportunities in the growing biomethane space.”

Shaath thinks Greenlane will post Adjusted EBITDA of negative $1.3-million on revenue of $24.0-million in fiscal 2019. He expects those numbers will improve to EBITDA of positive $2.0-million on a topline of $35.0-million in fiscal 2020.

Greenlane currently trades at an EV/Sales multiple of 1.0x based on our FY19E forecast of $24.0 Million (vs. guidance of $20-$25 million),” the analyst adds. “The company’s closest peer, Xebec Adsorption (XBC-V, BUY rated, $2.20 TP), has seen a significant multiple expansion over the last 12 months (shares are up 114%) from the accelerating tailwinds driving the RNG sector and increased investor awareness, and is currently trading at 2.0 EV/Sales (FY19). Precedent transactions in the sector point towards a valuation multiple of 1.75x sales. Consequently, we are applying an EV/Sales multiple of 1.75x FY19E to arrive at our 12-month target price of $0.55.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment