Echelon Wealth Partners analyst Douglas Loe says price softness in cancer biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) has no connection to the medical prospects for its immuno-oncolytic virus in development, pelareorep, but is more a matter of extended timelines. In an update to clients on Thursday, Loe maintained his “Speculative Buy” rating for ONC and one-year target of $11.00, representing a projected return of 354 per cent at the time of publication.

Echelon Wealth Partners analyst Douglas Loe says price softness in cancer biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart TSX:ONC) has no connection to the medical prospects for its immuno-oncolytic virus in development, pelareorep, but is more a matter of extended timelines. In an update to clients on Thursday, Loe maintained his “Speculative Buy” rating for ONC and one-year target of $11.00, representing a projected return of 354 per cent at the time of publication.

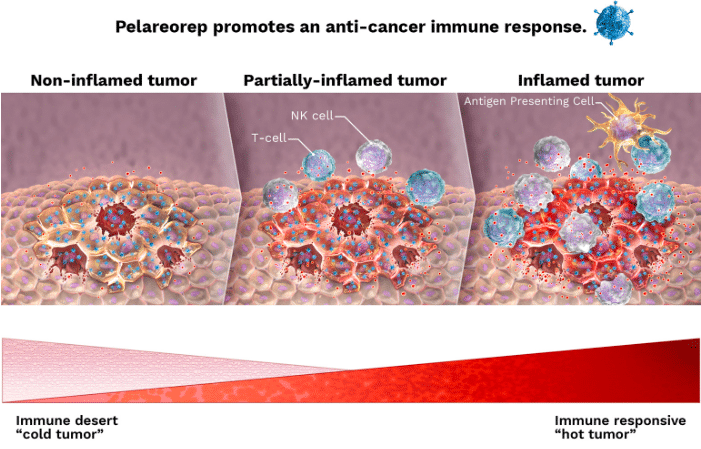

Oncolytics on Wednesday announced a new clinical collaboration for Reolysin (pelareorep) with EMD Serono/Pfizer in a three-arm 45-patient Phase II metastatic breast cancer trial. Loe expects the trial to begin next quarter and to have biomarket data by the first half of next year. Loe says that the collaboration shows clear confidence on the part of EMD Serono/Pfizer that pelareorep’s survival benefit in Oncolytics’ 74-patient Phase II metastatic breast cancer is clinically significant and could be improved if combined with an approved immunologically active checkpoint inhibitor anti-PD-L1 mAb such as EMD Serono/Pfizer’s Bavencio.

Loe notes that in recent quarters, Oncolytics has been leveraging its Phase II breast cancer data by initiating more smaller biomarker-focused studies, rather than advancing into more substantive Phase III testing, and that this approach may be the cause of the stock’s softness (ONC hit a high of $10.65 last May and is currently trading in the mid-$2.00 range).

“We continue to reflect on the fact that ONC shares are trading at a measurable discount to valuations ascribed to alternative oncolytic virus platforms and the private firms that were developing them, including: Amgen’s/BioVex’s herpes virus-based Imlygic (BioVex’s take-out valuation was US$1 billion, of which US$425 million was upfront cash), Merck’s/Viralytics’ coxsackievirus A1-based Catavak (take-out value US$394 million), and Boehringer Ingelheim’s (Private)/ViraTherapeutics’ vesicular stomatitis virus-based VSV-GP (take-out value US$244 million). ONC’s current enterprise value is $34.9 million,” says Loe.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment