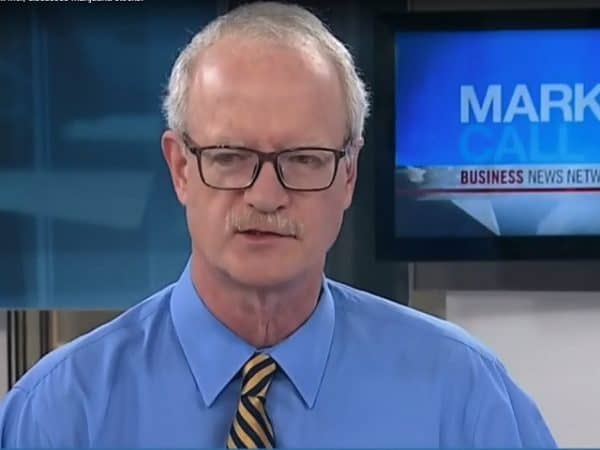

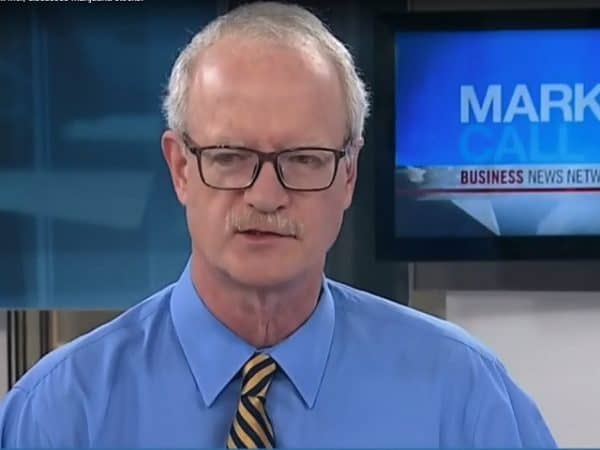

“Enghouse is a bit like Constellation Software, although they’ve been at it longer, meaning that they grow by acquisition. They’ve recently done an extremely large acquisition that will be quite significant for them,” says McWhirter, president and portfolio manager at Selective Asset Management, to BNN Bloomberg Friday.

“We have owned it in the past in our Canadian dividend fund but don’t own it at the moment,” he says. “Overall, earnings growth is expected to be pretty much unchanged in 2019, overall return on equity is pretty attractive at roughly 18 per cent. The company is free cash flow positive, which is a good thing, and overall, there’s still pretty good opportunity for them going forward.”

Enghouse has been a strong performer for much of the past decade, growing its share price from the $3.00 range in 2009 to where it now trades in the low $30’s. The stock was on the upswing over the first stretch of 2019 until ENGH’s quarterly earnings delivered on March 7, which disappointed on revenue growth of just one per cent year-over-year.

Enghouse posted a Q1 top line of $86.04 million compared to analysts’ forecast of $91.0 million, while its EPS at $0.27 per share was also a miss compared to the expected $0.30 per share.

Last month, management reaffirmed its faith in the company by renew its normal course issuer bid for up to four million shares, representing ten per cent of the publicly listed float, saying the market price for ENGH may be attractive.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment