Following CargoJet’s (CargoJet Stock Quote, Chart TSX:CJT) first quarter results, Beacon Securities analyst Ahmad Shaath is maintaining his bullish stance on the stock.

Following CargoJet’s (CargoJet Stock Quote, Chart TSX:CJT) first quarter results, Beacon Securities analyst Ahmad Shaath is maintaining his bullish stance on the stock.

This morning, CargoJet reported its Q1, 2019 results. The company posted Adjusted EBITDA of $32.3-million on revenue of $110.4-million, a topline that was up 11.3 per cent over the same period last year.

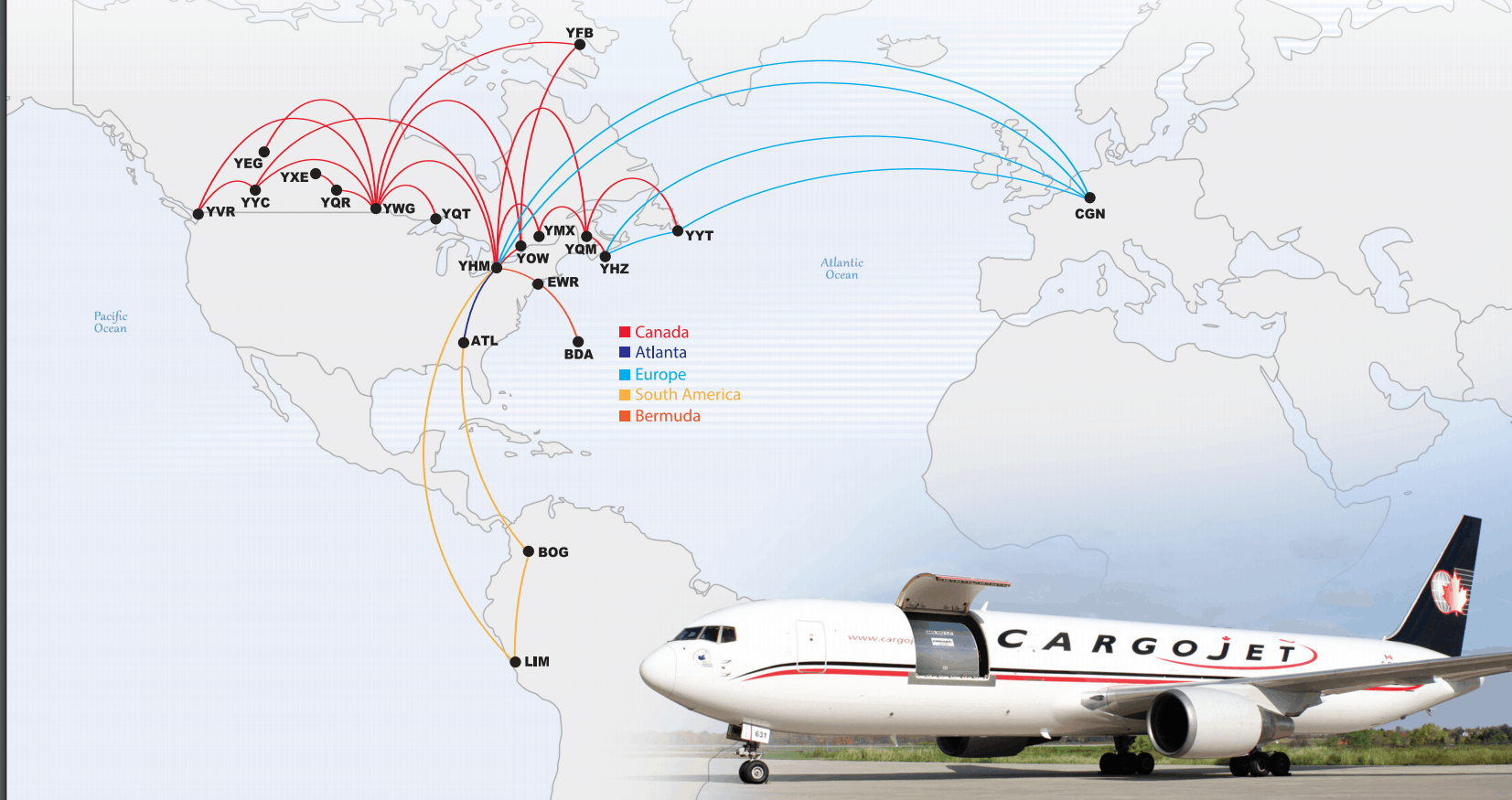

“We are very pleased with Cargojet’s financial and operating results during the past quarter,” CEO Ajay Virmani said “We continue to benefit as the primary enabler of e-commerce growth in Canada and to also grow our ad hoc and ACMI charter business globally. Our entire Cargojet team continues to be strongly focused on prudent cost management, profitable revenue growth, and to providing consistent and reliable service levels to our customers and adding value to our shareholders.”

Shaath says the company overcome some bumps to deliver on this quarter.

“Cargojet continued to report strong results beating consensus and our adjusted EBITDA Q1/FY19 estimates, despite some hangover effects from Canada Post labour disruptions from Q4/FY18,” the analyst says. “The secular growth in ecommerce points towards continued high-single-digit growth in core overnight revenues at minimum. Further growth should come from improvement in ACMI and all-in-charter revenues, especially as CJT can now fly from Miami, which should result in better volumes and increased frequency of flights between the U.S. and Latin America/Mexico.

In a research update to clients today, Shaath maintained his “Buy” rating and one-year price target of $105.00 on CargoJet, implying a return of 35 per cent at the time of publication.

The analyst thinks CJT will post EBITDA of $152-millio on revenue of $499-million in fiscal 2019. He expects those numbers will improve to EBITDA of $164-million on a topline of $529-million the following year.

Shaath says CargoJet is the only way to gain Canadian-listed exposure to a certain tech giant.

“The company is the carrier of choice for Amazon , and it flew dedicated charter flights for Amazon for the first time during Q4/FY18, a clear indication of Amazon’s growing presence in Canada. Consequently, we believe CJT shares will continue to justify a premium valuation multiple.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment