PI Financial analyst Jason Zandberg says he likes the new deal from Canopy Growth (Canopy Growth Stock Quote, Chart TSX:WEED) which will see the Canadian licensed producer acquire US-based cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) if and when cannabis becomes federally legal in the United States.

PI Financial analyst Jason Zandberg says he likes the new deal from Canopy Growth (Canopy Growth Stock Quote, Chart TSX:WEED) which will see the Canadian licensed producer acquire US-based cannabis company Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) if and when cannabis becomes federally legal in the United States.

In a corporate update to clients Thursday, Zandberg reiterated his “Buy” rating but has increased his target price from C$70.00 to C$90.00.

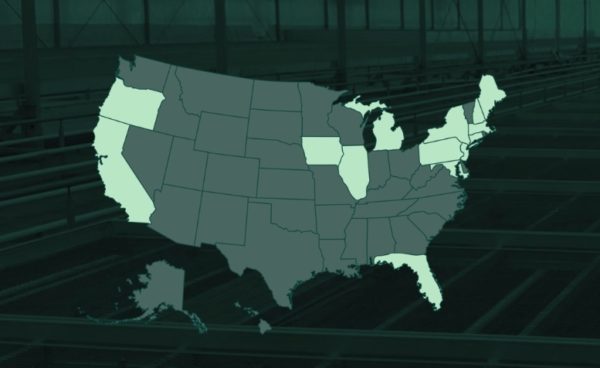

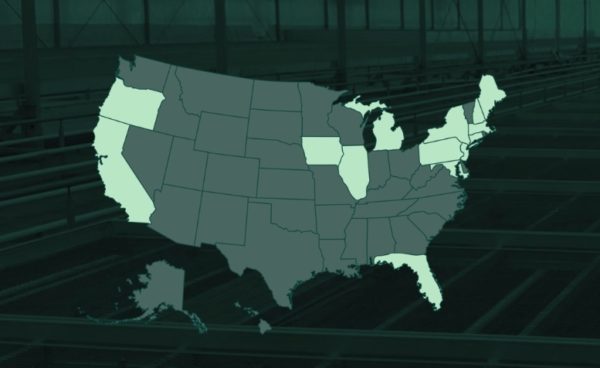

Canopy Growth again rocked the cannabis sector by announcing what would be the biggest deal in the history of the space, agreeing to the rights to buy Acreage for US$3.4 billion if cannabis becomes federally legal in the US. The terms of the deal have Acreage shareholders receiving an immediate up-front payment of US$300 million and, upon Canopy’s exercise of its right, shareholders would receive 0.5818 of a common share of Canopy Growth for each Acreage share. The US$3.4-billion deal would represent a premium of 41.7 per cent over ACRG’s 30-day VWAP ending on April 16.

Zandberg says the deal gives Canopy an accelerated entrance into the US cannabis market, once it becomes federally legal, but also gives the company the ability to begin building out its brands in the US ahead of legalization. Zandberg calls the event a positive for the stock.

“This essentially will give Canopy a head-start at building brand loyalty in the US market ahead of potential US Federal legalization. The two companies will continue to operate independently until a time if/when the Right is exercised,” the analyst says. “We expect other large Canadian LPs will follow this strategy as the US cannabis market rapidly develops.”

“Our forecasts remain unchanged at this time as we do not know when or if US Federal legalization will occur but we highlight the significant optionality that this agreement provides,” he adds.

Zandberg’s target of C$90.00 is derived from a 73x multiple of his fiscal 2021 EV/EBITDA estimate (previously 55x). The analyst sees Canopy generating fiscal 2019 revenue and EBITDA of $231.1 million and negative $202.4 million, respectively, and fiscal 2020 revenue and EBITDA of $750.1 million and negative $83.8 million, respectively.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment