Telecom and media company Quebecor released its fourth quarter and full year 2018 financials on March 13, reporting Q4 revenue of $1.09-billion, a 2.6 per cent year-over-year increase, and EBITDA of $450 million, a 7.7 per cent year-over-year increase.

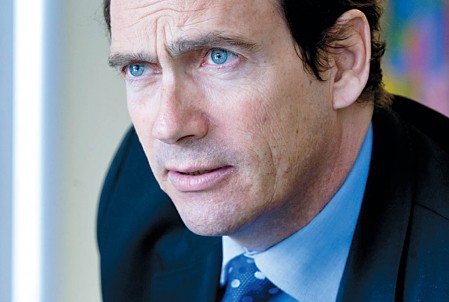

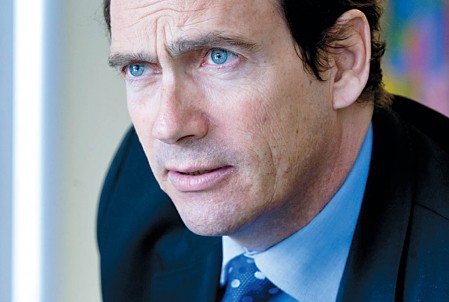

In his statement, President and CEO Pierre Karl Péladeau called the quarter a cap to an year in which the company achieved a “major milestone” by repurchasing all the shares in its Quebecor Media subsidiary.

“With this share repurchase, we now have access to all the cash flows generated by Quebecor Media, giving us full control over our assets, our development and our future. The financial leverage obtained by this share repurchase, combined with our increased profitability, are fully reflected in the 59.3 per cent increase in our adjusted income from continuing operating activities in the fourth quarter of 2018,” said Péladeau.

Quebecor’s quarterly revenue came in line with the consensus $1,087 million and below Goff’s $1,105 million estimate. QBR’s EBITDA was above both Goff’s $440 million estimate as well as the Street’s $432 million and according to Goff was driven by the company’s wireless division.

Goff says that he’s encouraged by the company’s aggressive new product and branding pipeline including offerings for Fizz and Alex, saying that “betting against QBR’s ability to roll out new services has been an abject mistake.”

“For a stock that has been awarded a discounted valuation to its peers despite peer leading execution, we are bullish on the prospects of moving to a dividend yield/growth model with strong FCF support. Furthermore, hold-co discounts discussions are mute,” he says.

“With its successful refinancing of its convertible and the minority repurchase, investors see a much clearer path as QBR moves towards a dividend growth model where we see support for positive revaluation considerations as wireless continues to drive financial results and the Company aggressively deleverages,” says Goff.

Goff has moved his 2019 revenue and EBITDA forecasts up by $40 million and $53 million, respectively, to $4,537 million and $1,858 million, respectively. The analyst is maintaining his “Buy” with the new $36.00 target, which represents a projected return of 13.6 per cent at the time of publication

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment