Following a recent acquisition, Echelon Wealth Partners analyst Gianluca Tucci remains bullish on Universal mCloud (Universal mCloud Stock Quote, Chart TSXV:MCLD).

Following a recent acquisition, Echelon Wealth Partners analyst Gianluca Tucci remains bullish on Universal mCloud (Universal mCloud Stock Quote, Chart TSXV:MCLD).

This morning, mCloud announced it had received TSX Venture Exchange approval for the acquisition of Flow Capital Corp.’s gross sales royalty in Agnity Global Inc.

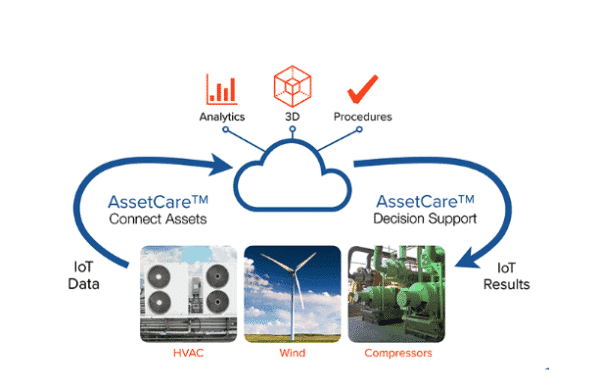

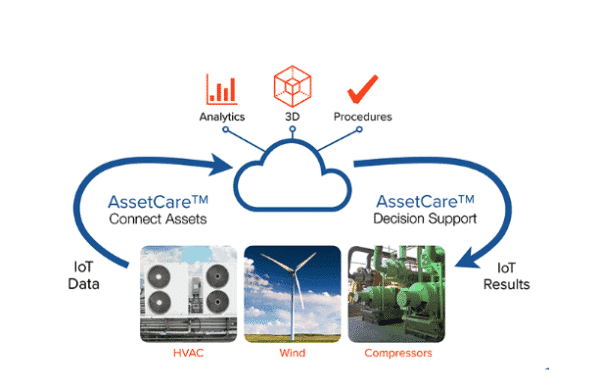

“The successful close of this transaction is an important milestone for mCloud and allows us to shift execution efforts to closing the acquisition of CSA Inc., which was originally announced on Jan. 11, 2018,” CEO Russ McMeekin said. “The Agnity acquisition creates strong synergies for mCloud and enables us to accelerate AssetCare’s expansion and entry into new markets, including Europe. We have commenced making commercial progress with previous acquisition transactions of Norwin and Endurance in U.K. and Europe. We expect to secure AssetCare contracts in the coming months in these markets based on strong demand.”

Tucci says this development fits with the bigger picture for Universal mCloud.

“MCLD’s model to shareholder value creation lies in having more assets connected to its AssetCare platform,” the analyst said in research update to clients Thursday. “The operating leverage model is clear with every incremental revenue dollar having more of a contribution margin effect. With over 28K assets connected as at 2018-end, we expect a continued scaling effect in 2019 and ultimately to reflect in realised results.”

Tucci today maintained his “Speculative Buy” rating and one-year price target of $0.80 on Universal mCloud, implying a return of 139 per cent at the time of publication.

Tucci thinks MCLD will post Adjusted EBITDA of negative $6.2-million on revenue of $5.8-million in fiscal 2018. He expects those numbers will improve to EBITDA of positive $1.1-million on a topline of $18.8-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment