Biopharm company ProMetic Life Sciences (ProMetic Life Sciences Stock Quote, Chart TSX:PLI) announced its third quarter 2018 financials this week, but the focus remains on ProMetic making regulatory progress with its therapeutic protein Ryplazim (plasminogen), says analyst Douglas Loe of Echelon Wealth Partners.

Biopharm company ProMetic Life Sciences (ProMetic Life Sciences Stock Quote, Chart TSX:PLI) announced its third quarter 2018 financials this week, but the focus remains on ProMetic making regulatory progress with its therapeutic protein Ryplazim (plasminogen), says analyst Douglas Loe of Echelon Wealth Partners.

In a client update on Thursday, Loe maintained his “Hold” rating for PLI with the reiterated target price of $1.00.

Revenue for the three and nine months ended September 30, 2018, came out at $12.3 million and $36.8 million, respectively. ProMetic’s EBITDA losses continued, with a third quarter loss of $24.7 million, a slight improvement on previous quarters, says Loe, where EBITDA losses ranged from $20 to $27 million.

Loe says that ProMetic’s cash flow issue eventually will need attending and that this is a source of caution on the company’s prospects.

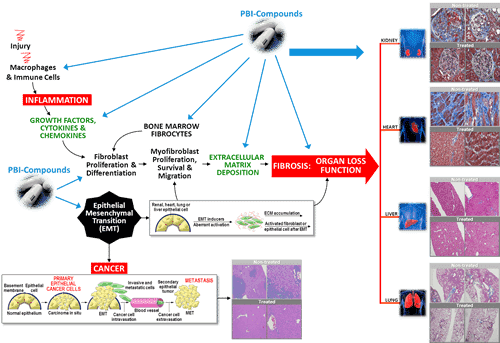

“Clearly with $21.4 million in cash and a FQ318 operating cash loss run-rate of negative $49.7 million, the firm has sufficient cash to fund Ryplazim regulatory and assay development activities, plus clinical activities for anti-fibrotic small-molecule drug PBI-4050 to about FQ219,” says Loe.

“Accordingly, it is clear that with operating cash flow unlikely to turn positive before available cash diminishes, ProMetic will need to actively seek out alternative sources of capital, either from capital markets or prospective partners or both and this lingering financial risk is a key element in our sustained cautious outlook on PLI, however attractive we believe its plasma products and PBI-4050 pipeline is on scientific merits,” says Loe.

The analyst said that on the conference call, ProMetic management spoke of its partnering activities, something Loe says will be pivotal for pushing pipeline assets across the goal line.

“Our key takeaway from the call was that talks are still ongoing, and while there are term sheets reached, the lag in formalizing partnership agreements may have been related to reshuffling of priorities on partners’ end. Nonetheless, we remain of the view that ProMetic’s attractiveness to potential partners should heighten and not retreat as Ryplazim gains further traction in terms of regulatory clarification, as implied by the recent Type C meeting with the FDA,” says Loe.

The analyst’s $1.00 target represents a projected 12-month return of 138 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment