Sure bets in the ever-evolving tech sector are a rarity, but if you had to name one, Alphabet (Quote, Chart NASDAQ:GOOGL) fits the bill, says Colin Stewart of JC Clark Limited, who argues that Google’s virtual monopoly over online advertising makes it a solid long-term hold.

Sure bets in the ever-evolving tech sector are a rarity, but if you had to name one, Alphabet (Quote, Chart NASDAQ:GOOGL) fits the bill, says Colin Stewart of JC Clark Limited, who argues that Google’s virtual monopoly over online advertising makes it a solid long-term hold.

Last week, Alphabet’s Google celebrated its 20th birthday, marking two decades during which the search engine has risen from one-among-many status to the dominant force that it is today. Even with growing competition from Amazon, Google still reigns supreme, accounting for almost 91 per cent of the worldwide search engine market share.

That virtual lock on a sector that’s so central to commerce and life in the modern world is part of what makes Alphabet unbeatable as a stock, says Stewart.

“Alphabet (or Google) has been a core holding for us for a long time,” Stewart, CEO and portfolio manager at JC Clark, told BNN Bloomberg recently. “It’s not overly expensive or challenging from a valuation standpoint. They’re so dominant when it comes to online advertising and that trend online continues to gain share at the expense of more traditional advertising outlets. We almost think of Alphabet as a utility-like business of the new age.”

“If there was one stock that you didn’t have to worry about the quarter-to-quarter and day-to-day and just have a position and wake up ten or twenty years from now, I think it’s a great company to own as part of your portfolio,” Stewart says.

After hitting a new all-time high of US$1291 in late July, Alphabet’s share price has taken a tumble, with the stock down eight per cent over that period. The stock remains up 12.6 per cent for the year.

Stewart says he also likes Alphabet’s penchant for R&D, something which is likely pay off for the company, he says.

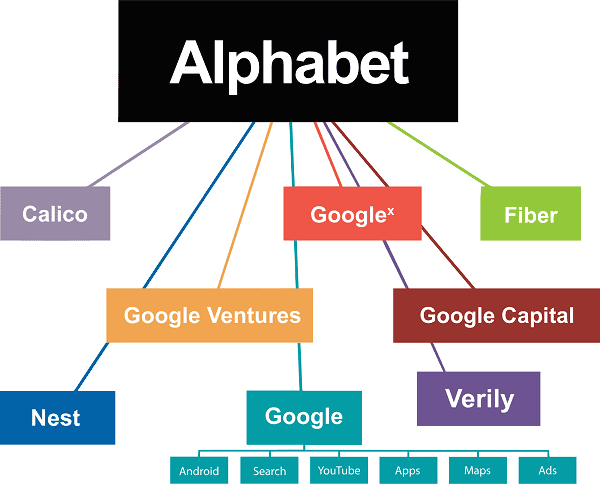

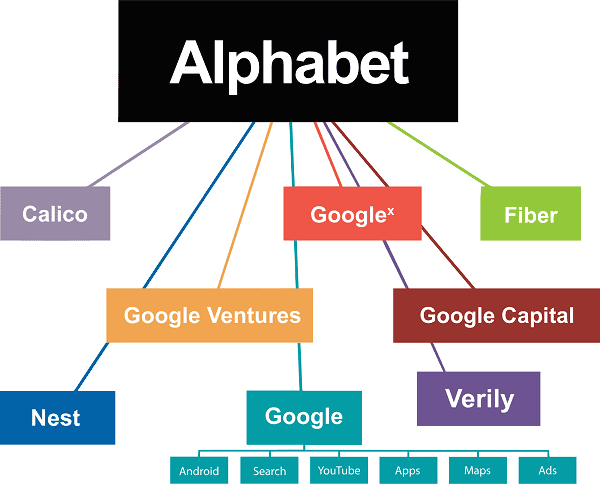

“Most of their cash flow and earnings come from this core advertising platform but they also have all of these other bets on things like driverless cars and other interesting technologies,” he says. “They spend a lot of money on capex and so I think you’re getting a great dominant, almost monopoly- or duopoly-like business when you buy Google at a reasonable market-type P/E multiple. The immense amount of money that they spend every year on these new opportunities, someday, one of those is going to come through.”

In July, Alphabet reported its second quarter earnings which beat analysts’ expectations, posting revenue of US$32.66 billion versus the consensus estimate of US$32.17 billion and adjusted earnings per share of US$11.75 versus the consensus estimate of US$9.59.

Disclosure: Jayson MacLean owns shares of Alphabet.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment