Quisitive Technology has 329 per cent upside, Echelon Wealth says

Microsoft Partner company Quisitive Technology Solutions (TSXV:QUIS) is a junior tech that can give investors exposure to a real blockchain opportunity.

Microsoft Partner company Quisitive Technology Solutions (TSXV:QUIS) is a junior tech that can give investors exposure to a real blockchain opportunity.

In a research report to clients today, Garcea initiated coverage of Quisitive with a “Speculative Buy” rating and one-year price target of $1.50, implying a return of 329 per cent at the time of publication. The analyst says the company’s next-gen payment processing platform, LedgerPay, has a distinct opportunity.

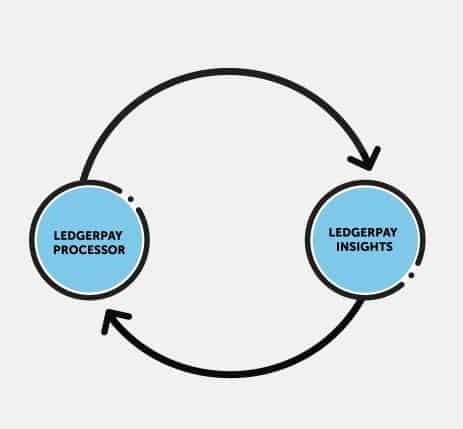

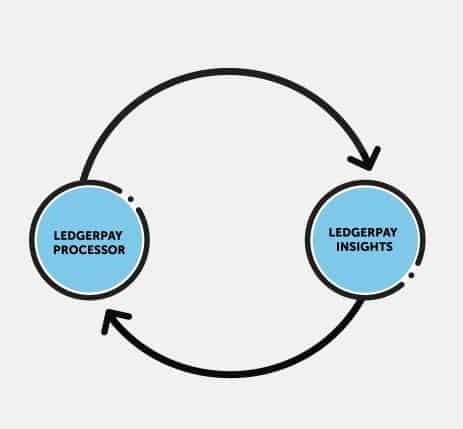

“Designed to leverage blockchain technology, LedgerPay will endeavour to provide holistic insights into consumer buying behaviours using retail transaction processing and consumer panel data in an integrated model between consumers, banks, and merchants,” Garcea says. “LedgerPay will use distributed ledger technology (DLT), Artificial Intelligence (AI), and Machine Learning (ML) in a 100% Azure-hosted service. (2) Quisitive is one of 35 companies that have earned the designation of “National Solution Provider” or NSP. Quisitive plans to create its own tier within the NSP designation as the premier Microsoft Solution Provider in North America, providing scale through acquisition to address the growing demand for Microsoft Azure-based services. (3) Quisitive introduced the Azure Accelerator Program, a proprietary assessment to help enterprise companies navigate and demystify cloud migration. Quisitive is one of only a few key Microsoft partners in North America to drive the adoption of Microsoft Azure through Quisitive’s unique Azure Accelerator Program. (4) Quisitive has developed a methodology to assist customers in understanding blockchain and helping them define use cases, develop proofs-of-concept (POCs), and build blockchain solutions for their business. Quisitive’s “Commonsense Blockchain Solution” gives customers a proven methodology to help them leverage blockchain technology in the enterprise.”

Garcea thinks QUIS will generate EBITDA of negative $100,000 on revenue of $11.6-million in fiscal 2018. He expects those numbers will improve to EBITDA of $600,000 on a topline of $15.8-million the following year.

“Within a fragmented Microsoft partner channel, Quisitive is able to grow both organically and through acquisitions to become Microsoft’s “Partner of the Future,” the analyst adds. “The goal is to become large enough to handle multi-million-dollar Microsoft Azure projects, and small enough to maintain the agility needed to develop unique and innovative solutions utilizing all the tools in the Microsoft Azure stack – including Blockchain, AI, and Internet of Things (IoT).”

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.