Specialty pharma company Correvio Pharma (Correvio Pharma Corp. Stock Quote, Chart, News: TSX, NASDAQ:CORV) has received notice from the US FDA that it could resubmit its application for antiarrhythmic drug Brinavess, a nice surprise, says André Uddin from Mackie Research Capital Corporation.

Specialty pharma company Correvio Pharma (Correvio Pharma Corp. Stock Quote, Chart, News: TSX, NASDAQ:CORV) has received notice from the US FDA that it could resubmit its application for antiarrhythmic drug Brinavess, a nice surprise, says André Uddin from Mackie Research Capital Corporation.

In a client update on Monday, the analyst reiterated his “Speculative Buy” rating for Correvio (formerly Cardiome) and 12-month target of US$3.30.

In 2010, the FDA placed Correvio’s (previously Cardiome) Phase III study for Brinavess on hold after a case of cardiogenic shock occurred in the trial. And while Brinavess is currently marketed in Europe and the rest of the world, its penetration into the US has since been stalled. In August of 2017, the company’s submitted New Drug Application (NDA) to the FDA was deemed insufficient, but now, the FDA has stated that it would consider a reapplication with data on Brinavess gathered outside of the US.

“In our most recent communication with the FDA, we asked the Agency if the Division of Cardiovascular and Renal Products would be willing to meet to discuss a regulatory path forward for Brinavess,” said William Hunter, MD, CEO and President of Correvio, in a statement. “We are pleased that the Agency has agreed to discuss Brinavess in a pre-NDA meeting, which we will seek to have in the fourth quarter.”

Uddin says that given historical FDA interactions, the news is promising.

“A potential positive outcome from the pre-NDA meeting with the FDA may indicate that no clinical trials would be required to support the Brinavess NDA resubmission — which could be attractive to potential licensees,” Uddin says. “To be conservative, we are not assuming any licensing deals or U.S. sales related to Brinavess in our model at this time.”

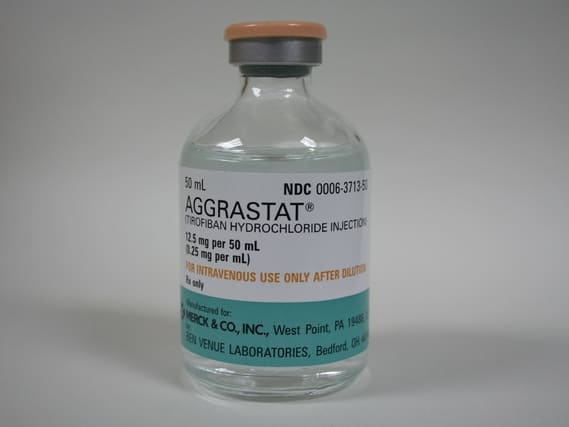

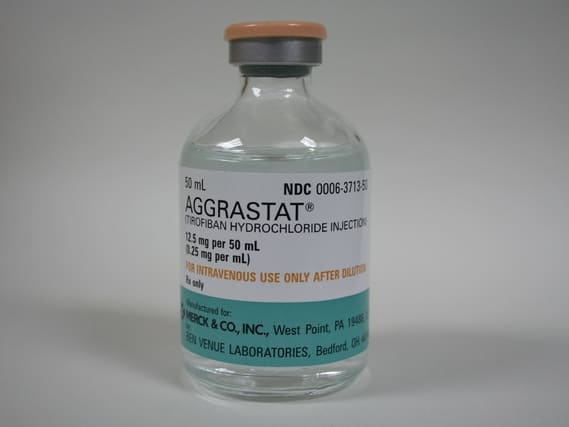

The analyst advises that there are a number of risks to Correvio Pharma, including competition to Brinavess, pricing pressure from other generic atrial fibrillation drugs as well as from generic versions of Corrvio’s antiplatelet drug Aggrastat.

Uddin’s valuation of CORV is based on applying a 3.7x EV/Sales to his 2019 estimates and discounting back 15 per cent. His US$3.30 target price represents a 59 per cent projected return as of publication date.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment