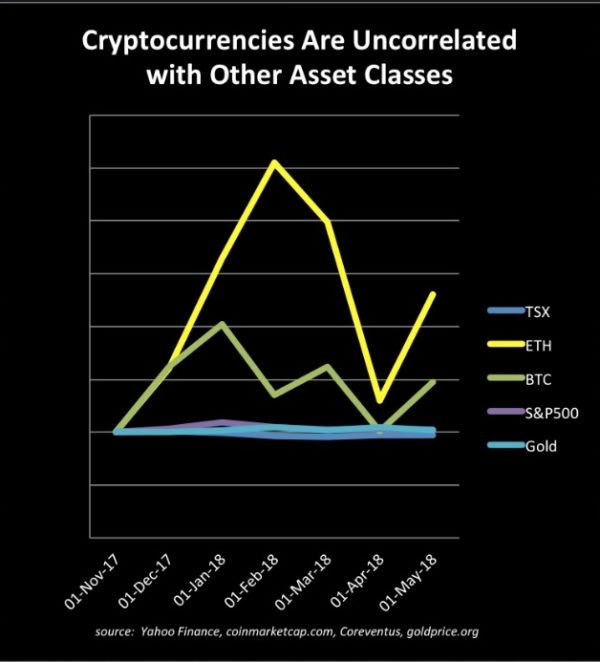

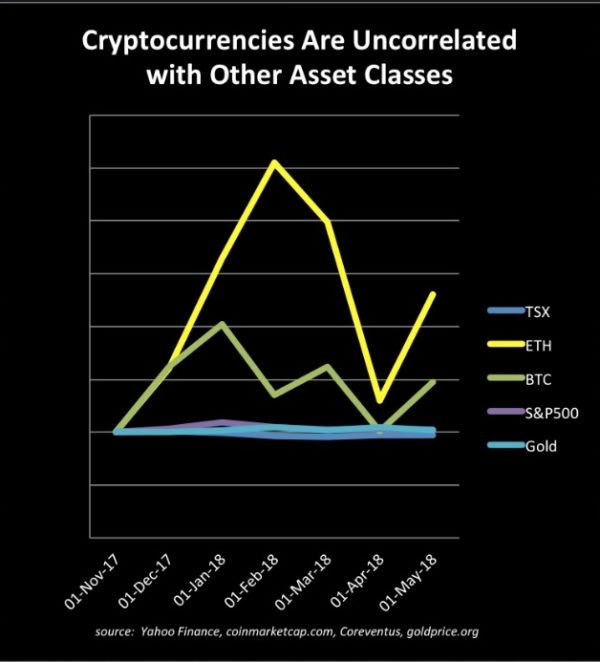

We looked at cryptocurrency performance compared to other assets classes. Cryptocurrencies are far more volatile, and in recent months have frequently gained – and lost – in excess of 50% per month. They appear uncorrelated with other assets.

We looked at cryptocurrency performance compared to other assets classes. Cryptocurrencies are far more volatile, and in recent months have frequently gained – and lost – in excess of 50% per month. They appear uncorrelated with other assets.

With a combined market capitalization of over $425 billion, and many of the larger cryptocurencies trading in excess of $1 billion a day, we believe that highly risk-acceptant institutional investors are going to start to look at cryptocurrencies as a way to achieve returns uncorrelated with other assets.

We also believe that the institutionalization of cryptocurrency investment will have two major effects. First, the increased demand will likely cause an upwards trend in price – albeit with significant corrections. Second, it will likely lead to a less volatile market overall, as many institutional market participants frequently rebalance their portfolios. However, we believe volatility will still be extremely high.

The above is not an endorsement or investment recommendation to purchase cryptocurrencies.

DISCLAIMER: AIRDROP is presented as an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific cryptocurrencies or related commodities or securities. Coreventus Inc. and/or its employees may own cryptocurrencies, some of which may be mentioned in AIRDROP.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment