Delays in launching its first major drug are cause for a target price reduction for Prometic Life Sciences (Prometic Life Sciences Stock Quote, Chart, News: TSX:PLI), says analyst Neil Maruoka of Canaccord Genuity, who on Monday maintained his “Buy” rating with a target lowered from $4.00 to $2.00.

Delays in launching its first major drug are cause for a target price reduction for Prometic Life Sciences (Prometic Life Sciences Stock Quote, Chart, News: TSX:PLI), says analyst Neil Maruoka of Canaccord Genuity, who on Monday maintained his “Buy” rating with a target lowered from $4.00 to $2.00.

Last week, biopharm company Prometic released its Q4 and year-end 2017 financial results, which included an update on Ryplazim, a treatment the company is developing for a rare genetic condition called congenital plasminogen deficiency. Prometic revealed that the US Food and Drug Administration has asked for additional manufacturing data, which means that approval of the drug will now be delayed by an added nine months.

Maruoka calls the lengthened timeline significant. “We believe that the extended timelines to the potential commercialization of the company’s first major drug is a clear negative, extending

the company’s elevated cash burn well into next year,” says the analyst in a note to clients. “While we continue to believe that Ryplazim ultimately has a good chance of approval (the FDA data request related to product stability and not efficacy), we nonetheless believe operational risks have increased for ProMetic.”

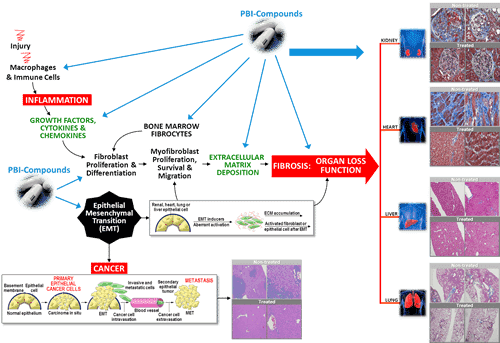

“We also believe regulatory risks have increased for the company’s entire plasma pipeline, and we have therefore lowered the assumed probability of success for each of the company’s plasma therapeutics by 20 per cent and increased the discount rate in our explicit NPV analyses from 10 per cent to 15 per cent,” he says.

With the drug’s launch now pushed into next year, Maruoka has decreased his 2018 revenue forecast from $150.4 million to $57.5 million and adjusted EBITDA from $16.0 million to a loss of $71.5 million.

“We value ProMetic based on a sum-of-the-parts,” says the analyst. “We value the resin business using a DCF analysis (unchanged 8.1% WACC and 2.0% terminal growth), plasma-derived therapeutics with an explicit NPV (15% WACC), and the small molecule pipeline with a pNPV (unchanged 15% WACC and 45% chance of success).”

The analyst reiterates his “Buy” rating with a lowered target price of $2.00, representing a one-year potential return on investment of 170.3 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment