With a Q2 that arrived in line with expectations and notable improvements in production costs, cannabis company OrganiGram Holdings (OrganiGram Holdings Stock Quote, Chart, News: TSXV:OGI) merits a revenue forecast increase for FY18, says Martin Landry, analyst with GMP Securities, who on Wednesday maintained his “Buy” recommendation and target price of $7.00 for OGI.

With a Q2 that arrived in line with expectations and notable improvements in production costs, cannabis company OrganiGram Holdings (OrganiGram Holdings Stock Quote, Chart, News: TSXV:OGI) merits a revenue forecast increase for FY18, says Martin Landry, analyst with GMP Securities, who on Wednesday maintained his “Buy” recommendation and target price of $7.00 for OGI.

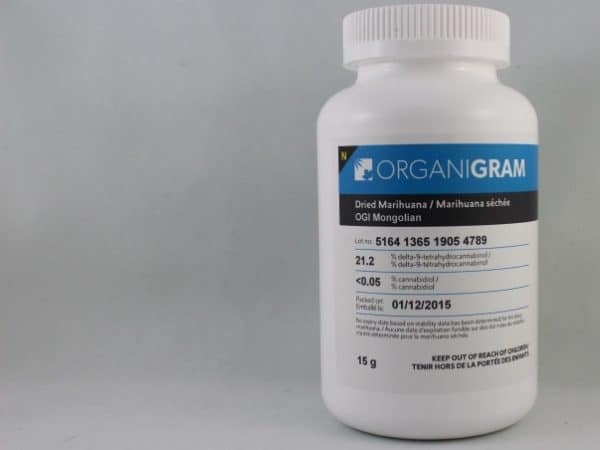

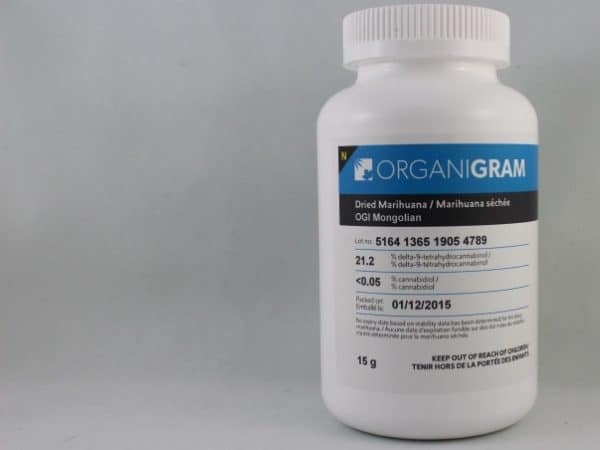

On Tuesday, Moncton, New Brunswick’s OrganiGram announced its financial results for the the three and six months ended February 28, posting Q2/FY18 revenues of $3.2 million, up 20 per cent by the quarter, along with an Adjusted EBITDA of negative $0.9 million, both of which were in line with consensus.

“We are incredibly proud of what we have achieved in Q2 as we registered record sales and a profit for the quarter,” said CEO Greg Engel in a press release, “but we have also significantly bolstered our balance sheet and from an operational and sales and marketing perspective we are well positioned to take full advantage of not only the medical market but also the burgeoning adult recreational and international opportunities as well.”

The earnings report came with a breakdown of the company’s cash costs of production for the first time, which showed a positive trend, Landry says.

“Cost per gram harvested averaged $1.22 during Q2, nearly $1.00/gram lower (~45 per cent) than Q1/FY18 levels of $2.19/gram. These cash costs are impressive and amongst the leading low cost licensed producers for indoor production,” says the analyst in a research update to clients.

“Cost improvement for OGI has been driven by improving yields, with grams per plant harvested up ~85 per cent QoQ, and lesser plant disposals (down ~60 per cent QoQ) which was an issue impacting past quarterly results. In our view, the above highlights substantial improvements on the cultivation side for OGI, with the trend in yields expected to generate further costs savings in Q3 & Q4/FY18,” says Landry.

The analyst notes that in the lead-up to rec cannabis legalization in Canada, OrganiGram’s ongoing expansion should bring the company’s near-term capacity to 36,000 kg, putting it within the industry’s top five LPs.

At the same time, all this good news has yet to resonate with investors, Landry says.

“OGI appears to be in a ‘show-me’ mode with investors,” says the analyst. “However, we see several upcoming catalysts which could turn the situation around rapidly, including (1) potential capital deployment announcements; (2) further supply contract awards with Canadian provinces; (3) upcoming investor day; and (4) recreational brand strategy announcement.”

Landry figures that at current valuation levels, OGI is at a 40 per cent discount to its peers, making for an “appealing entry point.” The analyst’s revised forecast has OrganiGram producing revenue and EBITDA in FY2018 of $41.5 million (was $31,665 million) and $8.0 million (was $7.2 million), respectively, and revenue and EBITDA in FY2019 of $136.2 million (was $130.9 million) and $39.2 million (was $47.4 million), respectively.

Landry’s $7.00 target represents a potential 12-month return of 78.1 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment