Technological advances in the cable TV sector are impacting Canadian industry players Espial Group (TSX:ESP) and Vecima Networks (TSX:VCM), says analyst David Kwan of PI Financial, who in a Friday note to clients maintained his “Neutral” recommendation for both companies.

Technological advances in the cable TV sector are impacting Canadian industry players Espial Group (TSX:ESP) and Vecima Networks (TSX:VCM), says analyst David Kwan of PI Financial, who in a Friday note to clients maintained his “Neutral” recommendation for both companies.

The tenth annual Cable Next-Gen Technologies and Strategies event was held in Denver, Colorado, last week, with over 300 cable industry representatives meeting to discuss ongoing and still to come developments within the rapidly evolving sector.

Kwan focused on a few takeaways from the event, including the more broad-scale deployment of distributed access architectures (DAAs), the commercial ramp-up of full duplex devices (FDX) for data transmission and the ongoing pressures within the Pay TV market.

The analyst sees these developments are having a slightly negative impact on Vecima and a neutral impact on Espial.

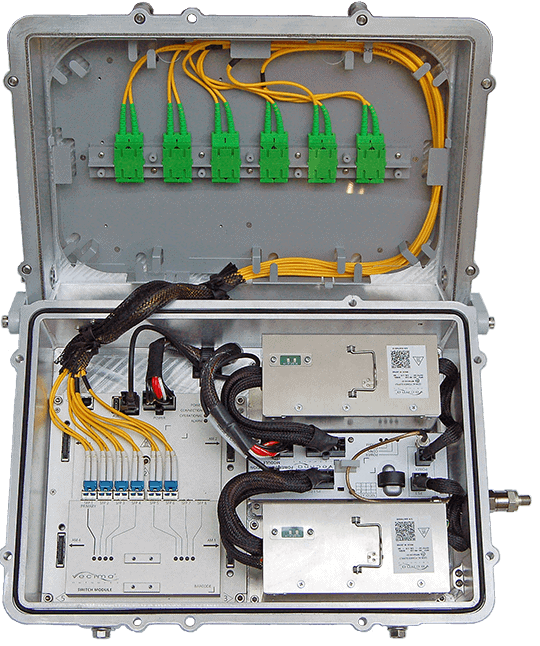

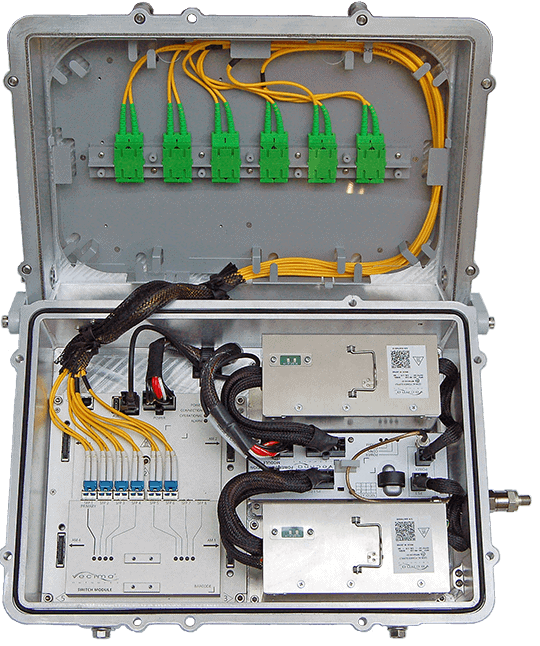

“While we remain bullish on the DAA opportunity for VCM with its Entra platform, there were some concerns from commentary and feedback we received including the potential limited near-term revenue opportunity due to the progress of FDX, possible re-qualifications for FDX solutions, and increased pricing pressure,” says the analyst.

“On the positive side, interoperability work between vendors is going well and we believe there could be (material) upside should VCM get qualified by Comcast for the DAA/FDX plans both from Comcast and through potential syndication deals,” he says.

Concerning Espial, Kwan thinks that while the company’s set-top box platform is one of the best on the market, the competition is catching up, which will make it more difficult for ESP to differentiate itself.

“ESP has done well to date with the Elevate SaaS business but we would like to see them win new and larger Multiple Systems Operators customers as well as successfully convert an increasing number of subs from their Elevate SaaS customers before we become more constructive,” he says.

Kwan maintains his “Speculative” risk rating for ESP and $2.25 price target, which is based on 1.2x his FY19 Sales estimate. For VCM, Kwan maintains his “Above Average” risk rating and $10.00 target, based on an average of 8.0x his FY19 EBITDA estimate and his net asset value.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment