Core revenue numbers for Cargojet’s (Cargojet Stock Quote, Chart, News: TSX:CJT) Q4 came in significantly ahead of expectations, says Ahmad Shaath, analyst with Beacon Securities, who reiterates his “Buy” rating with a raised price target of $75.00.

Core revenue numbers for Cargojet’s (Cargojet Stock Quote, Chart, News: TSX:CJT) Q4 came in significantly ahead of expectations, says Ahmad Shaath, analyst with Beacon Securities, who reiterates his “Buy” rating with a raised price target of $75.00.

Mississauga-based cargo airline Cargojet brought out its fourth quarter and year ended December 31, 2017, on Monday, boasting a 25.6 per cent revenue increase and an Adjusted EBITDA bump of 33.7 per cent over last year’s Q4. Topline and Adj. revenue for fiscal 2017 saw increases of 15.7 per cent and 17.5 per cent, respectively.

“We are very pleased with the strong financial results achieved in the fourth quarter.” said Ajay Virmani, Cargojet’s President and CEO, in a press release. “We continue to execute our plan to optimize our overnight network and to improve aircraft utilization while meeting the growing demands of e-commerce activity.”

In a client update on Monday, Shaath points to core revenues (attributed to faster than anticipated growth in the e-commerce sector) and hurricane relief activity as reasons why Cargojet beat his and the consensus’ Q4 estimates.

“Additionally, core-overnight revenue was up 11 per cent y/y vs our expectation of +4 per cent y/y, primarily on strength in volumes,” says the analyst. “This led to CJT reporting its strongest quarterly adjusted EBITDA to date.”

“In our view, the most important takeaway from CJT’s Q4/FY17 results is the strength in the core network. The 11 per cent y/y growth is largely attributable to strength in volumes (~6-8 pps contribution), which led to CJT reaching all-time high utilization levels and flying over the weekends. This trend is driven by continued strength in e-commerce, with the Canadian consumers increasingly switching to online shopping,” says Shaath.

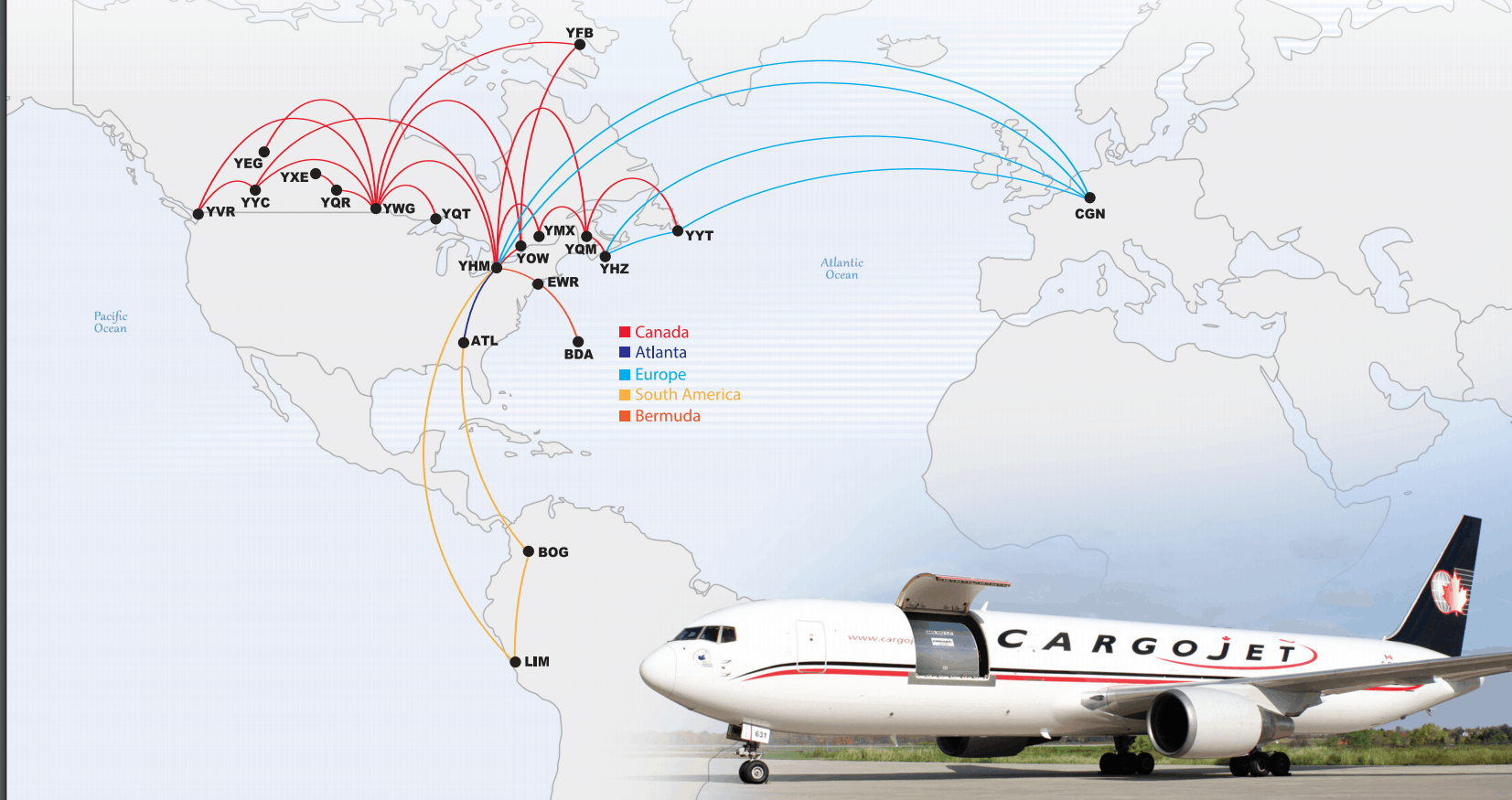

The analyst says that new CEO Jim Crane should help CJT establish itself in the United States, namely, through its 49 per cent stake in a joint venture with a US cargo provider. As well, Shaath sees Cargojet’s “healthy monopolistic position” in the Canadian air-cargo market to be of continuing benefit to the company.

The analyst reiterated his “Buy” rating and raised his target price from $62.00 to $75.00, representing a 15 per cent potential return on investment as of publication date.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment