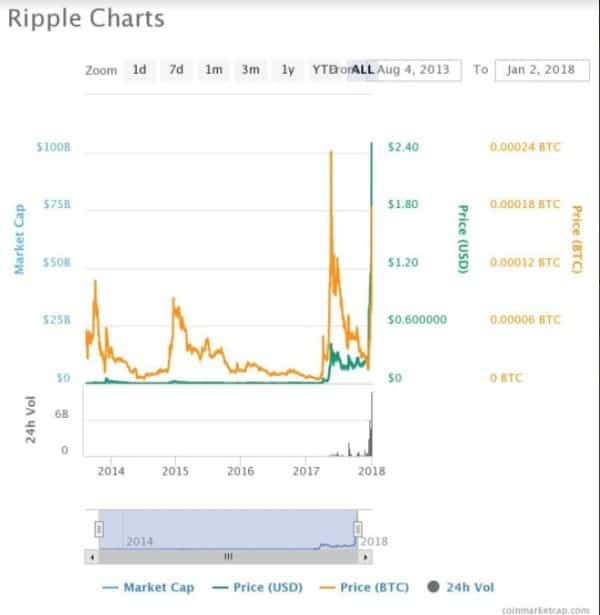

Ripple (XRP), with a market cap of nearly $90 billion, is now the second largest cryptocurrency by market cap; Bitcoin (BTC) remains the largest at just over $230 billion.

Ripple (XRP), with a market cap of nearly $90 billion, is now the second largest cryptocurrency by market cap; Bitcoin (BTC) remains the largest at just over $230 billion.

While BTC has seen its price increase by over 1300% since Jan 1, 2017, XRP has seen an increase of over 33,000%. Why this interest and growth? Ripple has far faster transaction confirmations, is much cheaper per transaction and has significant support from the financial services community. By some definitions, it’s also not a crypto…

What Is Ripple?

Ripple is a cryptocurrency with very limited functionality, and very superior performance. Ripple isn’t a currency in the way that Bitcoin is a currency. There is no sense that it is a store of value, although those benefiting from the recent price increase may beg to differ. A precursor was created in Vancouver, BC, in 2004, and since then Ripple has developed into a fully-featured payments system with significant support in the conventional finance community.

Ripple is all about payments. Ripple’s function is to process payments and transfers. The sender either uses a bank or corporation, or is a bank or corporation, to purchase Ripple and send it to the receiver, also a bank or corporation, who will either use the funds internally or make the funds available to a 3rd party if that is the desired destination. Because it is fully encrypted, it does away with the cumbersome and heavily-intermediated systems currently in use, such as SWIFT, and is much faster and cheaper than such systems. However, for now Ripple has focused on the banking and payments industries. It’s not for buying lattes. Not yet, anyways.

Ripple is more a fintech than a crypto (1). Ripple was created by a private company, unlike Bitcoin, Ethereum, Litecoin and most other cryptocurrencies, which are typically not-for-profit. Ripple has numerous high-profile VC investors, including Andreesen Horowitz, Google Ventures, Accenture and Seagate. Further, Ripple has also partnered with major financial services companies such as American Express, RBC, Santandar and Bank of America/Merrill Lynch, among others. We believe that the structure of Ripple, which is a company selling products and services that use its own crypto, high profile corporate relationships and customers, and senior VC investors differentiates it from the other cryptocurrencies. Think of it as the first big “corporate crypto”.

Ripple is more a fintech than a crypto (2). The early days of Bitcoin were dominated by more than technical wizardry. Libertarian and antibank thought permeated the ethos of the community, and the relative anonymity meant that a bitcoiner could avoid regulatory scrutiny, taxation or legal oversight. A philosophical perspective, this also allowed bad actors to use the currency freely, with crimes ranging from ransomware to drug dealing. Although Ripple the currency could survive without Ripple Labs the company, the corporate ties, oversight and customer base of the company put it at odds with the bitcoin community.

It’s Much Much Faster

Bitcoin Takes Hours. Recent average transaction confirmation times for Bitcoin have been abysmal, ranging from 117 minutes on December 28 to 2322 minutes (more than a day and a half) on December 31. Average confirmation times in September were occasionally below ten minutes – however, we think that it’s ridiculous for a transactional currency to take that long.

Ripple Takes Seconds. Four seconds.

Others Take Minutes. Ethereum (ETH) is six minutes, Litecoin (LTC) is 30 minutes, Bitcoin Cash (BCH) is 60 minutes. Many other altcoins are in this range. These times are OK for trading securities, but not for buying a latte.

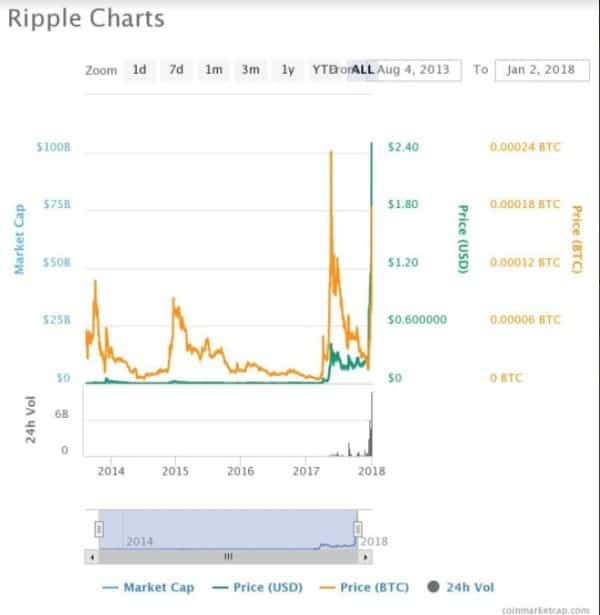

It’s Much Much Cheaper

The average transaction fee is 1.2 cents. The next cheapest of the major cryptos is Bitcoin Cash (BCH), at 33.5 cents. Bitcoin’s fees have been soaring and average over $25 per transaction.

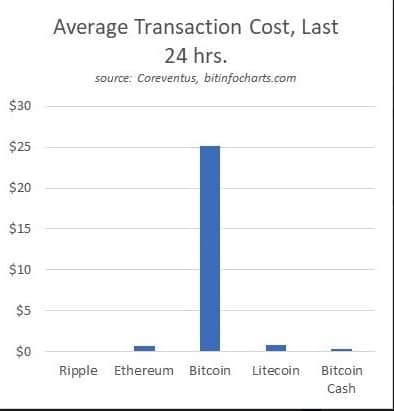

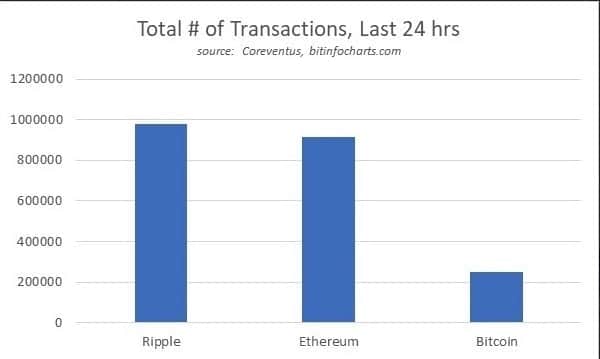

Everybody’s Doing It

We looked at transactions volumes, and Ripple was the leader, with almost 40% of recorded crypto transactions recently. We see this as a strong sign of market acceptance.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment